Monolithic Power Systems : The Monolithic Challenger in a High-Power, High-Stakes Game

A bite-sized powerhouse in a world of giants.

Market Overview: The Electrifying World of Power Management ICs

The Power Management Integrated Circuit (PMIC) market represents the foundational layer of modern electronics, a critical and rapidly expanding sector responsible for controlling the flow and conversion of electrical power in nearly every device imaginable. These sophisticated semiconductors are the unsung heroes of efficiency, enabling everything from the extended battery life of a smartphone to the stable operation of a city-sized data center. The market is not merely growing; it is being fundamentally reshaped and accelerated by a confluence of powerful, once-in-a-generation secular trends that are redefining global infrastructure, transportation, and consumer technology. Understanding this dynamic landscape is essential to contextualizing the strategic position of any player within it, including the highly focused challenger, Monolithic Power Systems (MPS).

The Megawatt Megatrends: Secular Winds Powering the PMIC Market

The robust growth of the PMIC market is directly tethered to several transformative technological shifts. These are not fleeting cyclical demands but structural changes that necessitate more advanced, efficient, and compact power solutions.

The EV Revolution: The global transition to electric and hybrid vehicles (EVs/HEVs) stands as one of the most significant catalysts for the PMIC market.1 An EV is not simply a car with a battery; it is a complex, high-voltage electronic ecosystem on wheels. Advanced PMICs are indispensable for managing high-voltage battery packs, controlling onboard and off-board charging systems, orchestrating regenerative braking, and powering the ever-growing array of sensors and compute modules required for Advanced Driver-Assistance Systems (ADAS) and autonomous driving capabilities.3 The International Energy Agency's report of a 35% year-on-year surge in electric car sales in 2023, adding 3.5 million units, vividly illustrates the scale of this demand driver.5 This trend creates unprecedented demand for PMICs that can handle high thermal loads and meet stringent automotive safety and reliability standards.1

AI and the Data Center Power Bill: The explosive growth of Artificial Intelligence (AI) and cloud computing has led to a corresponding explosion in the number and scale of data centers. These facilities are voracious consumers of electricity, and power management has evolved from a secondary operational cost to a primary design constraint.5 The deployment of power-hungry GPUs and custom AI accelerators creates a critical need for sophisticated PMICs that can deliver high-current, high-density power with maximum efficiency to minimize energy loss and thermal output.1 As AI models become more complex, the demand for these advanced power solutions will only intensify.

The Internet of Everything (IoT): The proliferation of billions of connected devices across consumer, industrial, smart home, and healthcare applications has created a vast and diverse market for PMICs. For these devices, the key metrics are often miniaturization and battery life. This translates into a massive demand for highly integrated, low-power PMICs that can operate with minimal quiescent current, enabling compact form factors and extending operational life from months to years on a single battery.

5G and Beyond: The ongoing global rollout of 5G communication networks, and the development of future wireless standards, places new demands on power management. High-frequency, high-speed communication hardware, from network base stations to the latest smartphones, requires a new generation of PMICs capable of efficiently managing power under dynamic load conditions and challenging thermal environments.

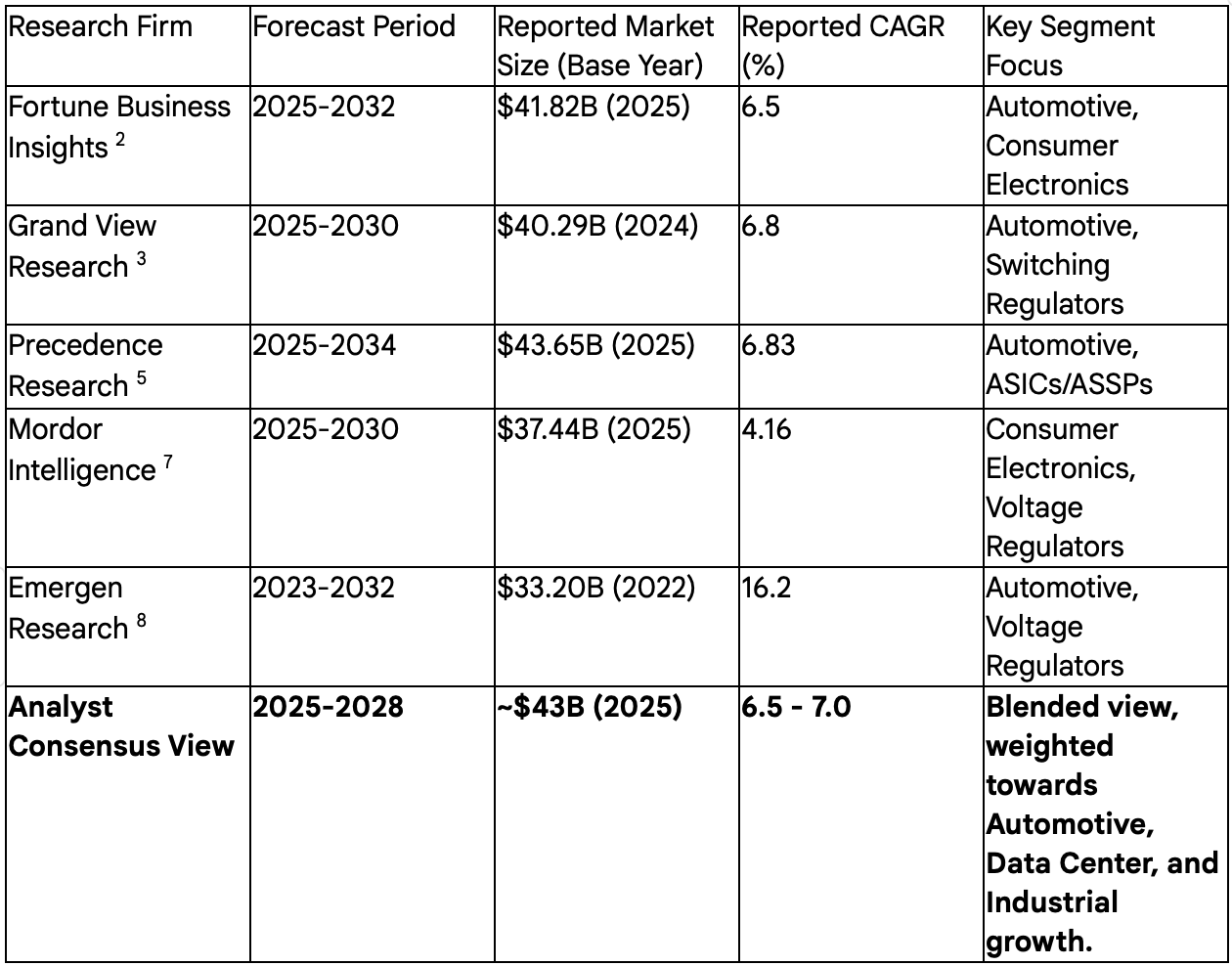

Market Sizing and Trajectory: The Great CAGR Debate

Gauging the precise size and growth trajectory of the PMIC market is a complex exercise, with various market research firms offering a range of forecasts. This variance often stems from different methodologies and market definitions, such as including or excluding certain types of discrete components or focusing on specific sub-segments like digital power management. Analysis of available data shows a 2024 global market size in the range of $33 billion to $41 billion, with a Compound Annual Growth Rate (CAGR) projected to be anywhere from a conservative 4.16% to a highly optimistic 16.2%.

To establish a consistent and defensible baseline for this report, a blended analysis of the most credible sources is necessary. The consensus points to a market size of approximately $40 billion in the 2024 base year. For forecasting purposes, this report will adopt a Blended Market Growth Rate of 6.5% to 7.0% for the 2025-2028 period. This rate aligns with the more consistent and detailed analyses provided by firms like Fortune Business Insights, Grand View Research, and Precedence Research, which offer a balanced view of the market's strong but maturing growth profile.

The Tech Frontier: Gallium Nitride (GaN) and Silicon Carbide (SiC)

A critical technological inflection point reshaping the PMIC landscape is the increasing adoption of wide-bandgap (WBG) semiconductors, namely Gallium Nitride (GaN) and Silicon Carbide (SiC). Compared to traditional silicon, these materials possess superior physical properties that allow them to operate at higher voltages, frequencies, and temperatures. This translates directly into power solutions that are significantly more efficient, smaller, and lighter. For applications in EVs, data centers, and 5G infrastructure, where power density and efficiency are paramount, GaN and SiC are not just incremental improvements; they are enabling technologies that unlock new levels of performance. Companies that can master the design and manufacturing of WBG-based PMICs will hold a significant competitive advantage in the market's most lucrative segments.

Geopolitical Power Grid: The Dominance of Asia-Pacific (APAC)

The gravitational center of the PMIC market is unequivocally the Asia-Pacific (APAC) region. Multiple market studies consistently identify APAC as both the largest market by revenue share and the fastest-growing region. This dominance is rooted in a trifecta of factors: its established role as the world's manufacturing hub for virtually all electronics; a massive and growing domestic consumer base for smartphones, PCs, and other smart devices; and substantial government investment in strategic initiatives like EV production and 5G network deployment.

Monolithic Power Systems reports that 94% of its revenue in fiscal year 2024 was derived from sales to customers in Asia, where its products are incorporated into end-user goods.12 On the surface, this appears to be a perfect strategic alignment, placing the company squarely in the market's primary growth engine. However, a deeper analysis reveals a more nuanced reality. This concentration represents less of an end-market exposure and more of a profound dependency on the global electronics supply chain, which is heavily centered in APAC. While this is a distinct advantage during periods of smooth operation and high demand, it also concentrates significant risk. Any disruption—be it from geopolitical tensions, new trade regulations and tariffs, or a slowdown in global consumer demand for electronics (even for products ordered by Western companies)—would disproportionately impact MPS through its APAC-centric sales and manufacturing channels. This is a critical supply-chain dependency risk that shadows the company's otherwise impressive geographic alignment with market growth.

Key Players: The Titans of Transistors and the Monolithic Challenger

The Power Management IC market is a fiercely competitive arena, characterized by a handful of semiconductor behemoths with immense scale and a cadre of specialized challengers who compete on technological innovation. The landscape is not uniform; it is a battlefield where different players leverage distinct strategies to win across various end-markets. To understand the unique position of Monolithic Power Systems, one must first map the terrain and profile the titans who dominate it.

The Four Horsemen of Power: The Incumbent Leaders

The market is largely consolidated under four major players who leverage broad product portfolios, vast manufacturing scale, and deeply entrenched customer relationships to maintain their leadership positions.

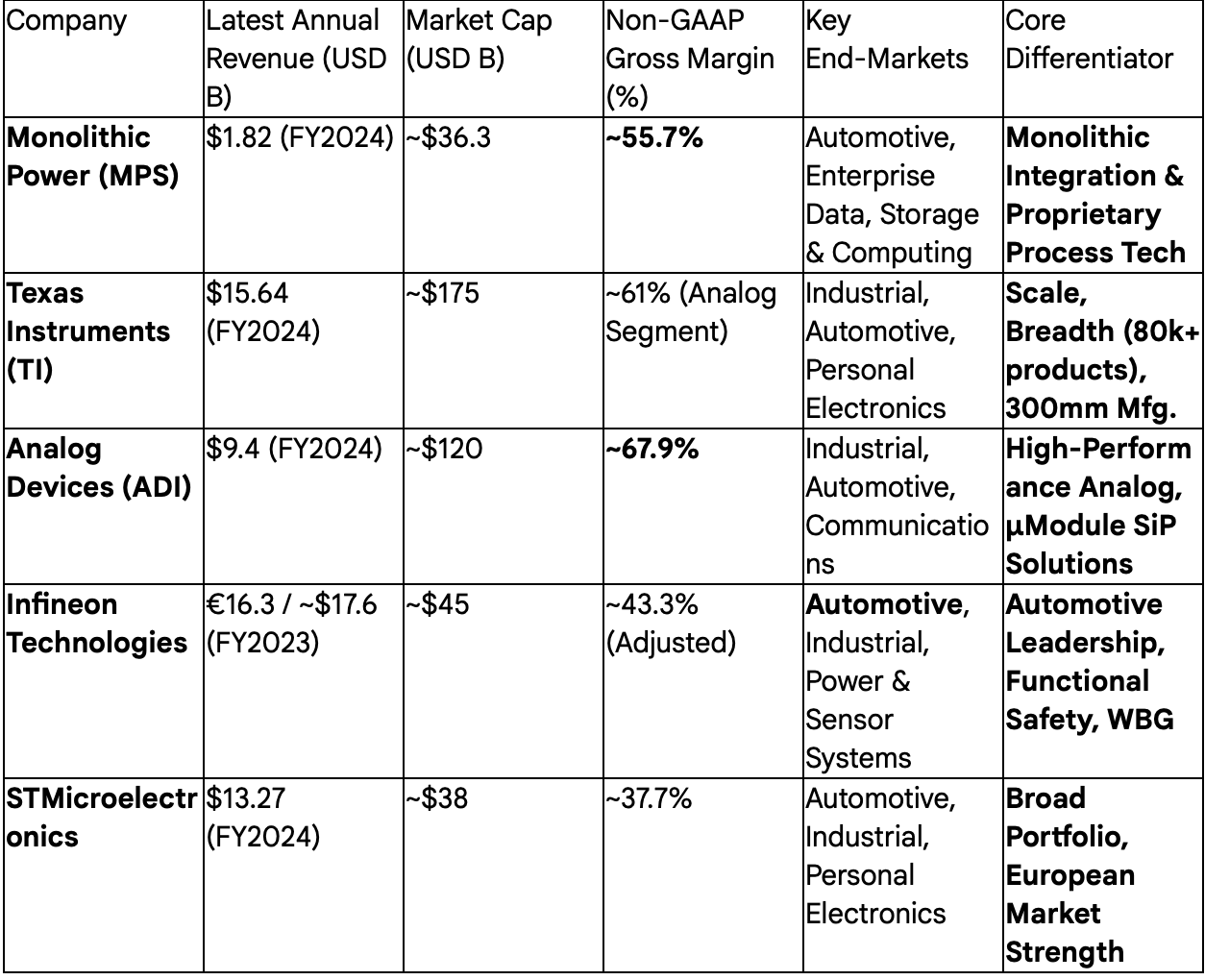

Texas Instruments (TI): The Scale Juggernaut. With 2024 revenue of $15.64 billion, of which a staggering $12.16 billion came from its Analog segment (which includes power management), Texas Instruments is the undisputed market leader by sheer volume. TI's strategy is one of overwhelming breadth and scale. The company boasts a portfolio of over 80,000 products, catering to nearly every conceivable application. Its competitive advantage is built on its massive internal 300mm wafer manufacturing capacity, which provides significant cost benefits and greater supply chain control. TI's offerings span the entire PMIC spectrum, from highly integrated multi-channel PMICs for complex systems-on-chip (SoCs) to a vast catalog of discrete regulators, converters, and battery management ICs, targeting all major end-markets including industrial, automotive, and personal electronics.

Analog Devices (ADI): The High-Performance Specialist. Analog Devices, which reported fiscal year 2024 revenue of $9.4 billion, competes primarily on performance and precision. Following its strategic acquisitions of Linear Technology and Maxim Integrated, ADI solidified its position as the premier supplier of high-performance analog and power management solutions. The company's strategy focuses on delivering complete, high-value solutions, exemplified by its µModule (micromodule) product line, which are complete system-in-package (SiP) power management solutions that simplify design for customers. ADI has built a powerful brand around proprietary technologies like its Silent Switcher architecture, which is engineered to minimize electromagnetic interference (EMI)—a critical requirement in noise-sensitive automotive and industrial applications.

Infineon Technologies: The Automotive and Industrial Powerhouse. Germany-based Infineon Technologies, with fiscal year 2023 revenue of €16.3 billion, is a dominant force in the automotive and industrial power semiconductor markets. The company's strength lies in its deep expertise in power electronics, particularly for high-voltage and high-reliability applications. Its OPTIREG family of PMICs and system basis chips (SBCs) are industry standards in the automotive world, with a strong focus on meeting rigorous functional safety standards like ISO 26262. As the automotive industry electrifies, Infineon's leadership in power semiconductors for electric drivetrains, onboard chargers, and ADAS systems makes it a formidable competitor.

STMicroelectronics (ST): The Broad-Range European Titan. STMicroelectronics reported fiscal year 2024 revenue of $13.27 billion, positioning it as another major broad-line supplier. Similar to TI, ST offers a vast and diverse portfolio of products, but with a strong foothold in the European market. The company is well-diversified across the Automotive, Industrial, and Personal Electronics sectors. Its power management portfolio is comprehensive, including AC-DC and DC-DC converters, battery management ICs, intelligent power switches, and a growing family of GaN-based power ICs, making it a direct competitor to MPS across multiple fronts.

The Challenger: Monolithic Power Systems (MPS)

Founded in 1997 by CEO Michael Hsing, Monolithic Power Systems was built on a singular, powerful vision: that an entire power system could be integrated onto a single piece of silicon. This "monolithic" philosophy remains the company's core differentiator and its primary weapon in the competitive landscape. With a market capitalization of approximately $36 billion and a revenue run-rate approaching $2.5 billion, MPS is substantially smaller than the incumbent titans. However, its consistent track record of above-market growth and premium profitability demonstrates the potency of its focused, technology-driven strategy.

The following table provides a clear, at-a-glance comparison of MPS against its primary competitors, distilling complex corporate strategies and financial data into an easily digestible format that highlights MPS's unique position.

This matrix immediately illuminates the competitive dynamic. While a giant like TI generates nearly nine times the revenue of MPS, MPS achieves a gross margin that is highly competitive, showcasing the premium value and pricing power of its specialized products. This financial performance is a direct result of its unique strategic approach.

The core of MPS's strategy and its primary point of differentiation is not just about integration, but about the method of integration. While competitors like ADI offer sophisticated µModule System-in-Package (SiP) solutions, these often involve co-packaging multiple discrete chips (like a controller IC, power FETs, and drivers) along with passive components inside a single module. MPS, true to its name, pursues a "monolithic" ideal. Its vision, as stated from its founding, is to integrate the entire power system onto a single die. This is achieved through the use of innovative and proprietary semiconductor process technologies developed in-house.

This is a fundamental architectural distinction, not merely an incremental one. A true monolithic solution, by eliminating the parasitic effects of bond wires and interconnections between separate chips, can achieve superior performance, unparalleled power density, higher reliability, and a lower total bill-of-materials (BOM) cost for the customer. This moves the basis of competition from the component level (e.g., "Whose DC-DC converter is 1% more efficient?") to the architectural level (e.g., "Whose solution saves the most board space and simplifies the entire power tree design?"). MPS is not just another PMIC supplier; it is a system architecture company that leverages its proprietary process technology as its primary competitive weapon. This explains how a smaller player can not only survive but thrive and win in crowded, technically demanding, and space-constrained applications—such as automotive ADAS modules, enterprise solid-state drives, and notebook computers—even when competing directly with the industry's largest players. Its success is a powerful validation of its long-held architectural bet.

Forecast: Charting the Next Three Years for MPS (2025-2027)

Want to see the full forecast? Subscribe to Waver Premium for $7.49 a month to read the rest.