The Magnificent Seven: Are Investors Putting All Their Eggs in One Basket?

Interactive Brokers' CEO recently dropped a bombshell: 70% of their clients' cash is flowing into just seven stocks! But with these mega-cap companies making up only 30% of the market?

Quick reminder : I recently released a book called "Investing with Eagles." 🦅 It dives deep into the strategies I've used to navigate the market and achieve my own financial goals. For our launch offer we’re dropping the price to 12,99$ for the paper version and 9,99$ for the kindle version. If you're ready to soar to new heights, check it out on Amazon.

The Magnificent Seven: Still Hogging the Spotlight

Picture this: I'm scrolling through Twitter, minding my own business, when BAM! I get hit with a truth bomb courtesy of Interactive Brokers' CEO. He's basically saying that the "Magnificent Seven" – those superstar stocks that are always making headlines – are still the hottest ticket in town. In fact, a whopping 70% of their clients' cash is flowing directly into these seven companies. It's like everyone's decided to invest in the stock market equivalent of a boy band – all the hype, all the attention, and potentially, all the heartbreak if things go south.

Interactive Brokers: A Quick Intro for the Folks in the Back

Now, I know most of you already know Interactive Brokers like the back of your hand. But for those of you in the back who might be scratching your heads, let's do a quick intro. Think of them as the superheroes of the investing world, swooping in to save the day (and your portfolio!).

They make buying and selling stocks easier than ordering a pizza (and with way fewer calories!), and they even have those mysterious "options" things. Think of them as bets on whether a stock will go up or down – way more exciting than betting on who's going to win the next season of "The Bachelor" (although, let's be honest, those rose ceremonies can be pretty dramatic).

Basically, Interactive Brokers is your one-stop shop for all things investing. They've got the tools, the technology, and the know-how to help you navigate the market like a pro (or at least like someone who knows what they're doing). So, whether you're a seasoned investor or just starting out, Interactive Brokers is your trusty sidekick on your journey to financial freedom.

Big Numbers, Bigger Questions (and a Whole Lotta Cash)

But Interactive Brokers is more than just a pretty face. These guys are handling some serious business! Think about this: they have over 3 million clients worldwide, and those clients trust them with over 500 billion dollars in equity. That's enough to buy a small country (or a really, really big yacht!).

And it's not just about the money. IBKR processes a jaw-dropping 1,088,390 stock trades every single day. That's like trading all the shares of your favorite company before lunch! It's a seriously impressive amount of action, and it shows just how much people rely on IBKR to handle their investments. But here's the thing that made me choke on my coffee: 70% of their clients' inflow is going into just seven companies! It's like everyone's decided to put all their eggs in one very expensive, very exclusive basket.

The problem is, these seven companies only make up about 30% of the S&P500. It's like going to an all-you-can-eat buffet and only eating the mashed potatoes. You're missing out on all the other delicious options!

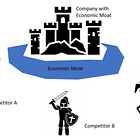

Why This is Riskier Than a Blindfolded Trust Fall

So, why is everyone so obsessed with these seven stocks? Well, they're big, they're flashy, and they've been doing pretty well lately. But putting all your money into just a few companies is like betting your life savings on a game of roulette – it might pay off big time, but it could also leave you with empty pockets and a serious case of buyer's remorse.

Think of it this way: the Magnificent Seven are like the popular kids in high school. Everyone wants to be their friend, but they might not actually be that cool (and they definitely have their own set of problems). Meanwhile, there are tons of other awesome companies out there, just waiting to be discovered, like the hidden gems in your local thrift store. But who am I to say? I only invested in 6 companies.

It's always smart to be aware of the risks and consider spreading your investments around. After all, that's what smart investing is all about!

What's an Investor to Do? (Besides Panic?)

So, what's the takeaway from all this Magnificent Seven madness? Well, it's up to you, my friend. You could join the hype train and throw your money at those popular stocks, or you could be a rebel and explore the uncharted territories of the market. Or, you could do a bit of both – diversify your portfolio like a boss and enjoy the best of both worlds.

Whatever you choose, just remember to have fun with it! Investing shouldn't be a snoozefest.

Loved this? Then share it, for the love of all that is holy! My family is threatening to eat me if I don't bring home the bacon (or the clicks)

Want to keep reading our free articles?

Disclaimer: The information provided in our analyses and reports is for informational and educational purposes only and should not be considered investment advice. We are not financial advisors, and nothing we say or write should be construed as a recommendation to buy or sell any security.

While we strive to provide accurate and insightful information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information presented.

It is important to note that we may or may not hold positions in the companies we discuss. Any opinions expressed are our own and are subject to change without notice.

Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. Never invest more than you can afford to lose.