The Great Remittance Disruption: Will Stablecoins Make Wise Obsolete?

A deep dive into whether crypto's advantages are enough to overcome the convenience and cost realities of established players.

Okay, picture this: Wise (formerly TransferWise), the cool kid on the block that made sending money abroad less painful and pricey than your old bank. They swoop in, simplify things, and generally make life easier.

But wait! What's that sound? Is it a bird? Is it a plane? No, it's... stablecoins! The new, new kid on the block, promising lightning-fast, super-cheap global money movement.

Wise vs. Stablecoins for Money Transfers: What's the Difference?

Are stablecoins like USDC going to replace services like Wise for sending money internationally? Let's look at what each offers.

Wise: Like an All-Inclusive Service

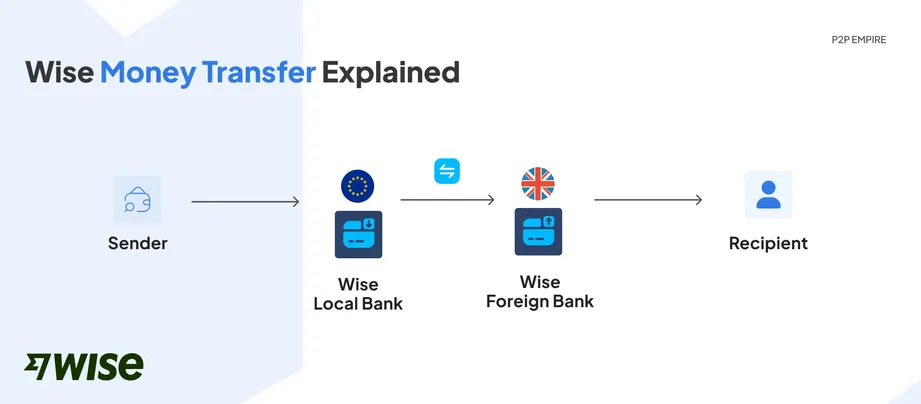

Think of using Wise as getting a complete service package for your money transfer. They handle everything from start to finish:

Getting Started: Wise verifies you and takes the money directly from your bank account.

The Transfer & Currency Exchange: They move your money across borders and convert it into the recipient's currency (e.g., Dollars to Euros) along the way, typically using a competitive exchange rate.

Final Delivery: They deposit the money directly into your recipient's bank account.

Essentially, Wise provides the entire service in one place.

Stablecoins: Like Buying Just One Ingredient

Now, think of stablecoins (digital tokens like USDC, pegged to a currency like the US dollar). They are very good at one specific part of the process:

The Digital Transfer: Sending the stablecoin value across a blockchain can be very fast and potentially very cheap (sometimes costing just cents).

But that's only the middle step!

To use stablecoins for a complete transfer (from your bank account to their bank account), you need to handle the other steps yourself, usually by using crypto exchanges:

Missing Step 1 (Sender): The person sending the money needs to go to an exchange, get verified, and use their regular money to buy the stablecoins first.

Missing Steps 2 & 3 (Receiver): The person receiving the money needs an account on an exchange to accept the stablecoins, then sell them for their local currency (like Euros), and finally withdraw that currency to their own bank account.

The Key Difference:

Wise offers the complete, end-to-end journey for your money transfer. Stablecoins handle the transfer part efficiently, but you (and your recipient) need to use separate services (crypto exchanges) to handle the crucial beginning (getting money in) and end (getting money out and exchanged) steps.

Crypto Transfers Aren't Always Cheaper: Beware of Hidden Fees!

Think using cryptocurrencies like USDC for sending money internationally is a cheap alternative? Not so fast. While it seems straightforward, crypto exchanges charge fees at multiple steps, which can add up quickly.

Let's break it down with an example:

Imagine someone sends you 2,000 USDC (worth about $2,000 USD) to your account on a European crypto exchange. You want to convert it to Euros (€) to spend. Here are the costs you might face just on your end:

Bad Exchange Rate (Slippage): When you swap USDC for Euros on the exchange, you might not get the best possible rate, meaning you lose a bit of value right away.

Trading Fees: The exchange charges you a fee just to swap your USDC into Euros. For example, Coinbase might charge around 0.60% for this.

Withdrawal Fees: Once you have Euros, you need to move them from the exchange to your regular bank account. The exchange charges another fee for this. Examples include €1 on Binance or even $25 on Coinbase.

The Bottom Line for You (The Receiver):

Just these fees on your end could easily cost you between 1% and 3% of the money you received. On $2,000, that's anywhere from $20 to $60 disappearing in fees!

Don't Forget the Sender!

Remember, this only covers your costs (converting and withdrawing). The person who sent you the USDC probably also paid fees to buy the crypto in the first place.

How Does This Compare?

Service like Wise could handle the entire process (sending the money, exchanging the currency, and receiving it) for a total fee of around 0.55-1%.

Are Stablecoins Really Better Than Wise? It's Complicated.

Stablecoins sound impressive – often described as more stable, cheaper, and faster. But are they truly better than a service like Wise for everyday international money transfers? The answer depends on who you are and what you need.

1. More Stable?

For someone in a country with extremely high inflation (like Venezuela): Yes, holding a stablecoin pegged to the US dollar (like USDC) is definitely more stable than holding a rapidly devaluing local currency.

For someone in a country with a stable currency (like the UK or USA): The local currency (Pound Sterling, US Dollar) is already reliable, so the stability benefit of a stablecoin isn't really needed for day-to-day use.

2. Cheaper?

Compared to traditional bank wires: Maybe. Stablecoins could cut out some middlemen compared to old-school international banking.

Compared to efficient services like Wise: Often no. As shown before, when you add up all the crypto exchange fees needed to buy the stablecoin, swap it for local currency, and withdraw it to a bank, the total cost can frequently be higher than Wise's straightforward fee.

3. Better Features (Faster, 24/7, Global)?

Fast & 24/7: Stablecoin transfers can be nearly instant, any time. However, traditional finance is improving with its own real-time payment systems (like FedNow in the US, Pix in Brazil, UPI in India). Also, remember "instant" transfers can mean instant loss if there's fraud or a mistake.

Global Reach: The transfer part works worldwide on the blockchain. But, the "first mile" (getting your regular money onto an exchange to buy crypto) and the "last mile" (getting crypto off an exchange into a local bank account) still face significant hurdles, costs, and regulations that vary by country.

Programmable Money: This is an interesting technical feature (money that can have rules embedded in it), but it's mostly theoretical for typical users sending money home right now.

Want to read the rest? Level Up Your Investing!

Tuesdays (Free): Get market insights and tips delivered to your inbox.

Thursdays (Premium): Exclusive access to:

Earnings analysis

Portfolio insights

Bonus articles

Quarterly market reviews

Free copy of my book "Investing With Eagles".

Subscribe to Waver Premium for only 7.49$ per month for in-depth market knowledge and financial growth. that less than 2 Starbucks coffee a month.