Waver Q1 2025 letter : Riding the Market Rollercoaster.

Performance, portfolio, and the strategies that kept me on track.

This quarter? Let's just say it was...interesting. The market threw a few curveballs, my portfolio decided to play a little hide-and-seek, and I spent a lot of time deciphering financial tea leaves. But beyond the headlines and the market chatter, what really happened? In this quarterly letter, I'm pulling back the curtain on my actual performance, the ups and downs of my key holdings, and the market's wild ride. You'll find the real numbers, the strategic moves I made, and a sneak peek into the new additions to my portfolio. No fluff, no hyperbole, just the straight story of how I navigated a quarter that kept us all on our toes.

First of all to start this quarterly letter, let's get one thing straight: if you're joining this party thinking you'll be swimming in a sea of shiny new investment opportunities every week or even every month, you're in for a rude awakening. Think of me as your brutally honest guy.

My philosophy? If I can unearth just one or maybe two gems a year, I'm doing a happy dance. Seriously, that's a win!

Now, about those weekly deep dives... let's just say most of the companies we dissect end up in the "nope" pile. Why? Often, they're priced like they're gold-plated unicorns when they're more like slightly tarnished donkeys. And sometimes, even if the business itself is decent, they manage their money like a toddler with a credit card. So, yeah, lots of "no's" but when I find a "yes"... oh boy, it's worth the wait!

And as always nothing in here or in waver.one can be treated as financial advice, Please understand that this letter is for informational and entertainment purposes only. I am sharing my personal investment journey, observations, and strategies, which may not be suitable for your individual financial situation. I am not a financial advisor, and the content presented here should not be construed as a recommendation to buy, sell, or hold any securities. Investing in the stock market involves substantial risk, including the potential loss of principal.

Tariffs, Tantrums, and Total Tranquility: This Quarter in a Nutshell :

First off, let's talk about the noise. Oh, the glorious, ear-splitting, mind-numbing noise. We're talking Trump's tariff tango, the market-crash-that-wasn't, inflation's hotfoot shuffle, and interest rates doing the rollercoaster boogie from 5% down to 4.3%. It's like a financial circus, and everyone's juggling flaming chainsaws.

And what's my secret weapon in this madcap spectacle? Zilch. Nada. Do. Absolutely. Nothing. When the market's throwing a hissy fit, you just sit back, grab some popcorn, and watch the show. Short-term drama? Pfft,I have no interest in that.

Now, let's get real for a sec. You know what makes my blood boil? Quarterly performance reviews. Seriously, they're the financial equivalent of watching paint dry. I'm not here for a quick thrill; I'm here for the long game, the epic saga, the marathon of money-making. So, if the market decides to take a little dip, or even a full-on swan dive, I'm not hitting the panic button.

I've got my eyes on the prize. And that prize is a mountain of cash five years down the line. We're talking "retire on a tropical island with a personal chef" kind of wealth, you know dream big! Forget quarters, forget semesters, forget even next year! Those are just tiny blips on my financial radar.

When I invest, I'm looking into the future, like a wizard gazing into a crystal ball (okay, it's probably just a spreadsheet, but let's keep the magic alive). I want to see those earnings in 2030 looking twice as plump, twice as juicy, twice as delicious! That's the kind of growth that makes my heart sing.

So yeah, quarterly performance reviews? Snooze-fest extraordinaire. Wake me up when we're counting stacks in 2030.

And that's why I'm not sweating when I see Kinsale's "meh" quarter. It wasn't a train wreck, just a little...underwhelming. And in the grand scheme of things, who cares? We're playing the long game, folks!

Performance this Quarter :

Q1 vs SP500 :

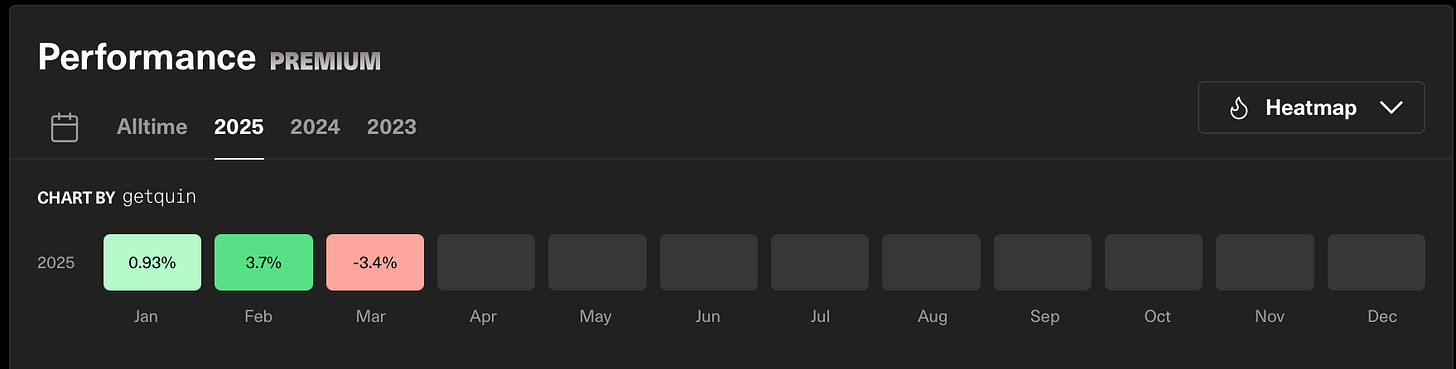

We started 2025 with a good January and excellent February, nothing special. It was just the earning season and some stock skyrocketed. We’re going to talk about that later.

I’m closing Q1 2025 up 1.11% (performance was 1.34% but new transactions costs brought it down by 0.23%) compared to -1.64% for the SP500. Quite happy with the results but not surprising. My stocks are high quality, low valuation stocks, they don’t move (up or down) as fast as those 30-40 PE stocks.

Portfolio split :

As premium subscribers, you already know the names in my portfolio and that we’re still very concentrated and I don’t plan on changing that, as Warren Buffett always says Diversification is a hedge against ignorance. It makes little sense if you know what you are doing.

I usually stay in the 5-7 companies in my portfolio, for now we’re at 6 companies and it’s enough for me, I know that I cannot follow way more companies than that for now. I also know that I may miss a lot of super hot or super trendy stocks that are performing like heaven, but I don’t care, my goal is to have mental peace with my portfolio growing steadily, not to be rich as quickly as possible, I know I'll get there but one step at a time. We’re looking for the 7th, but even after all the deep dives we did, I didn’t find any company that respected my business quality criteria AND valuation criteria. As Warren Buffett always says, from time to time, exceptional business comes at the right price for you and you just need to wait for them.

Patient is all I can be.

Concentration :

2 stocks represent 52% of the portfolio.

Top 3 : 70%

Top 4 : 84%

Portfolio % growth in investment base (not performance based) :

Let's talk about the money pile, not the money made pile, just the sheer glorious size of it. This quarter, our capital stash got a serious growth spurt and especially in March (details later in the letter), like it hit the gym and chugged a protein shake. We're talking a solid 17% bigger! Yep, that's right, our investment engine is chugging along, keeping up with the monthly grind. We're sticking to the plan, folks, and our capital is saying, "More, please!"

Where have we been since inception and vs indexes?

We're seeing some serious outperformance here. The numbers tell a clear story: we're not just keeping pace with the indexes, we're leaving them in the dust. A portion of that comes from genuine growth where our companies grow earnings faster than the market, but a significant factor is our ability to navigate the market correction in March 2025 where we didn’t took a hit as big as the market. You may ask why is that? well it’s pretty simple our Price to Free cashflow and P/E is lower than the market average, we have better quality at a better valuation.

To illustrate, on March 1st, our portfolio's alpha against the SP500 was a strong +20%. Today, that figure has climbed to an impressive +33%.

Looking at the overall picture, since the portfolio's inception, we've delivered a +77% return, while the SP500 sits at +45%. That's a substantial difference, and frankly, a pretty satisfying result.

Know before going into details for premium subscribers with the company we invested in, the price we bought at and the quarterly earning release, let’s talk on what happened on a personal side :

On a personal side :

I’ve published my first book Investing with Eagles, that talk about my path in investing and what is my investment framework, being honest with you i’ve wrote it for a great friend that want to invest but don’t understand what he should be looking for in a company, so i’ve brokedown my framework, how I look for companies, what do I look at when i’m interested in a company what how do a value a business.

I’m honestly proud of it, I'm not a writer so I don’t expect to sell thousands of them, but I've written it with no pressure so forget complicated jargon and dry financial textbooks! I've written this book in a fun, accessible way, using simple language that anyone can understand to guide you to invest on your own and it seems to work. The book entered the top 100 books on portfolio management and investing on Amazon! .

If you want to grab it, the book is available on Amazon and Kindle if you prefer the Ebook version. Find it here Investing with Eagles

If you want to read more, here’s the companies we analyzed and put in the NO bin :

Some of them are due to business issues, others due to valuation.

If you want to get access to portfolio details, think about joining the our Premium partners :

Tuesdays (Free): Get market insights and tips delivered to your inbox.

Thursdays (Premium): Exclusive access to:

Earnings analysis

Portfolio insights

Bonus articles

Quarterly market reviews

Free copy of "Investing With Eagles" book.

Subscribe to Waver Premium for in-depth market knowledge and financial growth.