The Financial Three Musketeers

A Fun Guide to How Your Income Statement, Balance Sheet, and Cash Flow Statement REALLY Work Together!

Every business has a story to tell, written in the language of numbers. Think of its financial statements not as dusty old reports, but as a diary, revealing performance secrets, current status, and where the cash actually went. To decode this story, you need to know the main characters: the Income Statement, the Balance Sheet, and the Cash Flow Statement.

Now, you might know these characters individually. The Income Statement is the scoreboard showing if you won (profit!) or lost over a period. The Balance Sheet is a selfie capturing what you own and owe at a specific moment. And the Cash Flow Statement is the detective tracking every dollar that came in or flew out the door.

But here’s the cool part: they don't work alone! They're like the Three Musketeers of finance – interconnected, always influencing each other, telling one unified story. This article is your guide to their secret handshake. We'll follow the money trail – where it pops up, how it zips between operations, big buys, and backers, and where it ends up. Understanding this flow, especially cool concepts like Free Cash Flow, is like getting financial X-ray specs for your business!

Meet the Crew: A Quick Recap

Before we see them in action together, let's re-introduce our heroes:

The Income Statement (aka P&L, the Scoreboard): This tells you how the business performed over a period (like a year). It lines up Revenue (the points scored) against Expenses (the points conceded) to give you the final Net Income or Loss – the trophy (or lack thereof!). Remember, it uses accrual accounting, which sometimes means counting points before the cash actually hits the bank. Profit isn't always cash!

The Balance Sheet (The Selfie): This snaps a picture of your company's financial pose at one specific moment. It follows the golden rule: Assets = Liabilities + Equity. Assets are the company's goodies (Cash, machines, IOUs from customers). Liabilities are the company's IOUs to others (bank loans, bills to pay). Equity is the owners' slice of the pie (their investment + accumulated profits).

The Cash Flow Statement (CFS, The Cash Detective): This trusty detective ditches the accrual guesswork and tracks real cash moving in and out over the same period as the Income Statement. It snoops around three main neighborhoods:

Operating Activities (CFO): Cash from the daily grind.

Investing Activities (CFI): Cash spent on or raised from big-ticket items (think buildings, equipment).

Financing Activities (CFF): Cash swapped with owners and lenders (loans, stock, dividends).

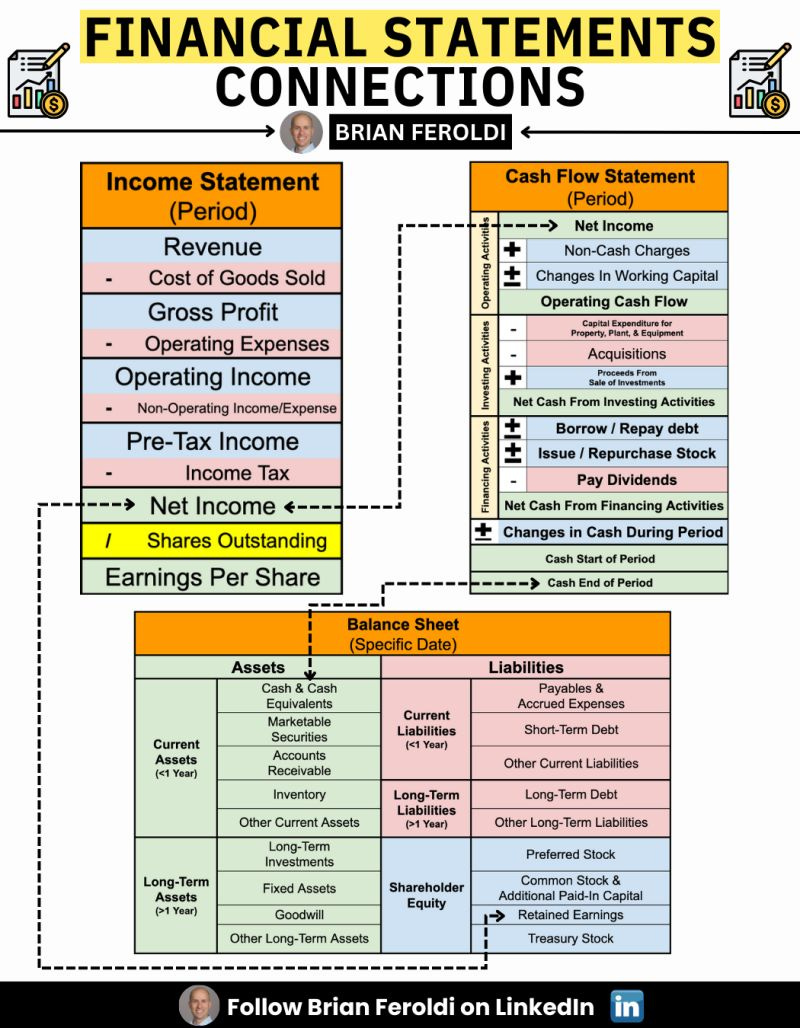

Credit to Brian Feroldi from mootleyfool for this excellent representation of the link between the 3 statements.

All for One, and One for All: How They're Linked!

This is where the magic happens. These three aren't islands; they're constantly passing notes and influencing each other. Here’s how:

Profit's Journey: From Scoreboard to Piggy Bank (IS to BS)

The Win: The Income Statement calculates Net Income. Hooray! This profit belongs to the owners.

Share the Spoils?: The company decides – hand out some cash as Dividends (a treat for owners) or keep it?

Into the Vault (Retained Earnings): The leftover Net Income gets tucked away in Retained Earnings, which lives in the Equity section of the Balance Sheet. It's like the company's cumulative piggy bank.

The Secret Formula: Ending Piggy Bank (BS) = Starting Piggy Bank (Prior BS) + This Period's Winnings (IS) - Treats Handed Out (Dividends)

Why it Matters: Shows how winning the game (profit) makes the owners' stake on the Balance Sheet bigger and stronger.

From Paper Profit to Real Cash: Linking the Scoreboard to the Detective (IS to CFS)