Atkore's Growth: A Spark or a Short Circuit?

Examining Atkore's Financial Trajectory, in Partnership with my friend Hidden Market Gem

Atkore: the name might not roll off the tongue like tech giants, but this industrial player has been quietly wiring its way into investor portfolios. But is that growth a sustainable surge, or a potential short circuit?

We teamed up with our friend Hidden Market Gems (definitely go check his Substack he finds great companies that are unknown) to plug into Atkore's financials and see if the company's connections are truly electrifying. Get ready to strip away the insulation and see what's really powering Atkore's bottom line

Company Overview

Atkore Inc. is a leading manufacturer of electrical infrastructure products and safety/security solutions for construction and industrial markets. The company operates two primary segments: Electrical (which produces electrical raceway products such as conduit, cable, and related fittings) and Safety & Infrastructure (which includes metal framing systems, mechanical pipes/tubes, perimeter security products, and cable management for critical infrastructure). Atkore’s products are used largely in non-residential construction and renovation projects, with some presence in residential and OEM applications. The company holds dominant positions in most of its product categories in the United States, supported by well-known brands and a nationwide manufacturing/distribution footprint.

Business Model

So, Atkore's business model revolves around selling a wide range of electrical, safety, and infrastructure products. Think of them as the hardware store for big construction projects. They manufacture these products in their own facilities, which are spread across the globe, and then get them into the hands of customers.

They primarily use a distribution network, meaning they sell to distributors who then resell to contractors and end-users. This is like a wholesale model, which makes sense for their product range. They also engage in direct sales for larger projects or to OEMs (Original Equipment Manufacturers), who incorporate Atkore's components into their own products.

Essentially, their revenue is directly tied to the volume of products they sell and the prices they can command. They're providing essential infrastructure components, the kind of stuff that keeps electrical systems running. These are the fundamental parts that ensure power gets from point A to point B safely and efficiently. This essential role in the construction and infrastructure supply chain creates a relatively consistent demand for their products.

Key revenue streams span multiple product categories, with the largest being plastic and PVC conduits, fittings, and pipes (approximately 37% of net sales), followed by metal framing & cable management systems (20%), metal electrical conduit & fittings (18%), electrical cable & flexible conduit (14%), and mechanical tubing & other products (11%). These products are essential components in building electrical power systems and in supporting structures like solar panel mounts, pipe systems, and security enclosures.

Clients

Atkore sells its products mostly through distributors that serve electrical contractors and builders. Approximately 83% of net sales come through electrical and industrial distribution channels, which include thousands of electrical distributor branch locations across the U.S. Major customers are large electrical supply distributors such as Consolidated Electrical Distributors (CED), Graybar, Rexel, Sonepar, and Wesco, as well as independent regional distributors. These distributors, in turn, serve end-users including electrical contractors, construction firms, industrial maintenance teams, and OEMs. Atkore also sells to members of distributor buying groups and even to big-box retailers for certain product lines. The customer base is fairly concentrated, with the top 10 customers accounting for around 38% of net sales, underscoring the company’s reliance on major distributors and reflecting its strong relationships with the largest players in electrical supply.

Geographical Operations

Atkore operates primarily in North America, with the United States contributing about 90% of revenue. In fiscal 2023, net sales were approximately $3.15 billion in the U.S. compared to $369 million internationally. The company’s U.S. presence is extensive, including manufacturing and distribution centers across the country that enable quick delivery to customers. Atkore currently manufactures products in 49 facilities and maintains around 7.5 million square feet of manufacturing and distribution space across eight countries. Its international footprint includes facilities or subsidiaries in Canada, Mexico, Australia, New Zealand, the U.K., Belgium, and China. Although these international sites contribute to regional demand, the majority of revenue remains U.S.-centric, which aligns with its core market of U.S. construction and infrastructure.

Market Landscape

Atkore operates in a competitive landscape that includes both large national players and smaller regional manufacturers. Key competitors vary by segment:

Electrical segment competitors: Rival companies include major producers of metal conduits, steel pipes, and electrical cables, with several large players offering overlapping product lines.

Safety & Infrastructure segment competitors: This segment competes with divisions of larger electrical or industrial firms that produce metal framing systems, cable management, enclosures, and related infrastructure products.

Competitive pressure in these markets centers on product quality, availability, breadth of offering, and price. Atkore’s ability to offer a “one-stop” solution across a wide range of products, combined with its nationwide distribution network, is a key competitive advantage. However, price competition and import pressure can challenge pricing in certain commodity-like categories. The company’s continuous product innovation and strategic acquisitions help it maintain and grow its market share.

So, Atkore's chilling in some seriously promising neighborhoods! First up, Uncle Sam's throwing a massive infrastructure party, thanks to the IIJA, with a whopping $1.2 trillion budget. And guess who's supplying the party favors? Atkore, of course! We're talking about roughly $491 billion worth of their products getting snapped up for power upgrades, internet expansions, and modern transportation. That's a lot of wiring and conduits!

Then, we've got the electric vehicle boom. All those charging stations popping up? They need Atkore's gear to keep the juice flowing. Plus, the power grid's getting a makeover to handle all that renewable energy, and a ton of those old lines and transformers are basically saying, 'retire me!' So, more upgrades, more Atkore.

And let's not forget the digital revolution! Data centers are multiplying like rabbits, thanks to 5G, cloud computing, and everyone working from their pajamas. We're talking a 21% growth rate through 2026! All those servers need power, and Atkore's got the electrical backbone to make it happen. Basically, Atkore is sitting pretty, with a whole bunch of mega-trends lining up to boost their business. It's like they've got a golden ticket to the infrastructure growth parade!

Growth Prospects

Atkore’s growth outlook is driven by both its strategic initiatives and favorable macro trends in its end markets. Internally, the company has pursued organic growth by expanding capacity and launching new products, along with targeted acquisitions to extend its product offerings and geographic reach. Even as overall sales declined in 2023 due to pricing normalization after a surge in 2022, underlying organic volume showed improvement.

On the broader market side, Atkore is well positioned to benefit from several secular trends:

Renewable Energy Build-Out: Expansion of solar and wind installations drives demand for components such as mechanical tubing and framing systems. Government incentives and corporate investments in clean energy are expected to sustain growth in this segment.

Grid Hardening and Electrification: Modernizing the electrical grid, expanding power distribution, and increasing EV charging infrastructure boost demand for Atkore’s products.

Digital Infrastructure: The boom in data centers, telecom fiber build-outs, and semiconductor fabrication plants provides additional growth opportunities.

Onshoring of Manufacturing: Large-scale construction projects in the U.S. are driving demand for electrical infrastructure, positioning Atkore to benefit from increased domestic spending.

In 2022 Atkore even provided a long-term fiscal 2025 Adjusted net income per diluted share target of greater than $18.00. And we’re way off those numbers.

Overall, these trends suggest a positive growth outlook for both Atkore and its broader markets, although risks include cyclical downturns in construction and fluctuations in government spending.

Valuation

Free Cash Flow Yield vs. 10-Year Treasury: Atkore produces robust free cash flow relative to its market value, resulting in an attractive free cash flow (FCF) yield. In fiscal 2023, the free cash flow yield was in the mid-teens (approximately 14.3%), far exceeding the 10-year U.S. Treasury yield of about 4.3%. This substantial yield suggests the stock is undervalued on a cash flow basis, assuming the business can sustain a sizable portion of its current cash generation.

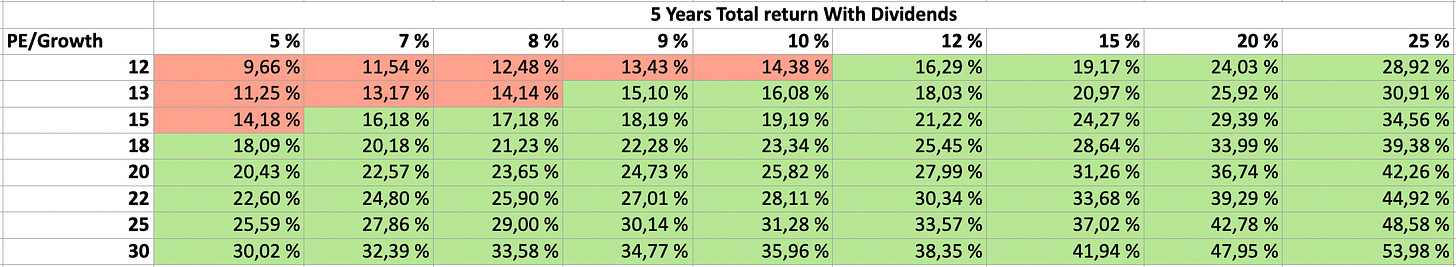

On the futur valuation/growth part, we're staring at a table full of green, which, let's be honest, is always a nice sight. But, as always, we need to dig deeper.

Here's the setup: Atkore's forecasting an EPS of $5.75 - $6.85 for 2025. To play it safe, we're going with the lower end of that range ($5.75) and completely ignoring those wild share buybacks for now.

Now, to hit our target 15% CAGR, Atkore needs to grow their EPS by 5% annually for the next five years and then trade at an 18x PE multiple. Here's the kicker: paying 18 times earnings for a company growing at a measly 5%? That's a hard pass.

A more realistic scenario? We're looking at 7-9% growth, which would put Atkore's fair PE somewhere between 13-15. But here's the reality check: Atkore's average PE over the past decade has been a mere 9.8. That's a significant gap. So, while the green on the table is tempting, we need to ask: Are we getting carried away with wishful thinking, or are we being realistic about Atkore's potential?

Now 2 questions remains :

Will the company be able to grow between 7-9% its EPS for the next 5 years?

Will the company keep that buyback pace (we’ll talk about it later)?

If the answer to both these questions is yes, then you’re looking at a 20% CAGR for 5 years.

Balance Sheet Strength (Debt, Cash, and FCF): Atkore’s balance sheet is strong and conservatively leveraged. At the end of FY 2023, the company had around $762.7 million in long-term debt and $388 million in cash, resulting in a moderate net debt position. With operating cash flow in excess of $800 million and free cash flow of approximately $589 million in FY 2023, the company could theoretically pay off its net debt in roughly 0.6 years. The modest leverage, healthy cash flow, and ongoing share buybacks highlight financial flexibility and reinforce valuation appeal.

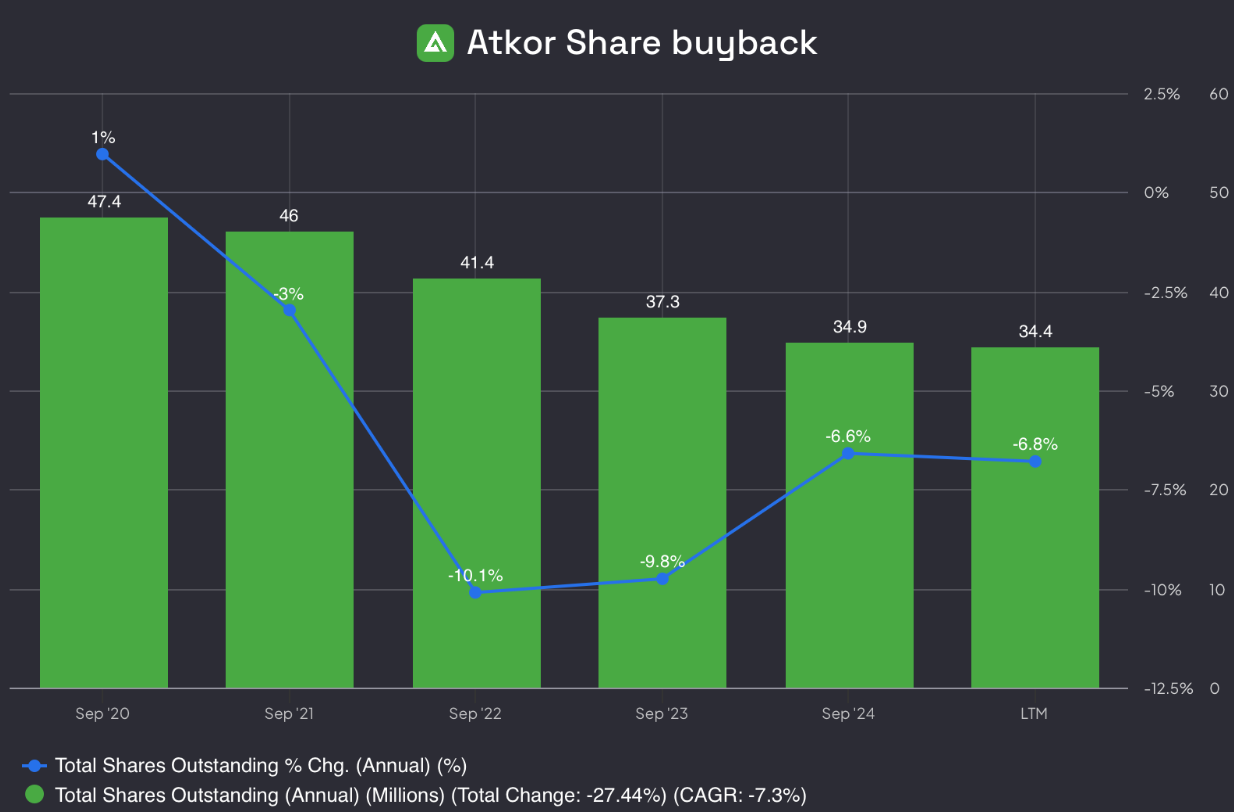

So, here's the deal with Atkore: their EPS (earnings per share) is outrunning their net income in a sprint, and the secret sauce? Share buybacks. Perfectly normal, lots of companies play that game. But Atkore's playing it in turbo mode. They're gobbling up their own shares at a rate of roughly 6% of outstanding stock annually over the past five years. That's a serious appetite! Now, that number alone doesn't tell us if it's a brilliant move or a reckless gamble. If they're snagging those shares at a bargain, then kudos, Atkore! But if they're paying top dollar, well, that's a different story. So, the question is: are they shopping smart, or just throwing cash at the register?

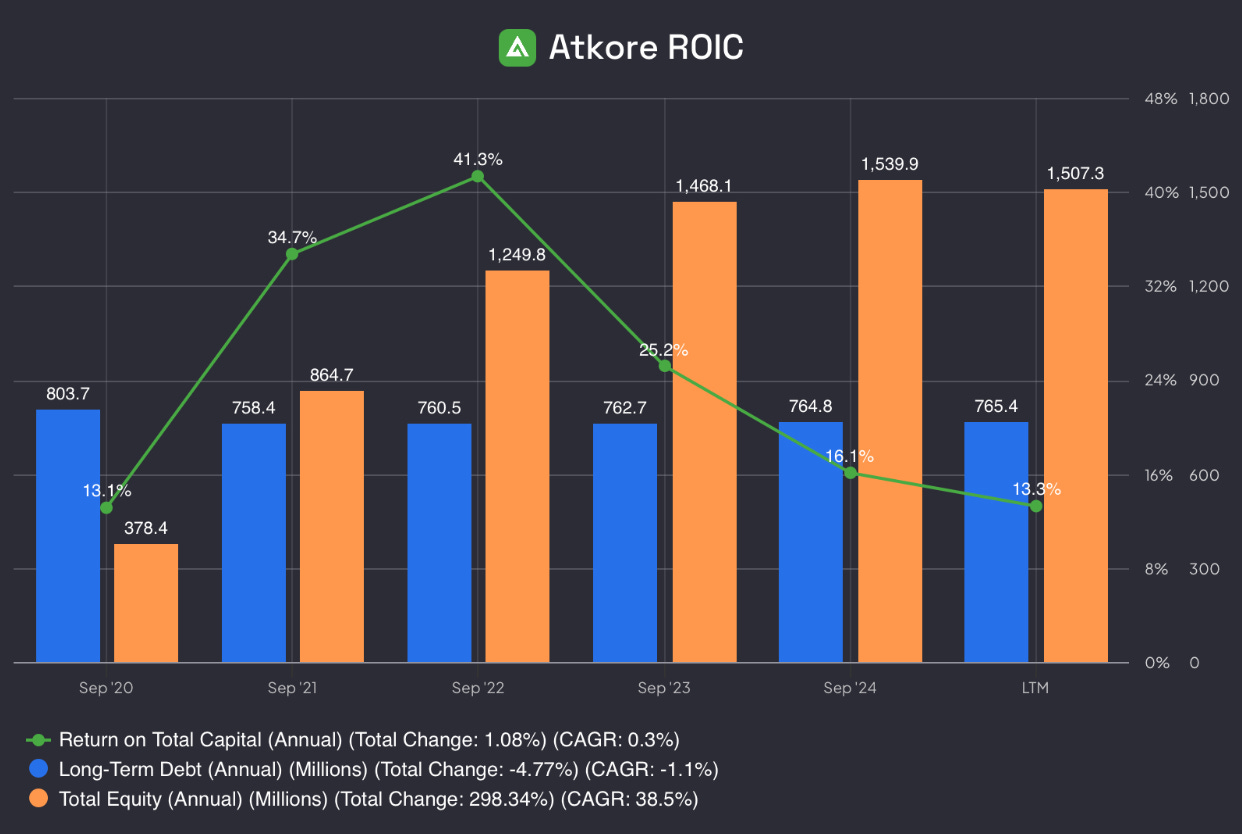

Return on Invested Capital (ROIC) & Return on Incremental Invested Capital (ROIIC)

ROIC (Return on Invested Capital): Atkore’s ROIC has been exceptionally high, reflecting efficient capital use and a competitive advantage. During the peak year of 2022, ROIC reached the mid-30% range, driven by record earnings and low capital employed. Even in 2023, the ROIC remained very high (around 42%), far exceeding the company’s cost of capital and indicating strong value creation.

Here's the scoop: our invested capital is getting fatter, thanks to all that lovely net income getting tucked back in. But, and this is a big 'but'... the more dough they pile up, the more their ROE and ROIC seem to be taking a little nap. That's making my eyebrows do a little dance of concern. Are we seeing the dreaded 'growth-spurt-is-over' phase?

Now, don't get me wrong, the ROIC is still hanging out in the 'meh, could be worse' zone – we're talking a 13% vibe in 2024. Not exactly a fireworks display, right? But here's the kicker: it's not that 2024 was a disaster, it's just that 2021 and 2022 were like, 'hold my beer, watch this magic trick!' levels of awesome.Net income in 2022 was 913M$ pretty much Two times 2024. So, we're kind of comparing a regular Tuesday to a rockstar's after-party.

We should look at the ROIIC to confirm this.

Alright, let's break down Atkore's ROIIC (Return on Incremental Invested Capital) – basically, how efficiently they're reinvesting their earnings. We want to see how much of their net income they're putting back into the business and at what rate they're getting returns on that investment.

Here's how we crunch the numbers:

Incremental Earnings: We take their earnings from FY24 and subtract their earnings from FY20. Think of this as the extra profit they've generated over that period.

Calculation: FY24 Earnings - FY20 Earnings

Incremental Invested Capital: We take their invested capital from FY23 and subtract their invested capital from FY20. This shows how much more capital they've put to work.

Calculation: FY23 Capital - FY20 Capital

ROIIC: Now, we divide the incremental earnings by the incremental invested capital. This tells us the return they're getting on that extra capital.

Calculation: Incremental Earnings / Incremental Invested Capital = 31%

Reinvestment Rate: We divide the incremental invested capital by the total earnings during that period. This shows what percentage of earnings they’ve reinvested.

Calculation: Incremental Capital / Sum of Earnings = 37%

Business Intrinsic Value Compounding Rate: We multiply the ROIIC by the reinvestment rate. This gives us an idea of how much the business's intrinsic value is growing due to reinvestment.

Calculation: ROIIC * Reinvestment Rate = 11%

Shareholder Intrinsic Value Compounding Rate: We add the compounding rate, the capital return yield (dividends, etc.), and the average buyback yield. This shows the total return shareholders are getting.

Calculation: 11% + 1.8% + 5% = 18%

Now, a big 'but' – these numbers are just a snapshot. They're only reliable if Atkore can maintain these rates, which, given their fluctuating annual numbers, is a bit of a gamble.

And about that buyback yield:

Atkore's market cap is $2.2 billion.

A 5% annual buyback means they're spending about $110 million.

That's roughly 1/5 of their 2024 net income and 1/4 of their 2024 free cash flow.

So, financially, the buyback seems sustainable. The real questions are: Will they keep buying? And, crucially, will they be buying at good prices, or just throwing money at their shares?

Investment Decision

Hidden market gems decision : Considering Atkore’s fundamentals and valuation, the stock appears to be an attractive buy rather than merely a watchlist candidate. The company has a dominant market position, high margins, strong returns on capital, robust free cash flow, and a sound balance sheet. Additionally, multiple growth drivers in infrastructure spending, clean energy, onshoring, and digital infrastructure support a positive medium-term outlook. The current free cash flow yield, which significantly exceeds the 10-year U.S. Treasury yield, indicates that the stock is undervalued relative to the cash it generates.

While the business is cyclical and experienced a downturn in FY 2023, these appear to be temporary adjustments rather than structural issues. Investors with a long-term horizon may find the current valuation compelling, as the fundamentals suggest the company is well-positioned to resume growth when market conditions improve.

Waver Decision : In essence, Atkore operates within an industrial sector that's outside my usual circle of expertise. The current valuation is undeniably low, but we can't ignore the CEO's ambitious, and ultimately unrealistic, 2022 projections of $18 EPS by 2025 – a figure they're now nowhere near achieving.

The market has certainly punished Atkore, with the stock plummeting from $190 a year ago, despite a significantly higher $12.7 EPS at that time, which placed it at a reasonable 15x earnings. This reinforces the fundamental truth: stripping away market noise and hype, stock prices tend to align with earnings.

The pivotal question now is: Can Atkore recapture its previous earnings levels? This is the core uncertainty that will dictate the company’s future trajectory. While the current valuation is tempting, the answer to that question will determine whether or not the current price is a true value play, or a value trap.

Did Atkore's story spark your interest? We'd love to hear your thoughts!

Let us know if you enjoyed this cross-analysis with Hidden Market Gem, and if you'd like to see more of these deep dives.

Don't forget to Waver to subscribe to level up your financial knowledge!

Tuesdays (Free): Get market insights and tips delivered to your inbox.

Thursdays & Saturday (Premium): Exclusive access to:

Earnings analysis

Portfolio insights

Bonus articles

Quarterly market reviews

Free copy of "Investing With Eagles" book.

And while you're at it, be sure to check out our friend’s brilliant work over at

Hidden Market Gems – you won't want to miss his hidden gems we do Have Vusion Group in common!

Disclaimer: The information provided in our analyses and reports is for informational and educational purposes only and should not be considered investment advice. We are not financial advisors, and nothing we say or write should be construed as a recommendation to buy or sell any security.

While we strive to provide accurate and insightful information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information presented.

It is important to note that we may or may not hold positions in the companies we discuss. Any opinions expressed are our own and are subject to change without notice.

Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. Never invest more than you can afford to lose.

I lost a good bit of money on atkore. Management doesn't know what they are doing. Bought back tons of shares at high prices and overestimated margin retention and commodity prices a lot as seen by their 18 eps target for this year vs 6 eps now. It's a commodity business, no matter what they say. The incremental benefit from the one stop shop strategy is heavily outweighed by commodity price fluctuations. Don't expect much of a rerating, it must be prices like a commodity producer.