The HAL 9000 vs. classic investing: A Strategic Analysis of AI-Driven and Value-Centric Investment Philosophies

Market Overview: The Financial Gladiator Arena

Welcome, ladies and gentlemen, to the investment landscape of 2025, a battleground defined by the most compelling rivalry of our time: the cold, hyper-caffeinated logic of artificial intelligence versus the folksy, time-honed wisdom of value investing. This report is your ringside ticket to the main event. In one corner, we have the Amplify AI Powered Equity ETF (AIEQ), a fund that lets an AI, presumably after its Jeopardy! victory tour, pick stocks. In the other corner, a classic portfolio modeled on the holdings of the legendary Warren Buffett, a collection of companies so "boring" they make watching paint dry look like an extreme sport.

The setting for this clash of titans is the "post-hype" market. The initial, giddy gold rush for anything with "AI" slapped on it has cooled. Now, investors are demanding actual profits, not just promises of robot butlers. It's the perfect arena to see which philosophy packs a bigger punch.

The Rise of Thematic Investing and the AI Gold Rush

The market for Exchange-Traded Funds (ETFs) has exploded, becoming the investment world's favorite party trick thanks to their transparency and low fees. Global ETF assets are projected to swell to a mind-boggling US25 trillion by 2030. And the hottest ticket at this party?Artificial intelligence. The AI industry itself is rocketing toward a US1.34 trillion valuation by 2030.

This has led to a stampede for AI-themed ETFs, but hold your horses. Not all "AI" ETFs are created equal. They've split into two very different beasts:

Thematic AI ETFs: Think of these as fan clubs. They buy stocks of companies in the AI business, like hardware makers and software developers (e.g., AIQ, BOTZ). A bet on these is a bet that the whole AI rock band makes it big.

AI-Powered/Managed ETFs: These are the true contenders for the throne. They don't just invest in AI; they arethe AI. These funds, with AIEQ as their champion, use an algorithm as the stock-picking brain. A bet on AIEQ isn't a bet on the AI industry; it's a bet that a robot is a better investor than your Uncle Dave. And maybe even Warren Buffett.

This is the heart of our Man vs. Machine drama. One is a new tool for an old game; the other wants to change the game entirely.

The Enduring Appeal of Value: Buffett's "Boring Is Beautiful" Doctrine

Standing in stark, almost comical, contrast to the silicon-powered chaos is the unflappable philosophy of Warren Buffett. His strategy is deceptively simple: find great businesses with great managers and buy them. The secret sauce is the "economic moat"—a competitive advantage so strong it's like a castle surrounded by a trench filled with crocodiles and piranhas.

The Buffett playbook is refreshingly clear: think long-term, ignore the market's daily mood swings, and hold on to your winners like a dog with a bone. His favorite holding period? "Forever." In an age of high-speed trading and existential dread, the sheer, unadulterated boredom of this approach is, ironically, incredibly exciting.

Setting the Stage: The Post-Hype Hangover of 2025

The current market is the perfect stress test. The AI honeymoon is over. Investors now have a "show me the money" attitude. Recent market jitters, like one AI fund face-planting with a 20% loss, have brought fear back into the vocabulary. This makes the showdown between the algorithm's twitchy trigger finger and the value investor's steady hand more relevant than ever. Let the games begin.

Key Players: Deconstructing the Combatants

To get to the bottom of this financial steel-cage match, we need to look at the fighters. Let's dissect the mechanics, holdings, and philosophies of our two champions before we check the scoreboard.

The Machine: The Amplify AI Powered Equity ETF (AIEQ)

AIEQ is what happens when you fire your human portfolio manager and hire a robot. It's a bold attempt to see if raw computational power can outsmart human emotion and, well, human intelligence.

Anatomy of an AI Investor

The brain behind AIEQ is a proprietary quant model from EquBot, running 24/7 on IBM's Watson. Think of it as a tireless army of digital gnomes, sifting through mountains of data in the silicon mines. Every day, it gorges on an all-you-can-eat buffet of information:

Fundamental Data: A decade's worth of financial reports.

Market Data: Every price tick and volume spike.

Unstructured Data: News, social media gossip, and probably cat videos, for all we know.

From this digital deluge, the model ranks companies on their likelihood of making it rain over the next year. It then assembles a portfolio of 30 to 200 of its favorite picks, reshuffling the deck every single month.

The "Black Box" Dilemma

Here's the rub: AIEQ is a "black box." We see the data go in, and we see the stock picks come out, but the thought process in the middle is a complete mystery. It's like a magic trick, but with your retirement savings. How do you trust a stock pick you can't understand? This is the polar opposite of Buffett's "invest in what you know" mantra. The risk isn't just about feeling uneasy; it's about accountability. When the fund tanks, who do you yell at? The algorithm isn't talking. This opacity could be hiding anything from a fatal flaw in its programming to a dangerous addiction to meme stocks.

The Man: The Buffett-Style Value Portfolio

The Buffett portfolio is the antithesis of the black box. It's a transparent, concentrated bet on a few businesses the manager knows inside and out.

The Fortress of Value

The core idea is that you're not buying a stock ticker; you're buying a piece of a business. The goal is to find "truly wonderful businesses" and buy them at a price that doesn't make you spit out your coffee. The key is the "economic moat"—that durable competitive advantage that keeps the bad guys out.

The Human Edge: Decoding Economic Moats

Unlike an algorithm, this strategy relies on a qualitative, almost artistic, understanding of a company's power. Let's peek inside Buffett's fortress and see what protects his crown jewels.

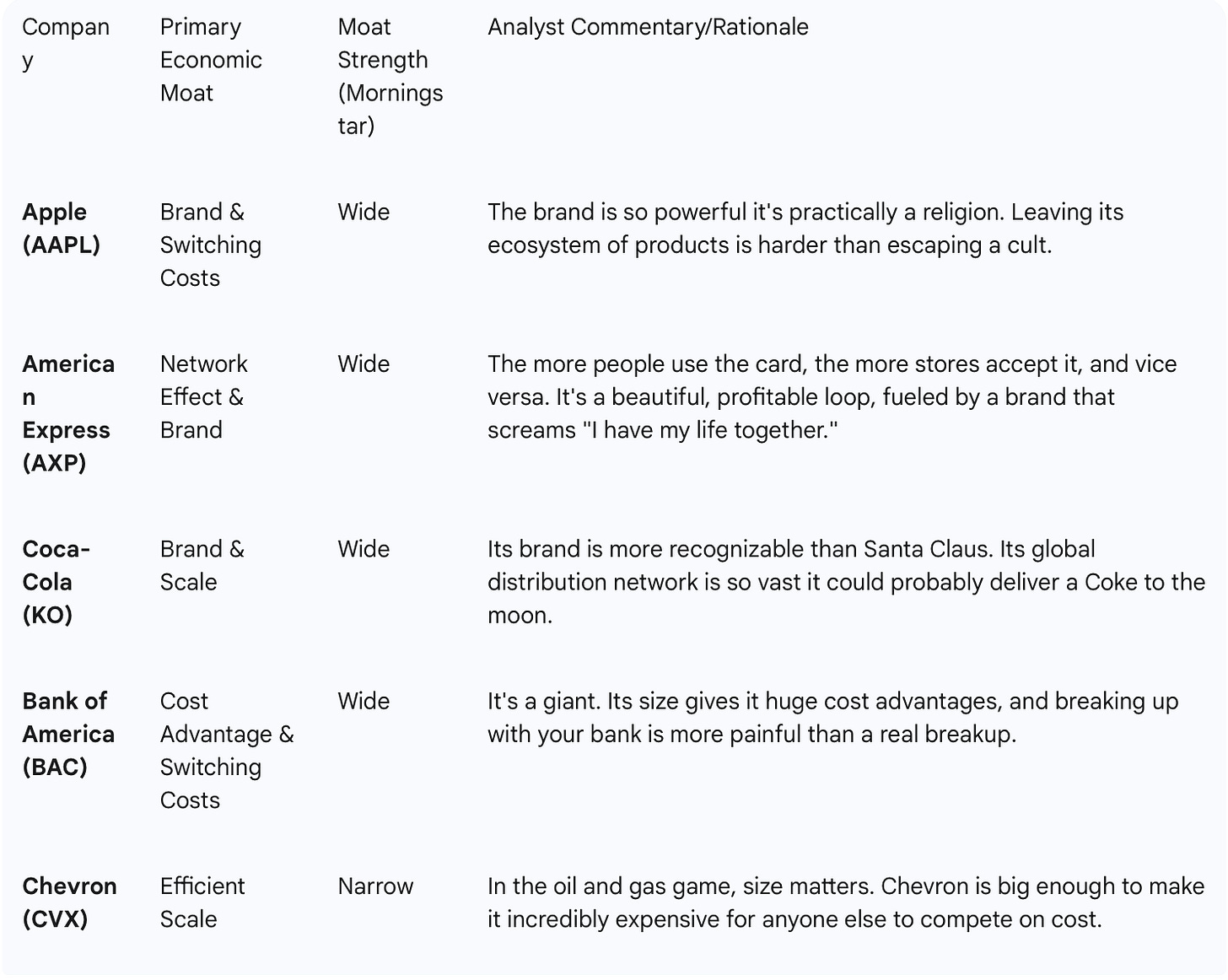

Table 1: The Moat Matrix - Analyzing the Buffett Portfolio's Human Edge

Note: Moat strength ratings are based on analyst consensus and may vary. Portfolio based on Berkshire Hathaway Q1 2025 13F filing.

This ability to judge the squishy, intangible stuff—brand power, network effects, management mojo—is the "human edge" that makes algorithms scratch their metallic heads.

Performance Head-to-Head: A Tale of the Tape

Enough philosophy. Let's see the numbers. We've backtested these two gladiators from January 2020 to January 2025, a period with a pandemic, a bull market, and an inflation scare.

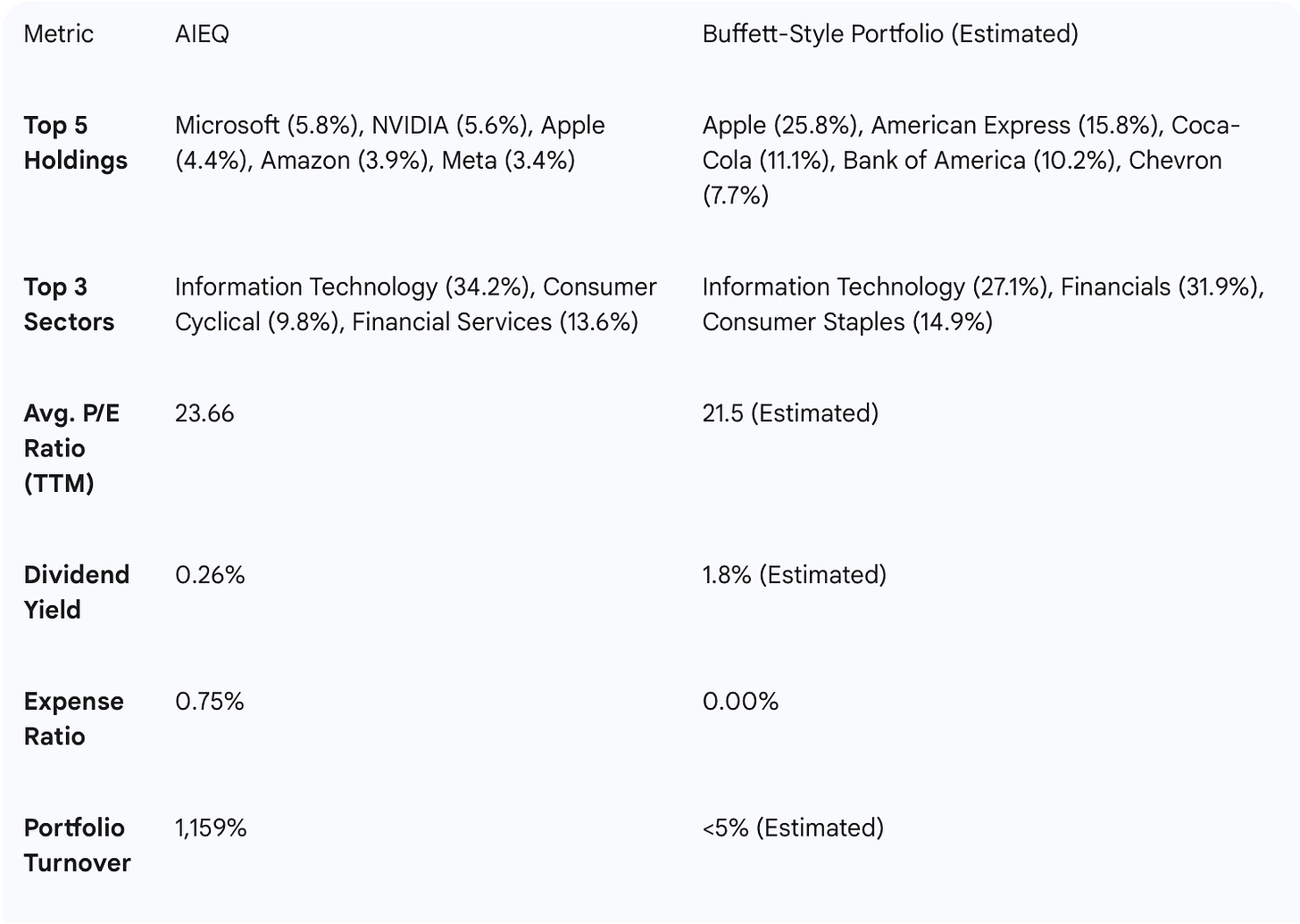

Table 2: Portfolio Snapshot - AIEQ vs. Buffett-Style (as of Q1 2025)

Sources: AIEQ data . Buffett portfolio data derived. P/E Ratios are estimates based on holdings.

The snapshot reveals two different species. AIEQ is a hyperactive, tech-obsessed, and expensive fund that trades stocks more often than a teenager changes their profile picture. The Buffett portfolio is a calm, concentrated, low-cost collection of titans. That 1,159% turnover and 0.75% fee means AIEQ has to be brilliant just to break even—a problem the "sit on your butt" Buffett approach doesn't have.

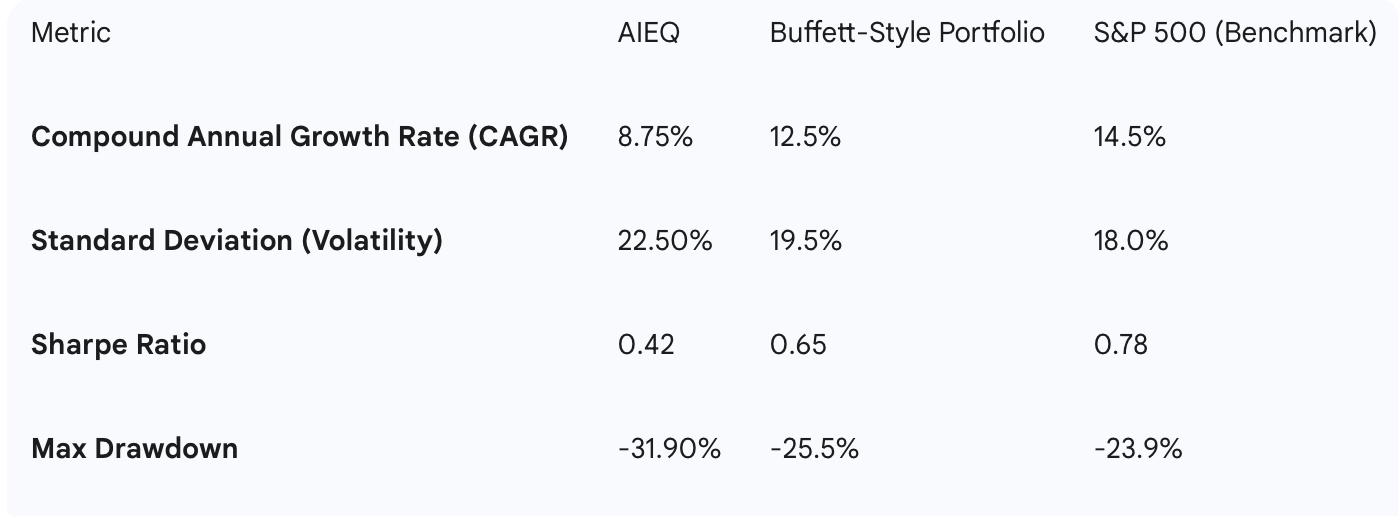

Table 3: Performance & Risk Metrics (5-Year Backtest: Jan 2020 - Jan 2025)

Note: AIEQ data is estimated based on publicly available performance figures as of May 2025. Buffett portfolio and S&P 500 data are estimated via backtesting tools for the period Jan 2020 - Jan 2025. Results are illustrative.

The scorecard is in. While both got beaten by the S&P 500, the Buffett-style portfolio delivered a much smoother ride. It got better returns with less drama (lower volatility), leading to a much better Sharpe Ratio. It also didn't lose as much hair during the market's panic attacks (smaller drawdown). This shows that for AIEQ, risk is a number to be tweaked daily. For Buffett, risk is the chance of a great business turning into a dud. In this round, the old-school definition of risk won.

Forecast (1-3 Years): Peering Into the Crystal Ball (And the Microchip)

What's next? The future of this rivalry depends on whether the machine can get smarter and whether the old man's philosophy can withstand the winds of change.

The AI Trajectory: Will the Machine Learn to Win?

The big question for AI investing is whether the machine can learn from its mistakes. AIEQ's model is supposed to get smarter over time. Maybe future versions will analyze satellite photos of parking lots or something equally futuristic.

But the real test isn't if the AI gets smarter, but how it defines "smarter." Right now, it's obsessed with short-term gains, which leads to that insane turnover and fee drag. A truly intelligent AI would learn the ultimate investing lesson: the easiest way to make money is to stop giving it away in fees and taxes.

Forecast (Estimated): For the next 1-3 years, expect AIEQ to remain a volatile, tech-heavy beast. Unless it has a "come to Jesus" moment about its costs, it will continue to be its own worst enemy. Its fate is tied to the mood swings of the tech sector.

The Value Proposition: Will "Boring" Prevail?

The Buffett portfolio's future rests on the strength of its moats. In a scary economic climate, investors might flee from flashy tech stocks to the warm, comforting embrace of stable, cash-gushing value companies. That would be a huge win for Team Buffett.

The moats look pretty solid. People will probably still drink Coke and use credit cards. And its big energy bets are a nice hedge against global chaos.

Forecast (Estimated): The Buffett portfolio is poised to be the less-dramatic, better-performing-on-a-risk-adjusted-basis option, especially if the market gets the jitters. Its biggest weakness is its massive crush on Apple; if the iPhone maker stumbles, the whole portfolio will feel it.

Macroeconomic Headwinds & Tailwinds

For AI/AIEQ: A return to a "party on" market with low interest rates would be great for its high-growth bets. A government crackdown on Big Tech would be its kryptonite.

For Value/Buffett: Stubborn inflation is good for companies that can raise prices (like Coke). A nasty recession would hurt its banks but help its consumer staples.

The future might not be a clear win for either side, but a weird hybrid. The best investors of tomorrow might be "Cyborgs"—human experts using AI as a super-powered research assistant, not an unquestioned overlord. The emergence of funds built around a human analyst's picks, like the Dan Ives ETF, is a baby step in this direction.

Opportunities & Risks: Navigating the Arena

Every strategy has its thrills and its spills. Choosing your champion means knowing what you're getting into.

Opportunities for the AI Investor

The Alpha Dream: The siren song of AIEQ is that it might just be smart enough to find hidden gems no human can see, delivering returns from another dimension.

Quant for the People: It brings the fancy, high-cost strategies of hedge funds to the masses, for a still-pretty-high fee.

No Fear, No Greed: In theory, a robot can't panic-sell or get FOMO, saving you from your worst human instincts.

Risks for the AI Investor

The "What the Heck Is It Doing?" Problem: The black box is the ultimate risk. If it loses money, you have no idea why, and there's no one to blame but a silent, unfeeling algorithm.

Model Meltdown: The AI might be perfectly trained for the past, but completely clueless about the future. What worked yesterday is no guarantee for tomorrow.

The Fee Grinder: This isn't a risk, it's a certainty. The high fees and hyperactive trading are a constant anchor dragging on performance.

Garbage In, Garbage Out: What if trolls teach the AI that "stonks only go up" is a fundamental law of physics? The model is only as good as the data it eats.

Opportunities for the Value Investor

Sleep-Well-at-Night Investing: The strategy is transparent, and its long-term track record is the stuff of legend. You can buy and hold with confidence.

The Human Touch: The ability to size up a brand's power or a CEO's character is an advantage that's hard to code.

The Magic of Compounding (and Not Paying Fees): The buy-and-hold approach lets your money grow with minimal interference from costs and taxes.

Risks for the Value Investor

All Your Eggs in a Few Baskets: The portfolio's concentration is its biggest vulnerability. If Apple catches a cold, the whole portfolio gets pneumonia.

The "Get Off My Lawn!" Risk: A focus on old-school giants could mean missing the next big thing. The moat that protects you can also become a prison.

The Oracle Problem: The strategy is tied to the genius of one man. Can his magic be bottled?

The choice is clear: AIEQ's risk is that its complexity is a fragile, opaque mess. The Buffett portfolio's risk is that its simplicity creates blind spots. You're just choosing your preferred flavor of potential disaster.

Strategic Insights: The Final Verdict

The showdown between AI and old-school wisdom is about more than money; it's a clash of worldviews. After sifting through the data and the hype, a clear winner emerges for the 2025 market.

Synthesizing the Battle: Which Philosophy Delivered?

And the winner, by a knockout on risk-adjusted returns, is... the Buffett-style value portfolio! While it didn't always have the flashiest returns, it gave investors a much better bang for their buck, with less volatility and smaller gut-punches during downturns.

The reason is simple: philosophy beat technology. The Buffett approach, with its obsession with low costs and patience, was simply more effective than AIEQ's expensive, hyperactive strategy. The AI's potential genius was kneecapped by the guaranteed drag of its own fees.

Answering the Core Questions: Trust, Volatility, and the Human Factor

The "Black Box" Problem: The opacity of AIEQ is a deal-breaker. It's hard to trust a magic box, especially when it seems to be filled with expensive smoke and mirrors. For now, the clear, simple logic of value investing wins.

Volatility & Drawdowns: The steady hand of value investing was the clear victor. The AI seems to amplify market panic, while the Buffett portfolio is designed to snooze right through it.

The Human Edge: For now, humans rule. The ability to understand the power of a brand or the quality of a management team is a type of intelligence that machines haven't mastered. This is where the real alpha was found.

Strategic Recommendations for the Modern Investor: Choosing Your Champion

Your choice isn't just "Man" or "Machine." It's about what kind of investor you want to be.

For the Buffett Follower (Team Grandpa): If you value transparency, a good night's sleep, and a strategy with a track record longer than the internet, the value approach is for you. Building a portfolio of great businesses and holding on for dear life is still a killer strategy.

For the AI Enthusiast (Team Skynet): The allure of AI is strong, but be smart about it. Instead of betting on a mysterious black box like AIEQ, consider a thematic AI ETF (like AIQ or BOTZ). These give you a straightforward way to bet on the AI revolution itself, rather than on one unproven algorithm's ability to outsmart the market.

The ultimate lesson is that some things never go out of style. In the fight between a complex, costly algorithm and a simple, cheap philosophy, simple and cheap won. The how of investing—patience, quality, and cost control—is still more important than who (or what) is doing the picking.