Ditch the Buffet, Find Your Flavor: Why Niche Investing Can Spice Up Your Returns!

Forget "Don't Put All Your Eggs in One Basket" – Sometimes, Concentrated Flavor is the Secret Ingredient to Market-Beating Success!

Okay, finance fanatics, gather 'round! We're about to dive into a topic that might make some of you raise an eyebrow (or maybe even spit out your coffee!). We're talking about those times when it actually makes sense to ditch the "don't put all your eggs in one basket" mantra and embrace a more concentrated approach.

Yes, you heard that right. Diversification, while a valuable tool in many cases, isn't the be-all and end-all of investing. Sometimes, breaking the rules can lead to some seriously sweet returns.

The "Average" Trap: Why Diversification Isn't Always Enough

Think of broad market exposure like a buffet. You get a taste of everything, but you might not truly savor any one dish. Similarly, with index funds or overly diversified portfolios, you're essentially betting on the "average" performance of the market. You'll ride the waves, but you might miss out on those mouthwatering gains that come from truly understanding a specific area.

This is where niche strategies come in – like ditching the buffet and heading to your favorite restaurant where you know the chef's got your taste buds covered. By focusing on areas where you have specialized knowledge or a strong conviction, you can potentially unlock those "OMG, this is amazing!" kind of returns.

Niche Strategies That Can Spice Up Your Portfolio

Let's explore some niche strategies that can add some serious flavor to your investment journey:

Sector Specialization: Become the Industry Guru

Are you obsessed with the latest tech gadgets? Do you spend your free time researching healthcare breakthroughs? Or maybe you're convinced that renewable energy is the future? If you've got a passion for a particular sector, why not turn it into an investment strategy?

By focusing on an industry you know inside and out, you can spot those hidden gems and undervalued companies that others might miss. Think of it like being a talent scout for the investment world – you're discovering the next big stars before they hit the mainstream.

Example: Remember those folks who were all over e-commerce back when Amazon was just a humble online bookstore? Yeah, they're probably sipping margaritas on a beach somewhere right now. Similarly, those who understood the power of cloud computing and invested early in companies like Salesforce or Amazon Web Services (AWS) are reaping the rewards of their foresight.

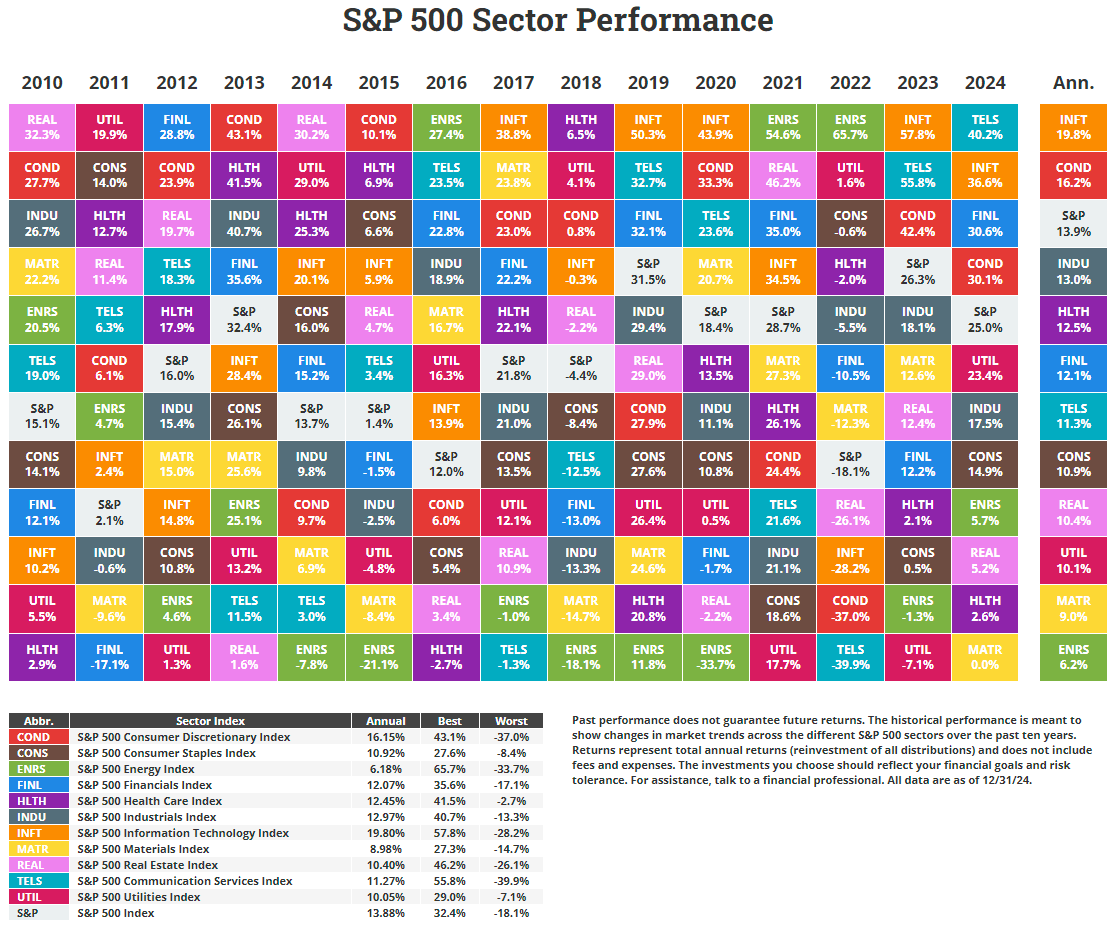

Historical Returns: While past performance isn't a guarantee of future success (because, you know, life is full of surprises!), it's worth noting that the tech-heavy Nasdaq-100 has often outperformed the broader S&P 500 over the years. So, if you've got a knack for spotting the next big thing in tech, this might be your jam.,

Geographic Focus: Become a Global Explorer

Who needs a passport when you can travel the world through your investment portfolio? Emerging markets, frontier markets, or even overlooked regions within developed countries can offer some seriously exciting growth potential.

By focusing on a specific geography, you can tap into trends and opportunities that might be missed by those with a more "global" perspective. It's like discovering a hidden gem of a restaurant tucked away on a side street – you get to enjoy the authentic flavors before the crowds arrive.

Example: Investors who recognized the rise of China in the early 2000s were handsomely rewarded. Similarly, those who identified the potential of Southeast Asian markets or specific African nations have been able to capture some impressive gains.

Historical Returns: Emerging markets can be a bit like a rollercoaster – thrilling but with some ups and downs. However, historically, they've often delivered higher growth potential than their more developed counterparts. For instance, the MSCI Emerging Markets Index has outperformed the MSCI World Index in several periods over the past couple of decades.

Value Investing with a Twist: Become a Bargain Hunter with Style

Value investing is all about finding those diamonds in the rough – companies that are undervalued by the market but have solid fundamentals. But you can take it a step further by adding a niche focus to your value hunting.

Think of it like this: you're not just looking for any old bargain; you're looking for a specific type of bargain. Maybe you're searching for undervalued companies within a high-growth industry, or you're on the hunt for those "cigar butt" stocks – companies with temporarily depressed prices but solid underlying value – within a sector you know like the back of your hand.

Example: Imagine finding a vintage Chanel handbag at a flea market for a fraction of its true value. That's the kind of thrill you can experience with niche value investing. You're combining your bargain-hunting skills with your specialized knowledge to uncover hidden treasures.

Historical Returns: Value investing has a long and illustrious history, with legendary investors like Warren Buffett demonstrating its potential to deliver market-beating returns over the long haul.

Small-Cap & Micro-Cap Investing: Become a Venture Capitalist Wannabe

Small-cap and micro-cap companies are like those indie bands that haven't quite hit the big time yet. They're often overlooked by the mainstream, but they have the potential to become the next chart-topping superstars.

By focusing on smaller companies, you can tap into their growth potential before they become household names. It's like being an early investor in Google or Apple – you get to ride the wave as they grow from scrappy startups to global giants.

Example: Think back to those who invested in Apple or Microsoft when they were still relatively small. They're probably laughing all the way to the bank now. Today, you might focus on identifying promising startups in emerging industries like artificial intelligence or biotechnology.

Historical Returns: Historically, small-cap stocks have often outperformed their larger counterparts over the long term, although they can be a bit more volatile (like that indie band's experimental music phase).

Quick reminder : Want to dives deep into the strategies I've used to navigate the market and achieve my own financial goals. Well, say no more and grab my book "Investing with Eagles." we’ve made it to the top 100 books on portfolio management and investment strategies, check it out on Amazon.

The Risks and Rewards: Embrace the Adventure

Of course, no investment strategy is without its risks. Niche strategies, with their concentrated bets, can be a bit like a rollercoaster – you might experience some thrilling highs and some stomach-churning lows. That's why it's crucial to do your homework, assess the risks, and have an exit strategy in place.

Finding Your Niche: Play to Your Strengths

So, how do you find your niche? It's all about playing to your strengths and following your passions. What industries do you genuinely enjoy learning about? What trends are you most excited about? Where do you have a knowledge advantage?

For me, it's financial services and the semiconductor industry (chips) with a mid cap preference and I've already explained why in my article on market caps. I've spent years geeking out on these sectors, understanding their inner workings, and identifying the key players. This deep knowledge allows me to invest with a level of confidence I simply wouldn't have in other areas.

And that's okay. I'm a firm believer that you can't be an expert in everything. Trying to understand every market, every industry, every trend – it's like trying to juggle flaming torches while riding a unicycle on a tightrope. It's just not sustainable (and frankly, a bit terrifying).

Take the pharmaceutical industry, for example. Novo Nordisk is all the rage right now with their game-changing GLP-1 treatments like Wegovy. While I recognize the potential of this company and the incredible impact of their products, I simply don't have the deep understanding of the pharmaceutical world to invest with conviction.

Yes, I might miss out on some big wins by staying within my circle of competence. But I'm also avoiding potential disasters and sleepless nights. For me, that peace of mind is worth more than any missed opportunity.

So, my fellow finance fanatics, my advice to you is this: focus on what you know. Identify those areas where you have a genuine passion and expertise. Dive deep, become an expert, and develop your own niche strategy. You might be surprised at the hidden treasures you uncover and the delicious returns you can achieve.

Craving More Market-Crushing Insights? Join the Waver Feast!

We're not just serving up financial snacks here at Waver. We're offering a full-course investment banquet, designed to satisfy your hunger for knowledge and help you achieve your financial goals.

Tuesdays: Free Appetizers to Whet Your Appetite

Every Tuesday, we deliver a delicious dose of market wisdom straight to your inbox. Think of it as your free appetizer – a taste of the Waver experience to get your investing taste buds tingling. We'll explore market trends, personal finance tips, and investment strategies to help you level up your game.

Thursdays: The Main Course for Serious Investors (Premium Subscribers Only!)

But if you're truly serious about conquering the market, you need to join us for the main course. Waver Premium subscribers get the VIP treatment, with exclusive access to:

Earnings Express: Get my hot-off-the-press take on the latest earnings releases. We'll dissect the numbers, analyze the trends, and uncover the hidden gems that others might miss.

Portfolio Peek-a-Boo: Ever wondered what's cooking in my own portfolio? Premium subscribers get a behind-the-scenes look at my investment moves and the strategies behind them.

Bonus Bites: Dive deeper into the most interesting market happenings with exclusive bonus articles. We're talking in-depth analysis, expert commentary, and all the juicy details you crave.

Quarterly Recap & Review: Get the inside scoop on what went down in the market (and in my portfolio) each quarter. We'll analyze the wins, the losses, and the lessons learned, so you can stay ahead of the game.

The Waver Cookbook (aka My Book): Unlock even more financial knowledge and become a true market master with a free copy of my book Investing With Eagles, packed with insights and strategies to help you navigate the investment world like a pro.

Don't let your family eat you out of house and home! Click here to subscribe and start your journey to financial freedom! Okay, maybe we can't guarantee complete freedom from your family (we've all got that one uncle who loves to talk about his "foolproof" investment strategy), but we can definitely help you bring home the bacon... or at least the investment returns!

Ready to Explore?

Diversification is a valuable tool, but don't be afraid to think outside the box. By carefully considering niche strategies and conducting thorough research, you can potentially unlock some seriously impressive gains and achieve your investment goals.

Now, let's hear from you! What are your thoughts on niche strategies? Share your own experiences and areas of interest in the comments below. Let's get this conversation flowing!

Want to keep the financial feast going? Check out these other tasty morsels from the Waver kitchen:

Disclaimer: The information provided in our analyses and reports is for informational and educational purposes only and should not be considered investment advice. We are not financial advisors, and nothing we say or write should be construed as a recommendation to buy or sell any security.

While we strive to provide accurate and insightful information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information presented.

It is important to note that we may or may not hold positions in the companies we discuss. Any opinions expressed are our own and are subject to change without notice.

Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. Never invest more than you can afford to lose.