The Portfolio Size Wars: A Market Analysis of Investment Strategies

Why Strategy, Not Size, Wins the Investment Game

Section 1: The Quest for the Magic Number

For decades, investors have been haunted by a deceptively simple question: "How many stocks should I own?" This report reveals that the "magic number" does not exist. The optimal number of stocks is not a fixed integer but the outcome of a strategic choice. It can be three, thirty, or three thousand, and each can be correct depending on an investor's goals, risk tolerance, and philosophy.

This analysis reframes the question. Instead of seeking a number, the sophisticated investor should evaluate competing strategies. We define this landscape as the "market for portfolio construction," where the core problem is managing the trade-off between risk and return. Different investment philosophies—from the high-conviction concentration of Warren Buffett to the massive diversification of index funds—operate as "vendors," each offering a distinct solution.

Key Findings Synopsis

Finding 1: Strategy, Not a Fixed Rule: The optimal number of stocks is a function of strategy. A concentrated, high-conviction approach might require only a few stocks, whereas a passive, market-mirroring strategy needs thousands. The number is meaningless without strategic context.

Finding 2: Technology is Blurring the Lines: Innovations like fractional shares, robo-advisors, and direct indexing are democratizing access to sophisticated strategies once reserved for the wealthy, fundamentally changing what is possible for the individual.

Finding 3: Passive Indexing's Triumph Creates New Risks: The massive flow of capital into passive funds has led to unprecedented market concentration in a few mega-cap stocks. This creates vulnerabilities that may present future opportunities for more active or "smarter" passive approaches.

Finding 4: The Costliest Mistake is "Diworsification": The greatest portfolio danger is not owning too few stocks, but owning too many without a coherent strategy. This leads to redundant holdings, diluted returns, and unnecessary complexity.

Strategic Recommendation Overview

This report introduces the "Magic Quadrant for Portfolio Strategies" to help investors navigate this landscape. The ideal strategy—and thus the optimal number of stocks—depends on an honest assessment of one's own profile: tolerance for risk, desire for hands-on control, and time commitment.

Section 2: The Modern Investor's Arena: Defining the Rules of Engagement

To evaluate portfolio strategies, we must understand the arena in which they operate. This framework is grounded in the Nobel Prize-winning work of Harry Markowitz, known as Modern Portfolio Theory (MPT).

The Fundamental Law: Risk vs. Reward

The most important principle in investing is that risk and return are inextricably linked. MPT formalizes this, stating that an investor seeking higher expected returns must accept greater risk. There is no high-return, no-risk investment. MPT assumes investors are risk-averse: given two portfolios with the same expected return, a rational investor will always choose the one with lower risk.

Meet the Two Villains: Systematic vs. Unsystematic Risk

MPT distinguishes between two types of risk, which is key to the "how many stocks" debate.

Systematic Risk (The Unavoidable Storm): This is the risk inherent to the entire market, often called "market risk." It is caused by macroeconomic factors like recessions, interest rate changes, and global conflicts. This risk cannot be eliminated through diversification.

Unsystematic Risk (The Player's Unforced Error): This is risk specific to a single company or industry, also known as "diversifiable" risk. It stems from company-specific events like poor management or a product recall. This is the risk that diversification is designed to combat.

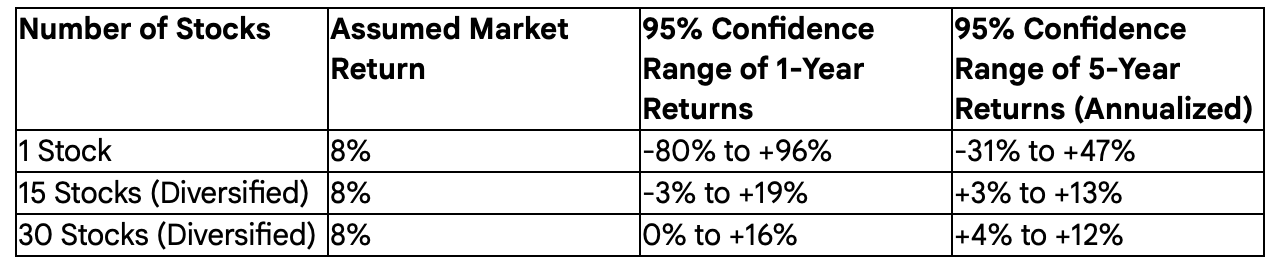

The purpose of deciding how many stocks to own is to minimize unsystematic risk. By holding a collection of stocks, the negative surprises from one company can be offset by positive surprises from another. Once company-specific risk is diversified away, the primary remaining risk is the systematic risk of the market itself.

The Winner's Circle: The Efficient Frontier Explained

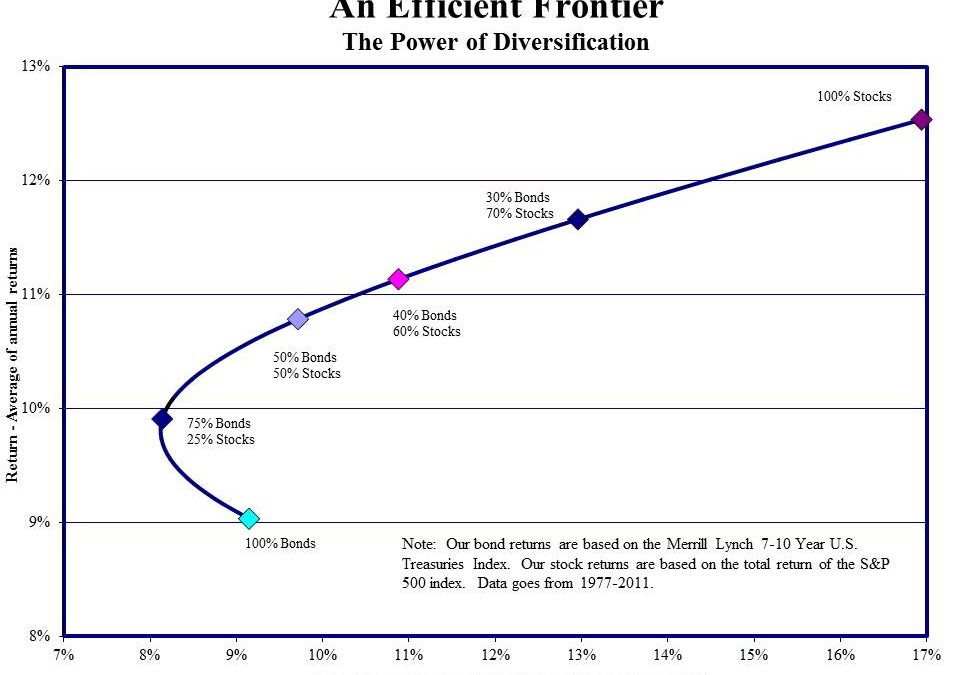

Harry Markowitz introduced the "Efficient Frontier," a graphical representation of all possible portfolios plotted by their expected return and risk. The theory posits that for any level of risk, there is one portfolio that offers the highest possible expected return. The line connecting these optimal portfolios is the Efficient Frontier.

Think of it like a "Chef's Tasting Menu" of investments. Any portfolio not on this special menu is suboptimal—you're either paying too much (in risk) for the return you receive, or not getting the best return available at that risk level. A rational investor should only choose from the Efficient Frontier.

Figure 1: The Efficient Frontier. This illustrates the set of optimal portfolios that offer the highest expected return for a given level of risk.

Section 3: The Contenders: A 'Magic Quadrant' for Portfolio Strategies

To analyze competing philosophies, this report uses the "Magic Quadrant" framework, a tool for visual, comparative assessment of the primary strategies available.

The Axes of Power

Y-Axis: Potential for Alpha (Ability to Execute): Measures a strategy's potential to outperform the market ("alpha"). A higher position means a higher potential return, but also greater demands for skill and risk.

X-Axis: Simplicity & Scalability (Completeness of Vision): Measures how accessible and manageable a strategy is. A position further to the right signifies an easier, more "set-it-and-forget-it" solution.

The Magic Quadrant for Portfolio Strategies

Figure 2: The Magic Quadrant for Portfolio Strategies. This quadrant maps the four primary investment strategies based on their potential for outperformance versus their ease of implementation.

Leaders (Top Right): The Indexers. Defined by massive diversification (hundreds or thousands of stocks), they mirror a market index. They are Leaders because they offer a complete, scalable, and effective solution for capturing market returns at a low cost.

Challengers (Top Left): The Diversified Stock Pickers. This strategy involves building a portfolio of 15-30 individual stocks to beat the market through skillful selection while still diversifying away most company-specific risk. They challenge the Leaders' premise that beating the market is futile.

Visionaries (Bottom Left): The Concentrators. The high-risk, high-conviction approach of holding very few (e.g., 3-10) stocks. Their success hinges on a unique, non-scalable insight into a few businesses. Their potential for alpha is the highest, but the strategy is impractical and extremely risky for most.

Niche Players (Bottom Right): The Robo-Advisors. These platforms use technology to automate portfolio construction, typically with a small number of low-cost ETFs. They serve the hands-off or beginner investor who prioritizes simplicity and automation.

Section 4: Deep Dive: Profiling the 'Vendors'

This section provides a detailed analysis of each "vendor" from the Magic Quadrant.

Profile 1: The Concentrators (The High-Stakes Visionaries)

Philosophy: Famously articulated by Warren Buffett, this strategy involves making large, high-conviction investments in a very small number of "wonderful businesses" that the investor understands with profound depth.

Optimal Number: Exceptionally small, typically 3 to 10 stocks.

Strengths: Unparalleled potential for generating alpha and life-changing wealth.

Cautions & Risks: Symmetrically high risk of catastrophic loss if the investor is wrong. This strategy is suitable only for the expert-level, business-analyst investor. For everyone else, it is a path to ruin.

Profile 2: The Diversified Stock Pickers (The Engaged Artisans)

Philosophy: This strategy is the traditional "happy medium," seeking to eliminate most company-specific risk through diversification while retaining the potential to outperform the market through skillful stock selection.

Optimal Number: A consensus points to a range of 15 to 30 stocks. Beyond this, the risk-reduction benefits diminish while complexity increases.

Strengths: A dramatic reduction in portfolio volatility compared to concentration, making returns more predictable.

Cautions & Risks: Requires a significant time commitment for research and monitoring. A major pitfall is "diworsification"—diversifying in name only by picking highly correlated stocks.

Profile 3: The Indexers (The Low-Cost Titans)

Philosophy: Built on the premise that consistently beating the market is incredibly difficult, so the most logical approach is to own the entire market by tracking a benchmark like the S&P 500.

Optimal Number: Hundreds or even thousands.

Strengths: Extremely low cost, instant and broad diversification, and high tax efficiency. Historically, most active managers fail to outperform passive benchmarks.

Cautions & Risks: An index fund will never beat the market. Because most major indexes are market-cap-weighted, investors are exposed to concentration risk in a few mega-cap stocks.

Profile 4: The Robo-Advisors (The Automated Guides)

Philosophy: These platforms use algorithms to automate portfolio construction based on an investor's goals and risk tolerance, typically using a handful of low-cost ETFs.

Optimal Number: A small number of ETFs (5-15), but these provide exposure to thousands of underlying securities.

Strengths: Ease of use, low account minimums, and low fees. Automated services like rebalancing and tax-loss harvesting enforce discipline.

Cautions & Risks: Lack of flexibility, as investors are limited to a pre-selected menu of ETFs. The pure-play model can feel impersonal.

Section 5: The Next Frontier: Emerging Technologies and Market Disruptors

Technological innovation is blurring the lines between old philosophies and forging new ones.

The Great Equalizer: Fractional Shares

What they are: The ability to buy and sell stocks in specific dollar amounts rather than full-share increments.

Market Impact: Fractional shares dismantle the high-cost barrier to entry, enabling investors of all sizes to execute the "Diversified Stock Picker" strategy with precision. They are a foundational technology for making sophisticated, customized strategies accessible to everyone.

The Ultimate Customization: Direct Indexing

What it is: Instead of buying an index fund, an investor uses technology to directly purchase the underlying individual stocks of an index in their own account.

Market Impact: This hybrid strategy combines the broad exposure of an index fund with the powerful advantages of direct ownership, such as enhanced tax-loss harvesting and portfolio customization (e.g., excluding stocks that conflict with personal values). This gives rise to a new category: Personalized Indexing.

Your New Co-Pilot: AI in Portfolio Management

What it is: Artificial intelligence is being integrated into the investment process to analyze vast datasets and augment human decision-making.

Market Impact: AI's primary value today lies in augmentation, not full automation. It can act as a tireless research assistant, synthesizing information from reports and news to identify trends. For platforms, AI is the engine behind automated rebalancing and tax-loss harvesting.

Cautions & The Human Element: Risks include the "black box" problem (opaque decision-making) and over-reliance eroding critical thinking. The future is likely an "HI + AI" (Human Intelligence + Artificial Intelligence) model, where AI provides the data analysis and humans provide context and strategic judgment.

Section 6: Strategic Recommendations: Choosing Your Champion

This analysis has shown that the "optimal number of stocks" is defined by strategy. The final step is to select your champion and avoid common pitfalls.

The Diworsification Diagnosis: Are You a Victim?

"Diworsification," a term coined by Peter Lynch, describes diversification taken too far, harming returns by adding complexity and cost without reducing risk.

Perform a self-diagnosis:

Do you own multiple funds with significant holding overlap? You may own the same top 10 stocks multiple times, creating redundant concentration.

Do you own so many stocks you can't explain why you own each one? Wide diversification is often a substitute for understanding.

Does your portfolio track a market index but with much higher fees and complexity? This is a classic symptom of a "closet index fund."

The cure is strategic consolidation and disciplined focus on a chosen strategy.

Choosing Your Strategy: A Decision Framework

If your primary goal is simplicity, effectiveness, and low cost...

Your Champion is The Indexer. This is the default winning strategy for most. The path is to consistently invest in a broad-market index fund or ETF.

If you enjoy research, want more control, and aim for modest outperformance...

Your Champion is The Diversified Stock Picker. This is for the engaged investor. The path is to build a portfolio of 20-30 well-understood companies across different sectors.

If you are a business analysis expert with a high net worth and extreme risk tolerance...

Your Champion might be The Concentrator. This path is fraught with peril and should be avoided by 99% of investors.

If you desire a completely hands-off, automated, and disciplined approach...

Your Champion is a Robo-Advisor. An excellent solution for those who value convenience over control.

If you have a large taxable account and want to maximize after-tax returns...

Your Champion is Direct Indexing. This is the emerging champion for sophisticated investors, offering market exposure plus powerful tax optimization.

Forecast: The Future of Portfolio Construction

The Passive Paradox: Passive indexing has won the war against the average active manager on cost and performance. However, its success has created a paradox: massive, valuation-agnostic flows have led to extreme concentration in a few mega-cap stocks. This may create market inefficiencies and increase systematic risk, potentially heralding a "golden period" for skilled stock pickers or "smarter" passive strategies.

The Rise of the Personalized Portfolio: The ultimate trajectory is toward hyper-personalization. The forces of zero-commission trading, fractional shares, direct indexing, and AI are converging. The future is a hyper-personalized, AI-augmented, directly-owned portfolio that is algorithmically managed to optimize for taxes, align with personal values, and capture market returns efficiently.

Concluding Thought

The quest for the magic number is over because it was always the wrong question. The number of stocks in a portfolio is merely an output, not an input. The more important quest—the one that truly defines an investor's journey—is the search for the right strategy. That search has just begun.