I've seen the 2025 Fundsmith Annual Shareholder meeting so you don't have to

Here's the key points that you should keep in mind

Alright, buckle up, folks, because we're diving headfirst into the Fundsmith Annual Shareholders' Meeting 2025, where Terry Smith and Julian Robins spilled the tea on everything from market madness to miracle weight-loss drugs. And let me tell you, it was a wild ride!

Fundsmith's 2024 Rollercoaster: Ups, Downs, and "Thought Police"

Picture this: Central Hall Westminster, February 2025. Ian King, the smooth-talking Sky News presenter, warms up the crowd, reminding everyone that if their burning questions don't get answered, it's his fault, not Terry and Julian's. (He's got our backs, folks!)

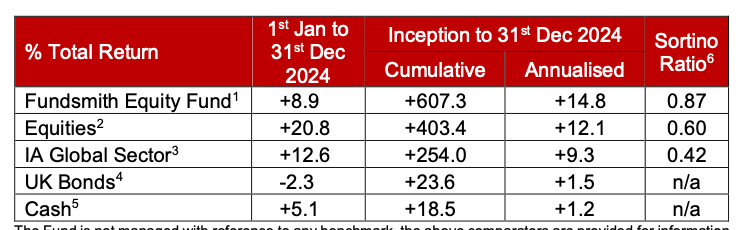

Then, Terry Smith took the stage, ready to deliver the lowdown on Fundsmith's 2024 performance. Let's be honest, it was a year of ups and downs. The Fundsmith Equity Fund saw an 8.9% rise, while the MSCI World Index surged by 20.8%. Terry, ever the pragmatist, pointed out the importance of the long game. Since its inception in 2010, the Fund has delivered an annualized return of 14.8%, beating the Index’s 12.1%. Not too shabby, right?

Terry broke down the portfolio's winners and the ones that stumbled a bit. Meta Platforms (formerly Facebook) was a star, making its fourth appearance as a top contributor. Terry joked about starting a fund that only invests in the stock that receives the most criticism, given Meta's journey. Microsoft, the reliable performer, showed up for the ninth time. Philip Morris also made the list, with Terry highlighting their Reduced Risk Products. He even took a jab at the "dysfunctional health organizations" opposing these products.

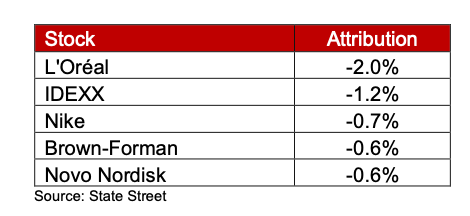

On the flip side, L'Oréal faced challenges in China's struggling economy. IDEXX, the veterinary diagnostics company, felt the slowdown after the pandemic pet boom. Nike stumbled due to management missteps and increased competition. Brown-Forman, the Jack Daniel's distiller, saw a dip in consumption. Novo Nordisk, despite its weight-loss drug fame, had a surprising downturn. Terry noted the "arms race" among drug companies in this space.

The "Fab Five" and the Passive Investing Plague

Terry then went on to discuss the concentration of market returns, pointing out that just five stocks (Nvidia, Apple, Meta, Microsoft, and Amazon) provided 45% of the S&P 500's returns in 2024. He's not thrilled about their sky-high valuations, especially Nvidia's 53 times earnings. And don't even get him started on Tesla's 99 times earnings. "It's a car company," he declared, like it's the most obvious thing in the world. He also highlighted the concentration in other markets, like Germany, where SAP significantly influenced the DAX Index.

Terry didn't hold back on his concerns about AI, comparing the boom to the Dotcom era. While acknowledging the hype, he pointed out key differences, like Nvidia's profitability compared to the Dotcom bubble's "clicks and eyeballs."

He also criticized passive investing via index funds, calling it a "momentum strategy" rather than truly passive. He argued that inflows into these funds drive up the largest companies, creating a self-reinforcing loop. Terry warned about the potential vulnerability of this strategy, especially if tech spending declines.

But the real villain of the story? Passive investing. Terry compared it to a momentum-based strategy, where money flows into the biggest stocks, driving their prices even higher. He even quoted John Bogle, the godfather of index investing, who warned about market distortions. "Labels are unhelpful," Terry quipped, "index investing is not a passive strategy."

Q&A: Where Things Got Interesting

Don't miss out on market insights!

Elevate your investing with Waver Premium: exclusive earnings analysis, portfolio peeks, and more every Thursday and Saturday. Subscribe now for the complete investment experience!

Now, let's get to the juicy part: the Q&A. Ian King threw some curveballs, and Terry and Julian didn't hold back.

Trump Tariffs:

Terry and Julian basically said, "We have no clue what he'll do, and neither does he." But they're not losing sleep over it. They're focused on the companies, not the politics.

Political Influence on Markets:

They argued that markets keep governments in check, especially when it comes to spending. And they gave a shout-out to the US state-level competition, where states fight for capital and talent like it's the Hunger Games.

Weight Loss Drugs:

Hold onto your hats, folks, because the obesity drug market is about to explode. Novo Nordisk is leading the charge, but competition is coming. And Terry thinks they might have stumbled upon the "elixir of life."

Cloud Infrastructure Investment:

Terry and Julian raised eyebrows about the massive spending by cloud providers on data centers. They're worried about returns, but they also admitted these companies have deep pockets.

Management Incentives:

They ripped into companies that use peer group comparisons to justify crazy executive pay. And they praised Unilever for cleaning up their act.

Dividend Policy:

Terry basically said, "Dividends? We don't know her." They're all about compounding value, baby! And they used Berkshire Hathaway as their shining example.

Market Concentration and Tech Dominance:

They reiterated that they change their portfolio as the market changes, and that they are not afraid of tech, as long as the companies are good.

Philip Morris and Novo Nordisk:

Terry and Julian defended their controversial picks, highlighting Philip Morris's transition to reduced-risk products and Novo Nordisk's potential for growth.

US Market Valuation:

They acknowledged the US market's high valuations, but they're not bailing. They're sticking with their high-quality companies.

Best Performing Share:

Unilever, according to Terry.

Fundsmith's Strategy: Buy, Don't Overpay, and Do Nothing (Mostly)

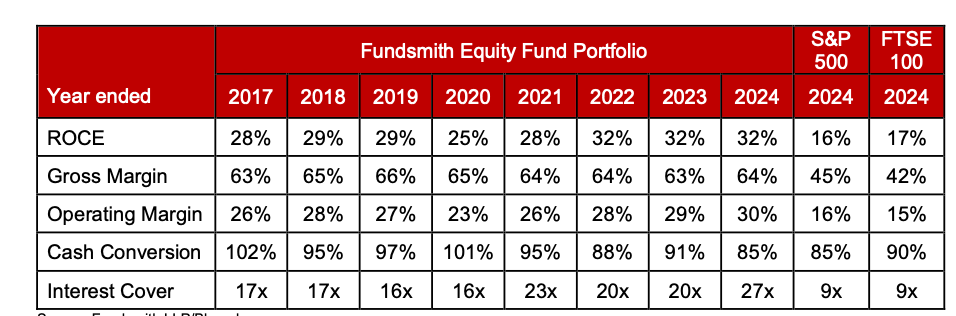

Terry reiterated Fundsmith's investment philosophy: Buy good companies, don't overpay, and do nothing. He provided a "look-through" analysis, comparing Fundsmith's portfolio to the FTSE 100 and S&P 500, highlighting its superior return on capital employed, gross margin, and operating margin.

He did address the dip in cash conversion, attributing it to increased capital expenditure at companies like Alphabet, Microsoft, Meta, and Novo Nordisk, particularly for AI and weight-loss drug production.

Fundsmith remains focused on minimizing portfolio turnover, with a rate of just 3.2% in 2024. They sold stakes in Diageo, McCormick, and Apple, while adding Atlas Copco and Texas Instruments.

In conclusion, Fundsmith's message is one of long-term focus, quality over hype, and staying the course. And maybe, just maybe, keeping an eye on those weight-loss drug stocks.

The Bottom Line: Stay Calm and Carry On

In a nutshell, Fundsmith's message was clear: Don't panic. Focus on quality, ignore the noise, and trust the process. And maybe, just maybe, invest in some weight-loss drugs.

So there you have it, folks. The Fundsmith Annual Shareholders' Meeting 2025, where market madness met medical miracles. Until next year, stay invested and stay curious!

If you want to see the full webcast it’s available on Youtube

Or in PDF version

What do you think about Terry’s statements on Nvidia and Tesla?

Interesting article indeed! What do you think about Terry's statement on passive investing not being truly passive?