7 Stocks, 55% of All Gains: Apollo’s Shocking Data on S&P 500 Concentration

Remember when your mom told you not to put all your eggs in one basket? Well, it turns out the S&P 500 didn’t get that memo.

Apollo’s latest chartbook just dropped the financial equivalent of a “we need to talk” conversation, and spoiler alert: it’s about how artificial intelligence has turned America’s most famous stock index into what’s essentially a Magnificent 7 fan club with 493 very quiet background dancers.

The “Diversified” S&P 500 That Isn’t Really Diversified Anymore

Here’s the tea, served piping hot by Apollo’s chief economist Torsten Sløk: the textbook idea that the S&P 500 gives you diversified exposure to risk is just simply no longer the case. Plot twist! Your “safe” index fund has turned into a concentrated AI bet.

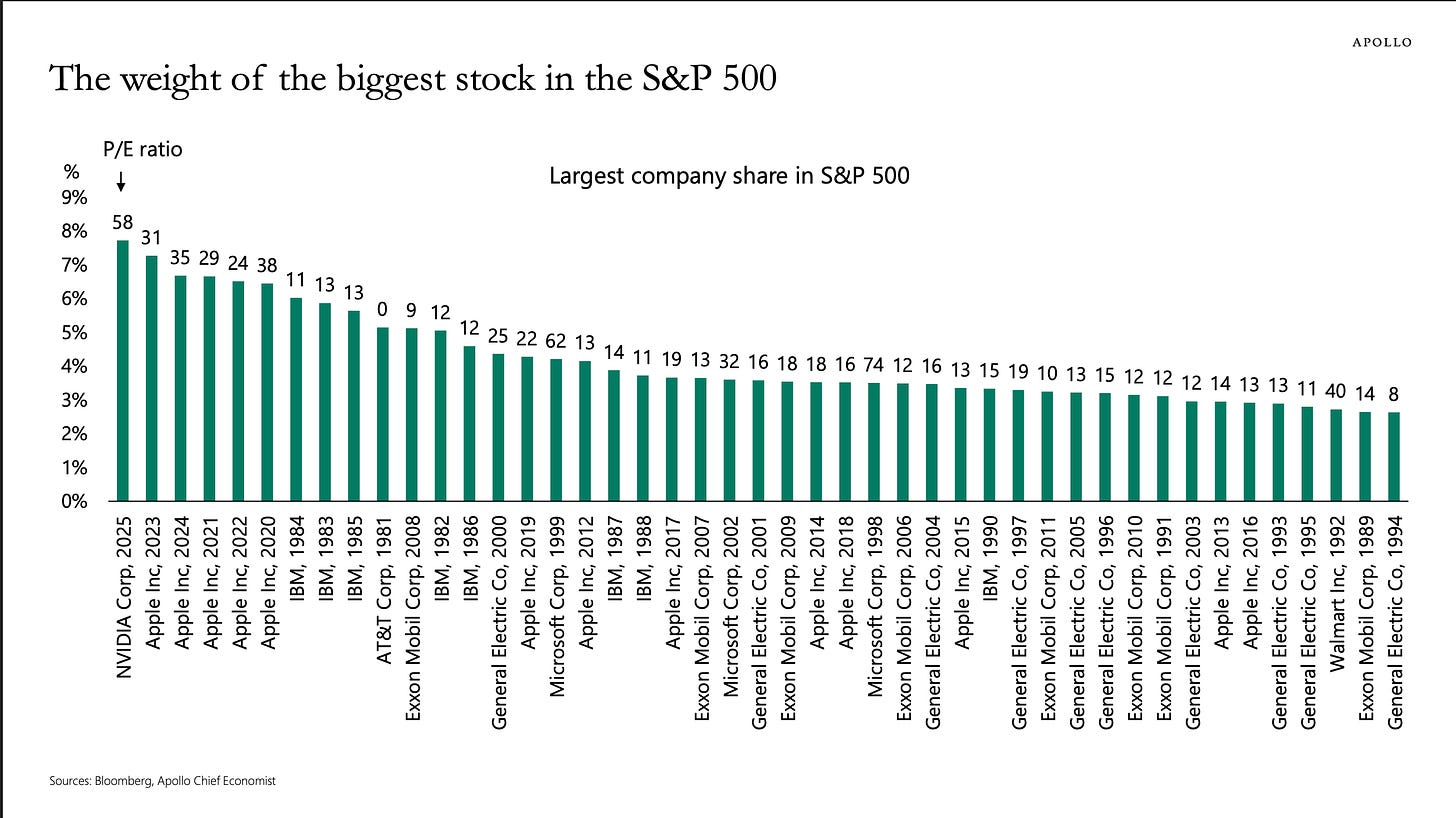

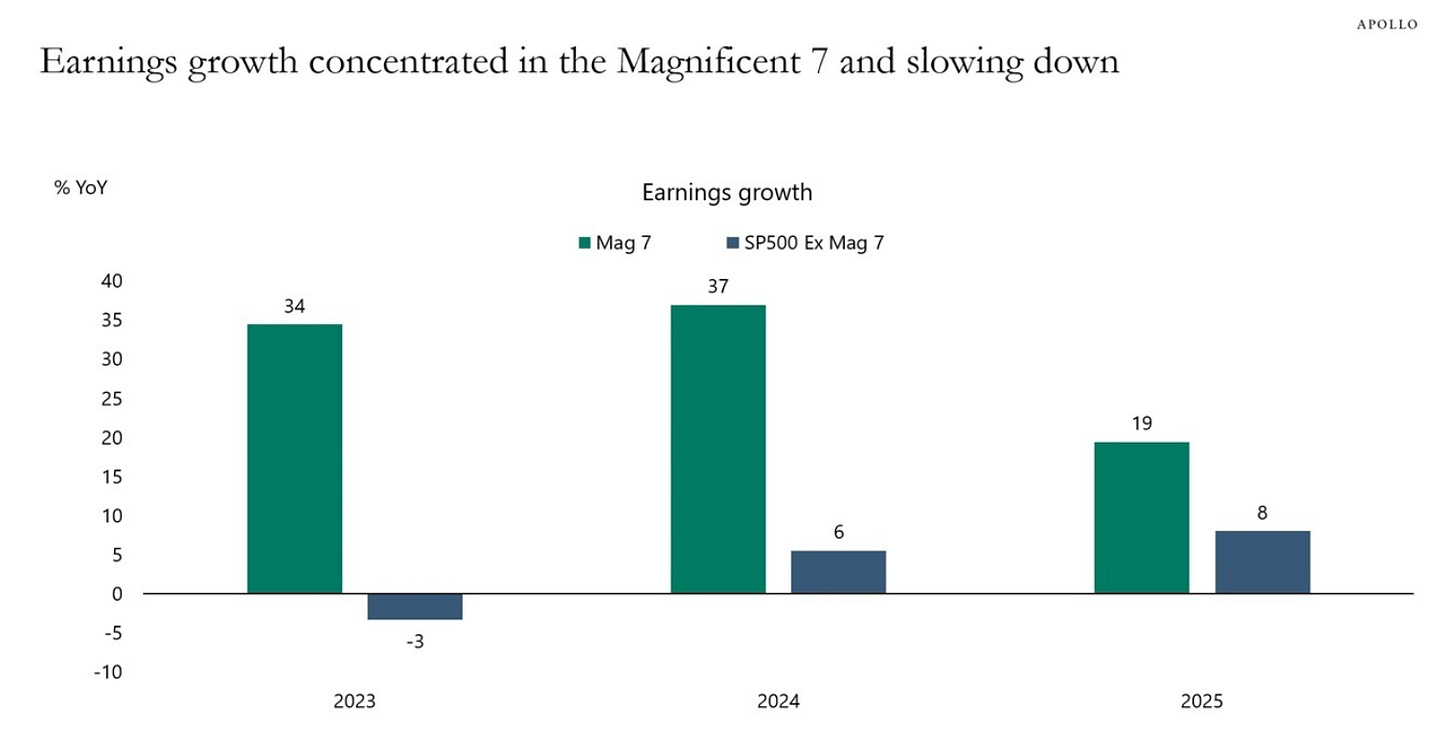

The numbers are honestly mind-boggling. Since January 2021, the top 10 stocks have contributed a whopping 55% of the S&P 500’s market cap gains. That’s right—10 companies out of 500 are doing more than half the heavy lifting. It’s like a group project where seven people do all the work while 493 others show up for pizza at the end.

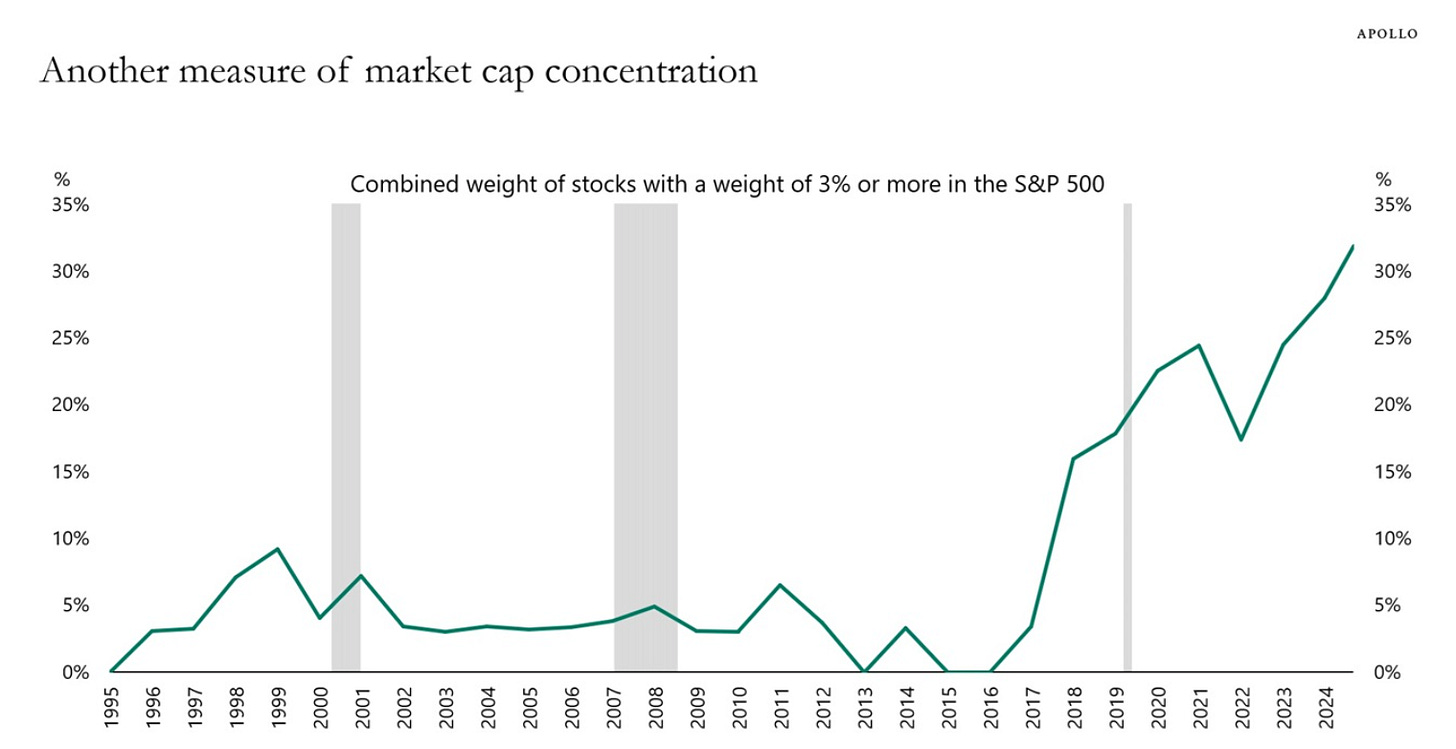

The Magnificent 7 now command over 30% of the entire S&P 500’s weight. To put this in perspective, these seven companies have a combined market cap that’s bigger than the entire stock markets of the UK, Canada, and Japan combined. Microsoft alone is worth more than Canada’s entire stock market. Sorry, Canada, but them’s the breaks.

The Bubble That Makes the Dot-Com Era Look Quaint

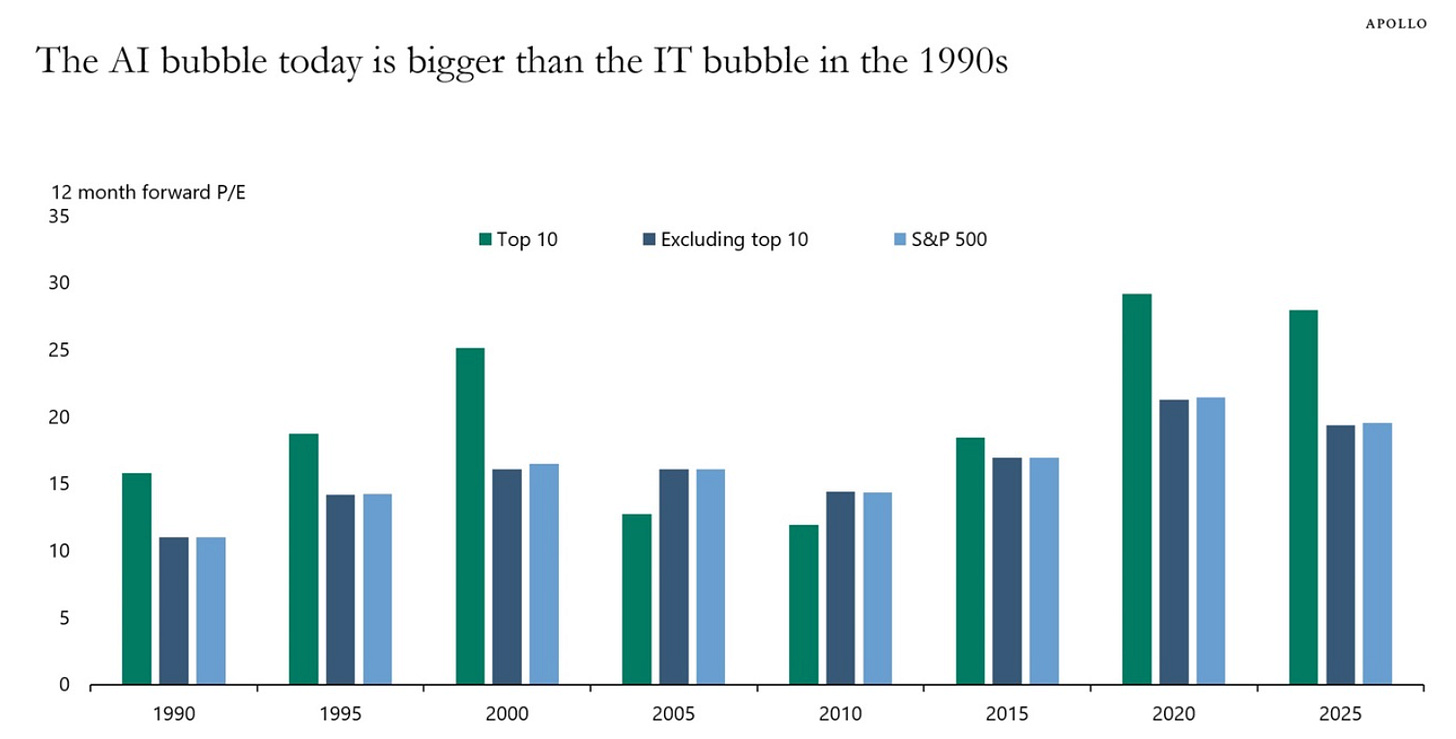

If you thought the late 1990s were wild, buckle up buttercup, because according to Apollo, the AI bubble today is bigger than the IT bubble in the 1990s. The average trailing P/E ratio of the top 10 companies is sitting pretty at around 50—that’s not a typo, that’s five-zero—compared to much more reasonable levels for the rest of the index.

Sløk’s chart comparing forward P/E ratios shows that today’s AI darlings are more stretched than yoga instructors on a retreat. The top 10 companies in the S&P 500 today are more overvalued than they were in the 1990s. And we all remember how that particular party ended, don’t we? (Hint: it involved a lot of crying and some very expensive lessons about gravity).

Follow the Money: Where AI Companies Are Spending Like There’s No Tomorrow

Apollo’s analysis reveals some truly jaw-dropping spending patterns. Hyperscaler capex (that’s fancy talk for “money spent on shiny new tech infrastructure”) has doubled as a share of U.S. private domestic investment since 2023. These companies are spending money faster than a lottery winner at a luxury car dealership.

The capex-to-sales ratio is approaching 20%, and capex now gobbles up around 60% of operating cash flow for the hyperscaler group. Translation: these companies are investing so aggressively in AI infrastructure that they’re eating their own cash generation for breakfast, lunch, and dinner. It’s like renovating your house with money you haven’t earned yet, except the house is made of semiconductors and the renovation costs billions.

The Performance Circus: When a Few Clowns Run the Whole Show

The market’s behavior has become, to put it mildly, a bit bonkers. While the S&P 500 keeps hitting new records, the percentage of index members actually reaching new highs is embarrassingly low. It’s like claiming your entire class aced the test when only the seven smartest kids actually passed.

Apollo’s “High-Low Logic Index” shows that AI is simultaneously creating winners and losers—think of it as the stock market’s version of “The Hunger Games,” except instead of tributes, we have tech stocks. The Magnificent 7 have been dramatically outperforming the S&P 493 (yes, that’s what we’re calling everyone else now), which is basically the financial equivalent of LeBron James carrying the entire Lakers team on his back.

What This Means for Your Boring Old S&P 500 ETF

Here’s the plot twist that might make you spit out your coffee: that diversified S&P 500 ETF you bought for “safe” broad market exposure is now essentially a leveraged bet on AI. Surprise! You thought you were buying vanilla ice cream, but you actually got Rocky Road with extra nuts and a side of existential crisis.

When you buy a cap-weighted S&P 500 ETF today, you’re not getting the diversified exposure your finance textbook promised. Instead, you’re getting:

• A concentrated exposure to AI and tech megacaps (whether you wanted it or not)

• Sensitivity to the whims of hyperscaler capex spending

• A front-row seat to the AI monetization experiment

• Valuation risk that would make dot-com veterans nervous

Risk Management for the AI-Concentrated World

So what’s a reasonable investor to do? Apollo’s data suggests a few tactical approaches that don’t require a PhD in rocket science:

Consider equal-weighted exposure to reduce your dependency on the seven AI overlords. Equal-weighted S&P 500 ETFs give each stock the same influence, which means the median company gets more love and NVIDIA doesn’t get to boss everyone around.

Blend in some quality screens because when the music stops, companies with actual cash flows and reasonable balance sheets tend to fare better than those running on pure hype and venture capital fumes.

Add mid and small-cap exposure to diversify away from the hyperscaler capex cycle. Small companies might not be building trillion-dollar AI infrastructures, but they also won’t collapse if AI spending suddenly becomes unfashionable.

Stress-test your portfolio by modeling what happens if the top 10 stocks experience a 20-30% de-rating. Given that their average trailing P/E is around 50, a multiple compression wouldn’t exactly be unprecedented.

The Bottom Line: Welcome to the AI Casino

The S&P 500 has quietly transformed from a diversified index into what’s essentially a concentrated AI growth bet with a diversified tail. That’s not necessarily bad—if AI delivers on its promises, this concentration could continue compounding returns in spectacular fashion. But if expectations reset, even a little bit, the index’s sensitivity to a handful of names could make for some very exciting (read: terrifying) volatility.

Apollo’s message is clear: the traditional notion of S&P 500 diversification is about as relevant as a flip phone at a tech conference. The index is now effectively a leveraged play on whether AI companies can convert their massive capital expenditures into sustained earnings growth, all while trading at valuations that would make even dot-com veterans blush.

For investors, this means getting intentional about portfolio construction. You can embrace the AI tilt, complement it with diversifiers, or find ways to hedge against it—but ignoring it altogether would be like pretending that seven-foot-tall elephant isn’t doing the tango in your living room.

The AI revolution might be real, but as Apollo’s data makes crystal clear, the market’s bet on it has reached proportions that would make even the most optimistic tech evangelist a little nervous. Buckle up—this could get interesting

If you want to read the full report : it’s available on Apollo website

The content of this newsletter is provided for informational and educational purposes only and represents solely my personal opinions. It does not constitute financial, investment, tax, or legal advice, nor does it represent a recommendation to buy or sell any securities. I am not a licensed financial advisor. Investing involves risks, including the possible loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified professional before making any financial decisions.