BlackRock Pt 1: Navigating Market Evolution and Driving Future Growth in Asset Management

BlackRock, the world's largest asset manager, stands at a pivotal juncture, demonstrating remarkable resilience and strategic foresight amidst a dynamic global financial landscape.

Executive Summary

With over US$11.55 trillion in Assets Under Management (AUM) as of 2024, the firm has not only maintained its dominant scale but has also proactively positioned itself in high-growth segments such as private markets, digital assets, and advanced financial technology. Its proprietary Aladdin platform serves as a foundational competitive advantage, enabling sophisticated risk management and driving operational efficiencies across its diverse offerings.

The global asset management industry, while reaching a record $128 trillion in AUM in 2024, faces mounting structural pressures, notably persistent fee compression and increasing demand for value-added services. BlackRock's strategic response involves a calculated shift towards higher-margin products like active Exchange-Traded Funds (ETFs) and private market solutions, complemented by significant investments in artificial intelligence (AI) and strategic acquisitions. This approach aims to offset margin pressure from traditional passive investments and capture new growth opportunities.

Over the next one to three years (2025-2027), BlackRock is projected to continue its AUM expansion, outpacing overall industry growth due to its diversified product suite and technological leadership. Revenue and net income are expected to follow a positive trajectory, albeit with a temporary slowdown in earnings per share (EPS) growth in 2025 reflecting ongoing investments. Key growth areas include private credit, infrastructure, digital asset ETPs, and the expansion of Aladdin's client base and capabilities. However, the firm must navigate intensifying competition, evolving regulatory landscapes, and the complexities of integrating recent large-scale acquisitions.

To sustain its leadership, BlackRock must deepen its "whole portfolio" advisory model, accelerate AI-driven innovation responsibly, fortify its private markets and digital assets leadership, and enhance client-centric solutions through strategic partnerships. Proactive engagement with regulators and continuous operational excellence will be critical for long-term resilience and value creation in an increasingly interconnected and volatile world.

1. Market Overview

The global asset management industry is undergoing a profound transformation, characterized by record AUM growth alongside significant structural shifts and technological disruption. Understanding these dynamics provides essential context for BlackRock's strategic positioning and future trajectory.

1.1 Global Asset Management Landscape: Size, Growth Drivers, and Key Trends

The global asset management industry achieved a record $128 trillion in Assets Under Management (AuM) in 2024, representing a substantial 12% increase from the previous year and a strong rebound from the decline observed in 2022. This growth, however, was predominantly driven by market performance, accounting for 70% of the industry's revenue expansion in 2024, rather than net investor inflows. This reliance on market appreciation highlights the industry's inherent vulnerability to external economic conditions and underscores an urgent need for reinvention to ensure sustained competitiveness. North American asset managers, in particular, dominated this landscape, holding nearly two-thirds (60.8%) of the total AUM, reaching $77.8 trillion by the end of 2023, and experiencing a 15.0% increase in their AUM.

Several powerful forces are reshaping the industry:

Product Evolution and Distribution Shifts: There is an increasing investor demand for low-cost, efficient products, with Exchange-Traded Funds (ETFs) leading this trend. A notable development is the high-growth phase of active ETFs, which constituted 44% of all newly launched ETFs in 2024 and have demonstrated a compound annual growth rate (CAGR) of 39% over the past decade. While active ETFs generally charge lower fees than traditional mutual funds (0.64% vs. 1.08% on average), they offer compelling value for investors. Beyond ETFs, a significant opportunity lies in providing retail clients with access to private assets. Semi-liquid private asset funds have expanded more than fivefold in the last four years, now exceeding $300 billion in net asset value, driven by rising demand for higher risk-adjusted returns and long-term performance.

Consolidation and Digital Transformation: The industry is experiencing a wave of strategic partnerships and mergers and acquisitions (M&A) as firms strive to achieve greater scale, broaden their product offerings, and bolster technological capabilities. A study revealed that the average asset manager doubled its AuM between 2013 and 2023. Larger firms leverage technological synergies, streamlined operations, and process efficiencies to drive down costs, while those managing less than $300 billion in AUM are compelled to adopt leaner operational models. This trend indicates that scale is increasingly critical for cost efficiency and competitive positioning.

Renewed Focus on Cost and Fee Compression: The asset management industry continues to grapple with persistent fee compression. Average ETF fees stabilized at 0.16% in both 2023 and 2024, while mutual fund fees saw a continued decline. This pressure is particularly evident for high-net-worth clients, with advisors expecting to charge less than 1% for clients with over $5 million in investable assets by 2026. This ongoing pressure on fees necessitates a strategic shift towards delivering differentiated value.

The industry's record AuM growth in 2024, largely a result of market performance, presents a complex challenge. While the top-line figures are impressive, the underlying structural pressures, particularly fee compression and the shift to lower-cost products, demand a fundamental reinvention of business models. This means firms cannot solely rely on market tailwinds for profitability; they must actively transform their product mixes towards higher-margin areas and leverage technology for efficiency to protect and grow their margins. The increasing demand for "more services beyond investment management," especially from high-net-worth individuals , indicates that asset managers are responding to fee compression not just by cutting costs, but by innovating with new product structures and expanding service offerings. This represents a strategic pivot towards delivering value-added solutions—such as personalized portfolios, tax-efficient strategies, and comprehensive financial planning—that justify higher fees, often enabled by technological advancements.

1.2 Macroeconomic and Geopolitical Context

The broader macroeconomic and geopolitical environment significantly influences the asset management industry. For the remainder of 2025, a landscape of slower growth and higher inflation is anticipated. The Federal Reserve is expected to delay significant interest rate cuts due to a tight labor market and potential tariff-induced inflationary pressures. This policy stance creates a challenging environment for investment returns and capital allocation.

Global geopolitical risks remain elevated, characterized by deeper fragmentation, a more volatile and less predictable world order, and an acceleration of supply chain rewiring. These risks can profoundly impact asset prices, increase government borrowing costs, and pose threats to overall financial stability. Such events lead to increased macroeconomic uncertainty, compelling investors to seek compensation for holding assets that may perform poorly during shocks. Consequently, diversification strategies are evolving, with alternative investments like real estate in stable regions or commodities such as gold increasingly viewed as safe havens. Analyst reports also highlight private debt and private equity as top choices for return on investment over the next three years. The persistent geopolitical uncertainty is thus driving a structural shift in portfolio construction, pushing investors and asset managers to seek genuine diversification beyond traditional asset classes, thereby fueling the growth in demand for alternative investments that can offer uncorrelated returns and downside protection.

1.3 Technological Disruption in Asset Management

Technology, particularly Artificial Intelligence (AI) and Generative AI (GenAI), is a "mega force" fundamentally reshaping economies and investment management.

Artificial Intelligence (AI) and Generative AI (GenAI): AI enables real-time analysis of vast datasets, identification of subtle market trends, prediction of potential risks, and optimization of investment strategies with unprecedented precision. Firms are progressing beyond the conceptual stage to the developmental stage of AI capabilities, leading to a rising interest in data center investments to support the necessary infrastructure. Traditional asset managers may be able to adopt AI faster due to their existing access to structured data, while alternative managers might require more sophisticated solutions for effective integration. The adoption of AI is evolving beyond mere cost reduction and process automation. It is becoming a strategic differentiator for asset managers, enabling superior decision-making, enhanced risk management, and the creation of more sophisticated, personalized investment products. Firms that effectively integrate AI into their core investment processes will gain a significant competitive advantage, potentially widening the gap between tech-forward and tech-lagging firms.

Digital Assets and Tokenization: There is strong investor enthusiasm for digital assets, with 83% of institutional investors planning to increase their allocations in 2025. This interest is largely driven by increasing regulatory clarity and continuous innovation in the product landscape. Crypto Exchange-Traded Products (ETPs) have garnered significant attention, with the first Bitcoin ETP experiencing unprecedented growth. Furthermore, there is growing interest in decentralized finance (DeFi) and tokenized assets, with 57% of survey respondents expressing interest in investing in tokenized assets. This indicates a substantial future growth area for the industry.

FinTech Disruption: Financial technology (FinTech) is transforming wealth management, making it more accessible through digital investment platforms, AI-backed financial planning, and mobile advisory services. Robo-advisors, powered by AI, automate portfolio creation, rebalancing strategies, and risk analysis. The future of wealth management is increasingly seen as "hybrid," blending human advice with technological tools to achieve enhanced efficiency, broader client reach, and deeper personalization.

Table 1: Global Asset Management AuM Growth & Forecast (2022-2027)

Note: 2022 and 2023 AuM figures are derived from the 2024 growth of $128T being a rebound from 2022 decline and 2023 being a strong rebound from 2022. Forecasted growth rates for 2025-2027 are estimated based on industry reports projecting continued, albeit potentially slower, growth influenced by market performance, investor inflows, and technological adaptation.

2. Key Players

BlackRock's position as a global leader in asset management is defined by its unparalleled scale, diverse product suite, and strategic technological differentiators, all operating within a highly competitive landscape.

2.1 BlackRock's Market Position and Core Business Segments

BlackRock stands as the world's largest asset manager, boasting an impressive US$11.55 trillion in Assets Under Management (AUM) as of 2024. The firm recorded record net inflows of $641 billion in 2024, contributing to a nearly 60% AUM growth over the last five years, reaching $11.6 trillion by year-end 2024. This substantial scale provides significant advantages in distribution, market access, and operational efficiencies across its diversified product offerings:

Passive Investing (iShares ETFs): BlackRock is renowned for its iShares ETF products and passive investment strategies. iShares holds a dominant position as the top ETF issuer in both the Americas and EMEA, with 30.4% and 43.5% market share respectively at the end of 2024.

Active Management: Beyond its passive strength, BlackRock offers a range of actively managed ETFs and mutual funds. These include specialized strategies such as the iShares U.S. Equity Factor Rotation Active ETF, iShares U.S. Thematic Rotation Active ETF, and the iShares A.I. Innovation and Tech Active ETF, which provide targeted exposure to market themes and technology trends.

Alternative Investments: BlackRock is strategically expanding its presence in private assets, encompassing private equity, private debt, infrastructure, and real estate. The firm has committed to "doubling down" on private markets, with its assets in this segment now valued at over $4 trillion. This expansion is underpinned by significant acquisitions, including Global Infrastructure Partners for $12.5 billion in 2024 to bolster its infrastructure capabilities, and HPS Investment Partners for $12 billion in 2024 to enhance its private credit offerings.

Digital Assets: Demonstrating agility in embracing emerging asset classes, BlackRock launched spot Bitcoin (IBIT) and Ether (ETHA) ETFs in 2024, making these digital assets accessible through traditional brokerage accounts.

Aladdin Platform: A cornerstone of BlackRock's operations and a significant external revenue stream, Aladdin (Asset, Liability, Debt, and Derivative Investment Network) is the firm's proprietary risk management and analytics platform. It currently manages over 30,000 portfolios for clients, representing more than $20 trillion in collective assets (as of 2020, with likely higher figures today).

BlackRock's overarching strategic priorities, as articulated during its Investor Day 2025, center on maintaining alpha generation, driving growth in ETFs, private markets, and technology, leading in sustainable investing, and serving as a comprehensive "whole portfolio" advisor.

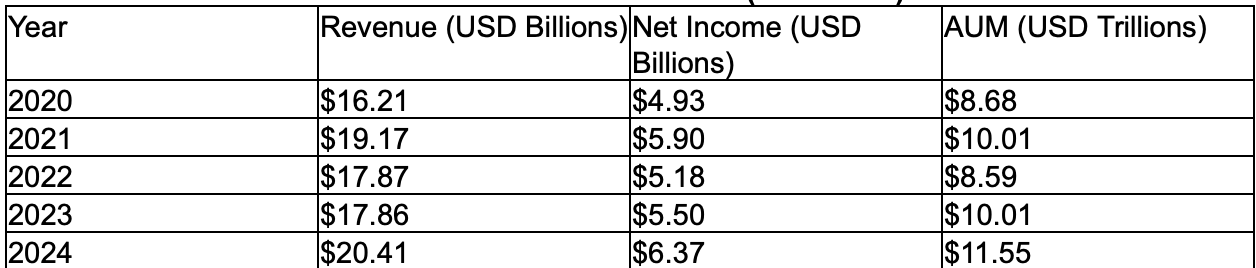

Table 2: BlackRock Historical Financial Performance (2020-2024)

Data Source: BlackRock's financial reports and public data.

2.2 Competitive Landscape: Traditional, Alternative, and FinTech Rivals

BlackRock operates within a highly competitive environment, facing rivals across traditional asset management, alternative investments, and the rapidly evolving FinTech sector.

Traditional Asset Managers: Key competitors include Vanguard Group, the second-largest asset manager globally ($8.59 trillion AUM in 2023, with 28.3% of the US ETF market share), and Fidelity Investments, the third-largest globally ($4.58 trillion AUM in 2023, with 1.1% of the US ETF market share). State Street Global, with its SPDR ETFs, is also a significant player, ranking as the third-largest US ETF issuer with a 13.9% share. A key competitive dynamic in this segment is Vanguard's significantly lower average ETF fee (0.07% in 2024), which is less than half of BlackRock's iShares average, exerting considerable fee pressure across the passive investment landscape.

Alternative Asset Managers: The alternative asset management space is dominated by firms like Blackstone Inc. ($1.1 trillion AUM in 2024, the largest alternative asset manager), Apollo Global Management ($750 billion AUM), KKR & Co., The Carlyle Group ($441 billion AUM), and Ares Management. These firms are increasingly capturing a larger share of industry fundraising and dry powder, indicating their growing influence. Additionally, specialized firms such as Thoma Bravo ($166 billion+ AUM with a focus on software and technology) and Insight Partners (specializing in tech and growth-stage companies) represent niche but formidable competition.

FinTech Disruptors: The financial technology sector presents a dynamic challenge. Robo-advisors and digital platforms like Betterment, Wealthfront, Robinhood, and Revolut are democratizing access to investing, offering automated portfolio management, rebalancing, and goal-based investing. These platforms challenge traditional models by emphasizing transparency and real-time access for clients. Startups such as Arta Finance, which has raised $92 million, are leveraging AI to provide wealth management services and access to alternative assets for accredited investors, effectively democratizing elite financial strategies. In the investment technology space, Aladdin faces competition from platforms like Black Diamond Wealth Platform (18.14% market share), Wilshire (13.51%), and Natixis (9.11%), as well as other sophisticated solutions like SimCorp Dimension, Charles River Development, Bloomberg AIM, Thinkfolio, SS&C Advent, and SS&C Eze.

Table 3: Top ETF Issuers by AUM (2024)

Data Source: TrackInsight, end of year 2024 AUM for Americas and EMEA.

2.3 BlackRock's Differentiators: Scale, Technology, and Strategic Focus

BlackRock's sustained leadership is underpinned by several key differentiators:

Unmatched Scale and Global Reach: With its immense size and a global footprint encompassing 70 offices in 30 countries, BlackRock benefits from significant advantages in distribution networks, market access, and economies of scale. This enables the firm to drive down costs through technological synergies and streamlined operations.

Aladdin Ecosystem: Aladdin is a comprehensive investment management platform that integrates risk management, portfolio construction, trading, and compliance functions. Its ability to process vast financial data and provide real-time insights is a core competitive advantage that is difficult for rivals to replicate. The platform not only serves BlackRock's internal teams but also generates a significant external revenue stream by being offered to other clients. This positions BlackRock not just as an asset manager, but increasingly as a financial technology provider.

Strategic Acquisitions: BlackRock's recent acquisition strategy extends beyond simply accumulating AUM; it is critically focused on acquiring specialized capabilities, data, and technological expertise in high-growth, complex segments. For instance, the acquisitions of Global Infrastructure Partners and HPS Investment Partners significantly bolster BlackRock's AUM and capabilities in the high-growth private markets segment. Furthermore, the acquisition of Preqin for $3.2 billion in March 2025 is designed to integrate leading private markets data into Aladdin, with the explicit aim to "index the unindexed" and enhance transparency in alternative investments. This approach allows BlackRock to deepen its product offerings and analytical capabilities, particularly for less transparent private assets, reinforcing Aladdin's comprehensive functionality and ability to meet evolving client demands.

Table 4: BlackRock's Key Strategic Acquisitions (2023-2024)

Data Source: BlackRock's acquisition history and related reports.

Proactive Digital Asset Strategy: BlackRock's early and successful entry into spot Bitcoin and Ethereum ETFs demonstrates its agility and commitment to emerging asset classes. This move leverages its strong brand and extensive distribution power to make digital assets accessible to mainstream investors.

"Whole Portfolio" Approach: BlackRock's strategic intent to serve clients' entire portfolios, combining public and private markets, traditional and alternative investments, and leveraging technology for holistic risk management and customized solutions, positions it uniquely in the market. This comprehensive approach allows BlackRock to offer integrated solutions, providing a more complete and sophisticated service to its diverse client base.

BlackRock's strategic response to ongoing fee compression is evident in its aggressive expansion into higher-fee, higher-value areas like active ETFs and private markets. While its iShares platform dominates passive ETFs, the even lower fees offered by competitors like Vanguard intensify the pressure in this segment. By diversifying its revenue streams towards products and services that justify higher fees, BlackRock executes a sophisticated strategy to offset margin pressure from its core passive business. This involves a calculated shift from pure beta exposure to alpha generation and specialized asset classes, leveraging its scale for distribution and its technology for product innovation.

Aladdin's role as a central nervous system and strategic moat is critical. It is a comprehensive ecosystem that underpins BlackRock's "whole portfolio" approach, enhances its competitive intelligence in private markets, and serves as a significant revenue generator. Its continuous evolution, exemplified by the introduction of Aladdin Copilot , creates a substantial competitive barrier, making it challenging for rivals to replicate BlackRock's integrated capabilities and data-driven insights. This positions BlackRock not just as an asset manager, but increasingly as a financial technology provider.

Furthermore, BlackRock's M&A strategy extends beyond merely acquiring Assets Under Management (AUM) for scale. Its recent acquisitions, such as Global Infrastructure Partners and HPS Investment Partners, and particularly Preqin, are aimed at acquiring specialized capabilities, data, and technological expertise in high-growth, complex segments like private markets. This allows BlackRock to deepen its product offerings, enhance its analytical capabilities (especially for less transparent private assets), and reinforce Aladdin's comprehensive functionality, thereby strengthening its competitive position and ability to meet evolving client demands.

Unlock the Full Analysis

You've read our comprehensive analysis of BlackRock's dominant market position and strategic differentiators. The remainder of this premium article reveals our forward-looking projections and strategic insights.

To continue reading, please choose an option:

1. Purchase This Article (15 pages): Get complete access to this single article for a one-time payment of €2.99.

2. Subscribe for Full Access: Become a premium subscriber to unlock this article and get unlimited access to all of our in-depth reports, market forecasts, and exclusive analysis.