Forget Wall Street? Nah, Just Look Around! Awesome Stocks Hiding Outside the USA

First Stop: Sweden – Where Stocks Sizzle Like Swedish Meatballs!

Let's talk investing! Chances are, the convo instantly snaps to the good ol' USA. And hey, fair enough! The US market is HUGE, like the Godzilla of stock exchanges, packed with flashy names and tech giants everyone knows. Apple? Amazon? Yup, American icons. But here's the hot goss: staring only at the US might mean you're missing out on some serious action happening elsewhere on the globe!

While Wall Street's bright lights are blinding, some other markets are quietly cooking up killer investment opportunities. Think of them as the hidden gems, the underdogs with surprisingly sharp teeth (and potentially awesome returns!). We're going on a little adventure to peek into markets like Sweden, Switzerland, and Singapore – places you might not think of first, but totally should.

Spotlight On: Sweden! More Than Just Meatballs and IKEA!

Today, we're zooming in on Sweden. This Nordic powerhouse isn't just about stylish furniture and catchy pop music; it's got a seriously cool innovation streak and a business scene that punches way above its weight. You might have heard whispers about the rockstar stock Evolution AB, but hold onto your hats, because Sweden has other chart-toppers that have been delivering knockout performances for the last ten years. These aren't always headline-grabbers, but man, have they made investors happy. Let's meet some of these Swedish stealth stars!

Over the past decade, while Evolution AB was soaking up the limelight, other Swedish companies were quietly racking up insane growth. We're gonna check out four of 'em: Mycronic, Note AB, Invisio AB, and CTT Systems. Each plays in a different sandbox, but they all share one thing: they've delivered whopping returns.

Mycronic: The Tech Wizard Behind Your Gadgets That You've Never Heard Of!

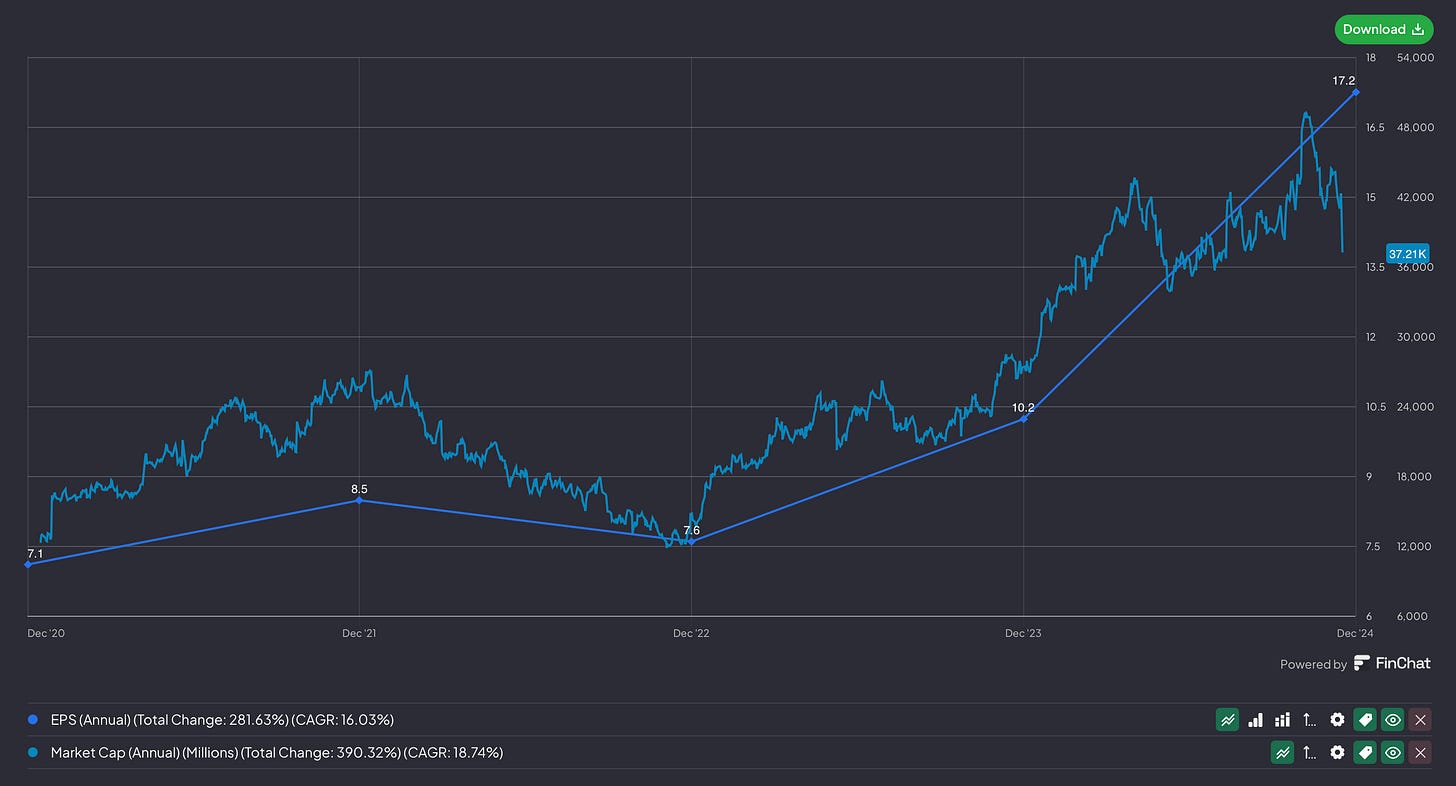

Leading the victory parade with a jaw-dropping 3,392% 10-year total return is Mycronic! Think of them as the wizards behind the curtain of the electronics world. They build the super-precise, high-tech machines that other companies need to make all the tiny, complex bits inside your phones, computers, cars, and even fancy defense gear. They're the ultimate enablers!

How they roll: They dominate specific niches in electronics production, aiming for lots of steady, recurring income (smart!). They're split into four teams, each laser-focused on its market, making them nimble and customer-savvy. Plus, they're always hunting for cool new tech and companies to scoop up.

Show me the money! They sell seriously sophisticated equipment. A big chunk of their cash (42% last year!) comes from making "mask writers" – essential tools for creating super-advanced screens and chips. They also make gear for assembling circuit boards, testing stuff, and sticking tiny components together. They're basically selling the shovels in the digital gold rush!

Recent Buzz: These guys smashed expectations in 2024 – revenue up 24%, profits soaring 69%! Orders are pouring in (up 64% in Q4!), and they're predicting even bigger sales in 2025. They even bought another company (Modus High-Tech) to get even better at spotting tiny flaws in electronics. Analysts are giving them the thumbs up! Mycronic is plugged into the heart of the tech boom, and it shows.

Note AB: The Unsung Heroes Building Your Tech Guts

Hot on Mycronic's heels with a sizzling 2,128% 10-year return is Note AB! These folks are the crucial, but often unseen, builders in the tech world. They're an EMS (Electronics Manufacturing Services) company – basically, they build the electronic guts (like circuit boards and assemblies) for other businesses across Europe and beyond. They're the reliable partner you call when you need quality electronics built right.

How they roll: Their game is top-notch manufacturing, clever logistics, and being a true partner, not just a supplier. They stick with products from design all the way to after-sales support, building long-term relationships. They've got factories strategically placed in Europe and China.

Show me the money! They get paid to manufacture electronics for other companies – stuff that ends up in complex systems for security, control, and surveillance. A big part of their growth plan? Buying other companies! They snapped up DVR Ltd in the UK recently to beef up their presence in a market expected to boom. Sticking close to clients likely means steady cash flow.

Recent Buzz: Note AB is leveling up its own tech by adopting IFS Cloud software to streamline everything and prep for more growth and future shopping sprees (acquisitions!). While analysts are playing it cool ("neutral"), they see potential for the stock price to climb, hinting it might be a bit of a bargain right now. Note AB is quietly crushing it in the essential, behind-the-scenes world of electronics manufacturing.

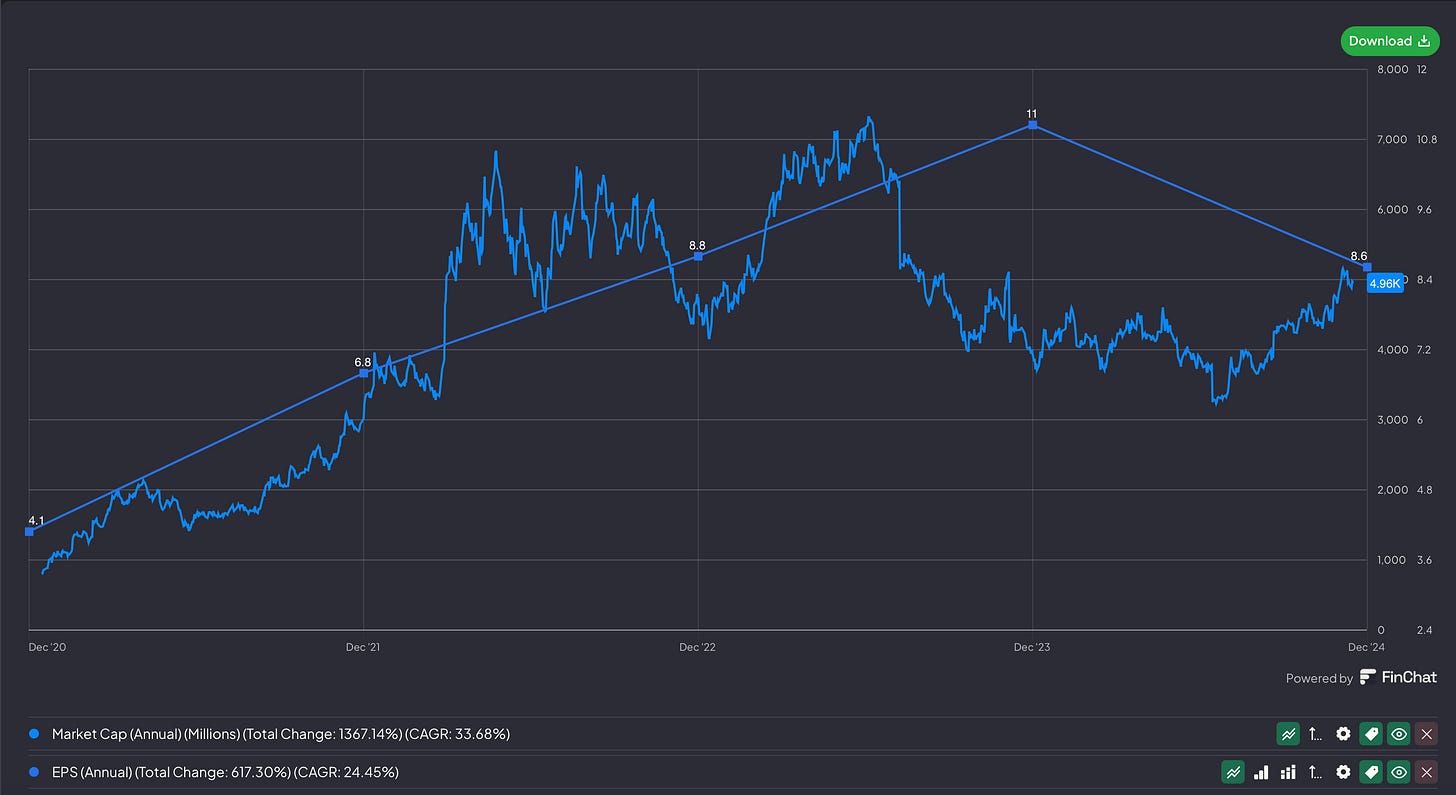

Invisio AB: Hear Ye, Hear Ye! Keeping Heroes Connected

Next up, with a fantastic 2,233% 10-year return, is Invisio AB! These guys are all about crystal-clear communication in the loudest, most critical situations imaginable. They design and sell super-advanced communication gear and hearing protection for folks like soldiers, police officers, and security pros. Think high-tech headsets that let you hear orders clearly even next to a jet engine, while protecting your ears.

How they roll: They operate under two brands (INVISIO and Racal Acoustics) and are obsessed with innovation – plowing about 15% of their revenue back into R&D! Their plan? Grab more market share, invent cooler gadgets, find new types of users, and conquer new countries. They have a global sales network ready to deploy.

Show me the money! They sell specialized headsets, control units, and intercom systems. A lot of their business, especially defense contracts, involves long processes and big framework deals, which means predictable income once they land 'em. They recently bought the UltraLYNX™ product line to offer even more integrated tactical gear (think audio, power, data, and computing all in one).

Recent Buzz: Record-breaking results for 2024! Revenue and orders went through the roof. They also massively increased their estimate of how big their potential market is – now a whopping SEK 25 billion annually! Cha-ching! They even worked with the US Defense Innovation Unit on a fancy new wireless system. Investors are hyped – the stock price has surged! Invisio is a leader in a tough-to-enter market that's getting bigger.

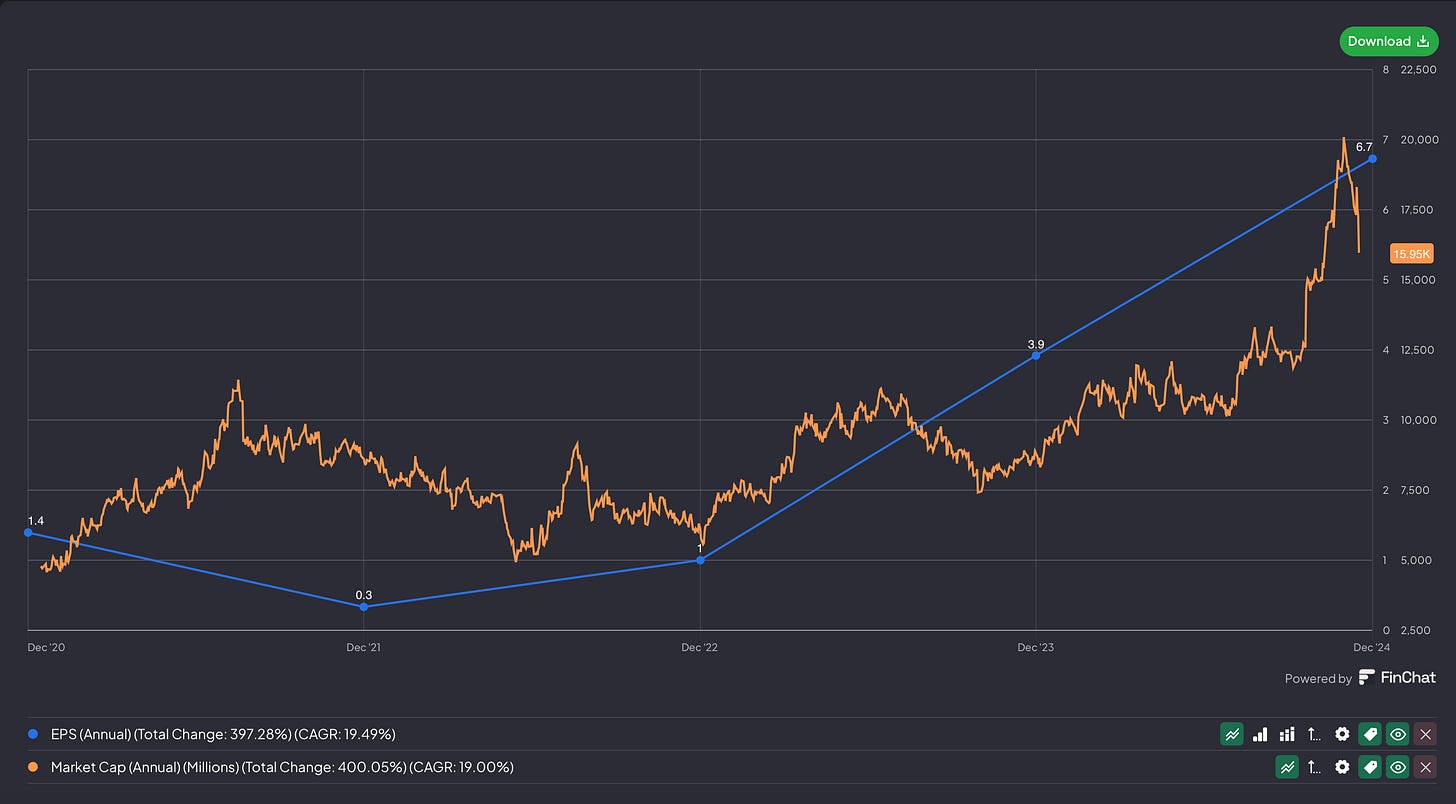

CTT Systems: Making Your Flight Less Sweaty (and Saving Fuel!)

Rounding out our Swedish superstars with a cool 1,593% 10-year return is CTT Systems! Ever noticed how plane air can be weirdly dry or sometimes clammy? CTT fixes that! They design and sell clever humidity control systems for commercial jets and private planes.

How they roll: They're the top dogs in tackling the "humidity paradox" on aircraft. They make humidifiers (to stop the air from being desert-dry) and dehumidifiers (to prevent dampness and condensation). This makes flying comfier for everyone and their dehumidifiers cleverly help airlines save fuel by reducing aircraft weight (less water buildup!). They sell directly to giants like Boeing and Airbus and also to airlines upgrading their existing planes.

Show me the money! They make cash selling these specialized systems. Their fortunes are partly tied to how many new planes Boeing and Airbus are churning out (especially long-haul ones), but they also profit when airlines decide to retrofit their current fleet.

Recent Buzz: They just released their 2024 annual report and are paying out a nice dividend to shareholders. Analysts expect their sales to keep climbing. Plus, some number-crunchers think the stock might be a bit undervalued right now – potential bargain alert #2! With airlines increasingly focused on passenger comfort andfuel efficiency/sustainability, CTT is sitting pretty in a sweet spot. Their gear makes flights nicer and greener!

Conclusion: Don't Snooze on These Nordic Nuggets!

Boom! The incredible performance of Mycronic, Note AB, Invisio AB, and CTT Systems proves it: amazing investment treasures aren't just hiding on Wall Street. These Swedish powerhouses, rocking diverse fields from high-tech manufacturing to defense gear and aerospace wizardry, have been absolute rockstars for investors.

Sure, the US market deserves its hype, but broadening your horizons can uncover seriously exciting growth stories (and potentially plump up your portfolio!) in places like Sweden. Keep your eyes peeled for these "Nordic nuggets" – they're a shining example of why exploring the whole global investment map is totally worth it!

Alright, folks, think of this as just a whirlwind tour – a little appetizer to showcase these Swedish stock market rockstars! We've barely scratched the surface here. The main mission today was just to nudge you, get you excited about peeking beyond the usual US stomping grounds, because seriously, there's a whole world of potentially awesome investments out there! But hey, maybe Mycronic's tech wizardry, Note AB's manufacturing muscle, Invisio's cool communication gear, or CTT's comfy-flight tech really caught your eye? If you're itching for the real deep dive – the nitty-gritty numbers, the full story, the works – on any of these Swedish champs, you gotta let me know! Sound off in the comments below and tell me which companies you want me to investigate further!

Love this? Level Up Your Investing!

Tuesdays (Free): Get market insights and tips delivered to your inbox.

Thursdays (Premium): Exclusive access to:

Earnings analysis

Portfolio insights

Bonus articles

Quarterly market reviews

Free copy of "Investing With Eagles" book.

Subscribe to Waver Premium for only 7.49$ per month for in-depth market knowledge and financial growth. that less than 2 Starbucks.,

Disclaimer: The information provided in our analyses and reports is for informational and educational purposes only and should not be considered investment advice. We are not financial advisors, and nothing we say or write should be construed as a recommendation to buy or sell any security.

While we strive to provide accurate and insightful information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information presented.

It is important to note that we may or may not hold positions in the companies we discuss. Any opinions expressed are our own and are subject to change without notice.

Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. Never invest more than you can afford to lose.