Mycronic AB: Mastering the Niches on the Frontiers of Electronics

How a Swedish Tech Champion Wins by Not Fighting Fair

1. Market Overview: The High-Stakes Arenas of Precision Electronics

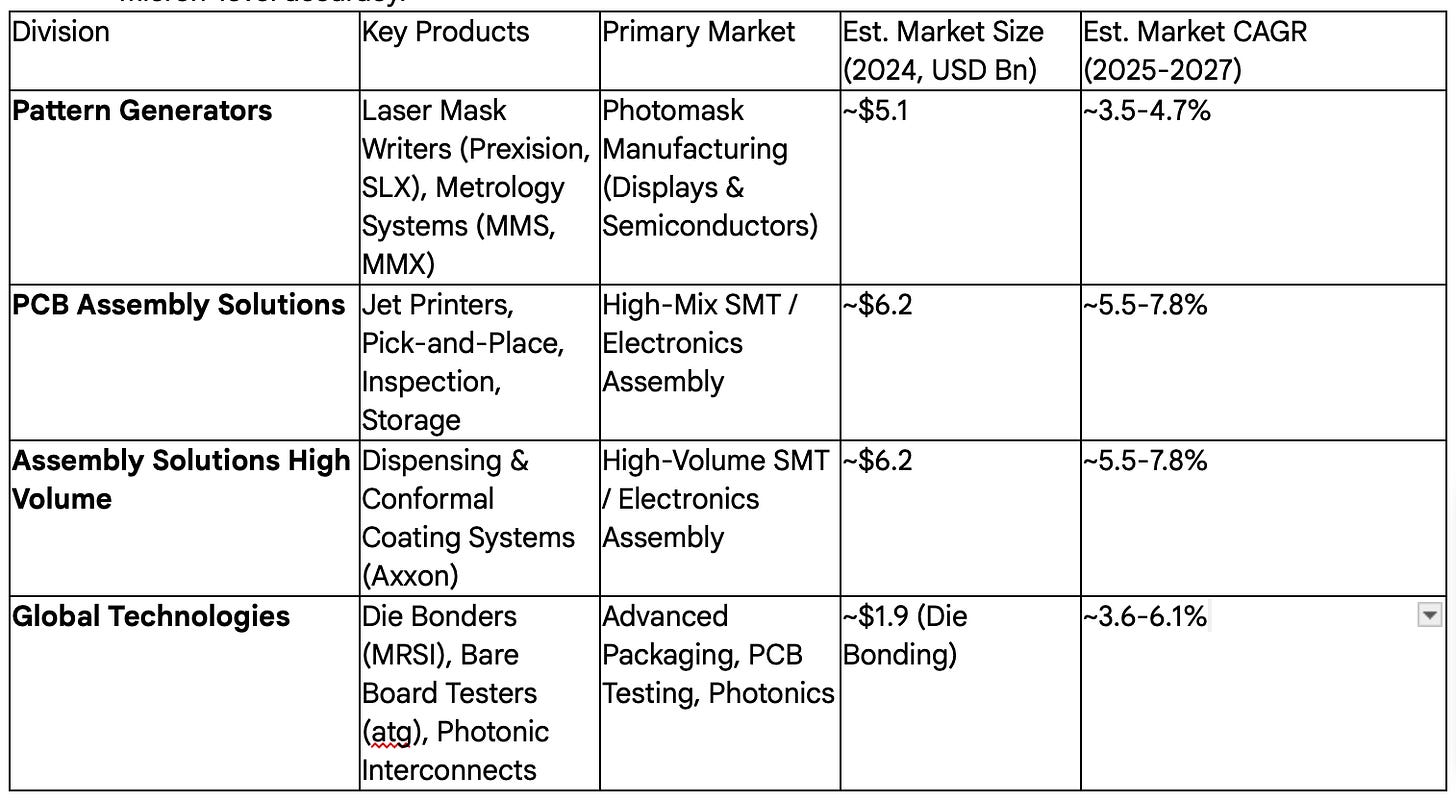

Mycronic AB operates at the bleeding edge of the electronics industry, a landscape defined by relentless innovation and microscopic precision. The company's success is built not on dominating a single, monolithic market, but on achieving leadership in three distinct but deeply interconnected battlegrounds: the creation of photomasks, the assembly of complex circuit boards, and the advanced packaging of semiconductor devices. Understanding these arenas is key to understanding Mycronic's strategy and future.

Battleground 1: The Photomask Market - Precision is Paramount

Photomasks are the master blueprints of the electronics world; intricate quartz plates that dictate the circuitry of every microchip and the pixel structure of every advanced display. This is a market where precision is not just a feature, but the entire value proposition.

The global photomask market was valued at approximately USD 5.1 billion in 2024 and is projected to exhibit steady, value-driven growth. Forecasts indicate a compound annual growth rate (CAGR) of between 3.5% and 4.7%, pushing the market towards USD 7.0-7.4 billion by 2030-2033. Geographically, the market's center of gravity is firmly in the Asia-Pacific region, which commands over 36% of the market, propelled by its world-leading semiconductor foundries and display fabrication plants.

The market's growth is fueled by two powerful technological currents:

Semiconductors: The insatiable demand for more powerful chips—driven by AI, 5G, and the Internet of Things (IoT)—is pushing the industry towards smaller, more complex manufacturing nodes (sub-5nm). This requires a new generation of sophisticated and costly Extreme Ultraviolet (EUV) photomasks. Simultaneously, the proliferation of electronics in automotive and industrial applications creates a robust, high-volume demand for masks used in mature, cost-sensitive manufacturing processes.

Displays: The consumer appetite for vibrant, high-resolution screens in smartphones, televisions, and emerging AR/VR devices is driving the adoption of OLED and micro-LED technologies. The display segment is a major consumer, accounting for over 33% of the photomask market. Manufacturing these next-generation displays requires photomasks of unprecedented complexity and precision.

While the overall market's unit growth appears modest, this figure masks a crucial underlying trend: a profound shift in value. The manufacturing equipment needed to produce a state-of-the-art EUV or G10+ OLED photomask is orders of magnitude more complex and expensive than the equipment used for older technologies. This creates powerful replacement cycles for high-value capital equipment, even if the total number of masks produced grows slowly. Consequently, the growth of a company like Mycronic, which produces this capital equipment, is more closely tied to the rate of technological change in its customers' industries than to the simple volume growth of end-products. The recent launch of the Prexision 8000 Evo mask writer, priced between USD 40-45 million, is a direct response to this demand for higher precision and complexity, not just higher volume.

Battleground 2: The Electronics Assembly (SMT) Market - The Need for Speed and Agility

If photomasks are the blueprints, the Surface Mount Technology (SMT) market is the factory floor where those designs are brought to life. This is a colossal market, valued at over USD 6.2 billion in 2024 and forecast to grow at a robust CAGR of 5.5% to 7.8%, potentially exceeding USD 9.5 billion by 2032. While Asia-Pacific remains the dominant manufacturing hub, geopolitical shifts are fueling a significant trend of "reshoring" and supply chain diversification, with new investments flowing into North America and Europe.

Key drivers for the SMT market include:

Miniaturization: The continuous shrinking of components for everything from medical implants to automotive sensors demands assembly equipment with ever-higher precision.

High-Mix Manufacturing: The modern electronics landscape is defined by product personalization and rapid innovation cycles. This creates a need for flexible production lines that can quickly switch between different products (high-mix) and handle rapid prototyping for new product introductions (NPI).

Secular Growth Trends: The global build-out of AI data centers, the rollout of 5G infrastructure, and the accelerating electrification of the automotive industry are creating immense, long-term demand for sophisticated printed circuit board (PCB) assemblies.

Battleground 3: The Die Bonding Equipment Market - Building the Future, One Chip at a Time

Die bonding represents the final frontier of miniaturization and performance, where individual semiconductor dice are precisely placed and connected to form complex, multi-chip modules. This specialized but vital market was valued around USD 1.88 billion in 2024 and is forecast to grow at a CAGR between 3.6% and 6.1% through 2030. The primary catalyst for this market is the architectural shift in semiconductor design towards advanced packaging techniques. Technologies like System-in-Package (SiP) and "chiplets" are becoming essential for building the high-performance processors and photonic components required for AI, 5G, and next-generation data centers. This, in turn, drives demand for ultra-high-precision die bonders capable of handling multiple die types and complex bonding processes with micron-level accuracy.

2. Key Players: A Field of Titans, Specialists, and Guerrillas

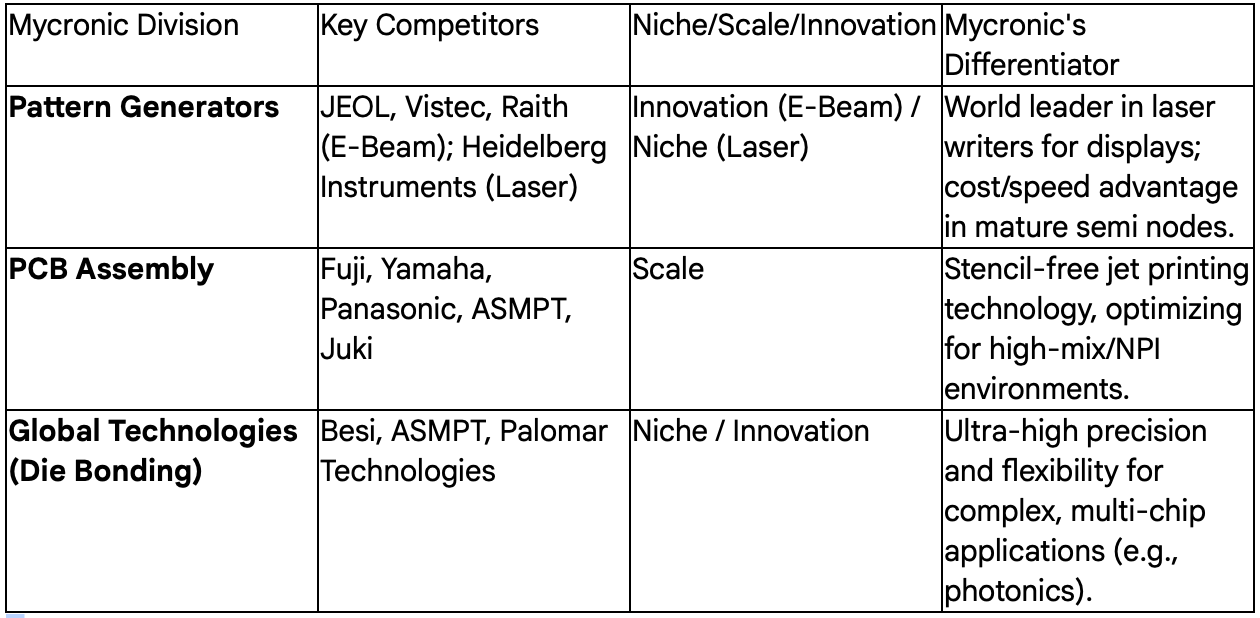

Mycronic navigates a competitive landscape populated by global titans defined by scale, nimble specialists defined by their technological niche, and disruptive innovators. The company's strategy involves carefully choosing its engagements, leveraging its unique strengths to compete effectively in each segment.

Pattern Generators: The Heavyweights' Ring (Laser vs. E-Beam)

In the world of photomask writing, two core technologies compete: laser-based direct-write and electron-beam (e-beam) lithography. Mycronic is the undisputed world leader in laser writers for the display industry, where its Prexision series is the de facto standard for producing the large, high-precision masks required for modern TVs and smartphones.

Its primary competitors operate in a technologically adjacent space. E-beam giants such as JEOL, Vistec Electron Beam GmbH, and Raith produce systems that use a focused beam of electrons to achieve higher resolution than laser-based systems. This makes e-beam technology essential for fabricating the most advanced semiconductor masks for sub-7nm logic chips. However, e-beam systems are typically slower and more expensive, making them less suitable for the very large area masks used in display manufacturing.

This technological divide reveals a core element of Mycronic's strategy. Rather than engaging in a costly head-to-head battle with e-beam players for the leading-edge semiconductor market, Mycronic chose to dominate the parallel, highly profitable display market where its laser technology provides a distinct advantage in speed and cost-effectiveness. Having secured this stronghold, it then flanked the e-beam giants by introducing its SLX series—a laser-based writer optimized for the cost-sensitive mature semiconductor node market. Here, it competes not on ultimate resolution, but on providing a more economical and higher-throughput alternative for less critical layers. This is a masterful example of strategic market segregation, not direct confrontation.

PCB Assembly: The High-Mix Gauntlet

The SMT market is dominated by high-volume titans like Fuji Corporation, Yamaha Motor, and Panasonic, who excel at equipping massive production lines for consumer electronics. In this arena, Mycronic, with an estimated 12% market share, is a specialized challenger.

Mycronic's competitive strategy is to weaponize flexibility. Competing with a giant like Fuji (18% market share) on raw placement speed for a single, long production run is a difficult proposition. However, the manufacturing reality for many companies, particularly in North America and Europe, involves frequent product changeovers and small batch sizes. In this high-mix environment, the primary bottleneck is not the speed of the machine, but the downtime between jobs. A major source of this downtime is the management of stencils—metal sheets used to apply solder paste. Ordering, programming, cleaning, and storing stencils for every product variation is time-consuming and costly.

Mycronic's unique MY700 Jet Printer completely eliminates this bottleneck by depositing solder paste with inkjet-like precision, no stencil required. This innovation transforms a competitor's strength (scale optimized for one product) into a weakness (inflexibility for many products). For a high-mix customer, a Mycronic line can deliver superior overall productivity and a lower total cost of ownership, even if the theoretical peak speed of a single machine is lower. Mycronic is not trying to win the entire SMT market; it is strategically targeting and winning the high-value, high-mix segment.

Global Technologies: A Constellation of Acquired Stars

This division is a portfolio of leading niche technology providers that Mycronic has acquired and integrated. The crown jewel is MRSI Systems, a leader in high-precision, high-flexibility die bonders. In this specialized field, it competes with other experts like Besi Semiconductor Industries, ASMPT, and Palomar Technologies. Competition here is fought on the frontiers of accuracy (micron and even sub-micron placement), speed, and the ability to handle advanced processes like eutectic and epoxy bonding for applications in photonics and advanced packaging. The dynamic nature of this market is highlighted by the emergence of innovative startups like TERASi, which are using advanced die bonders to enable novel wireless communication modules.

3. Forecast (2025–2027): Charting the Path to SEK 10 Billion

Mycronic has set an ambitious long-term financial target: to reach net sales of SEK 10 billion by 2030 at the latest, a goal that will be achieved through a combination of organic growth and strategic acquisitions. The following 1-3 year forecast focuses on the organic growth trajectory, built on several core assumptions.