Amex Shines in Q1: Revenue Climbs, Young Spenders Flock, and Outlook Stays Bright!

Strong Start to 2025: Card Fees Climb, Millennials Spend Big, and International Becomes the New Frontier

So, American Express (AXP) didn't just get by in the early 2025 economy; it cruised through with serious style! They dropped some strong first-quarter results that really showed off the strength of their brand and how they run the show. Even with some folks biting their nails about the market, AXP basically shrugged off any wobbles and looked impressively solid.

Let's Crunch the Q1 Numbers!

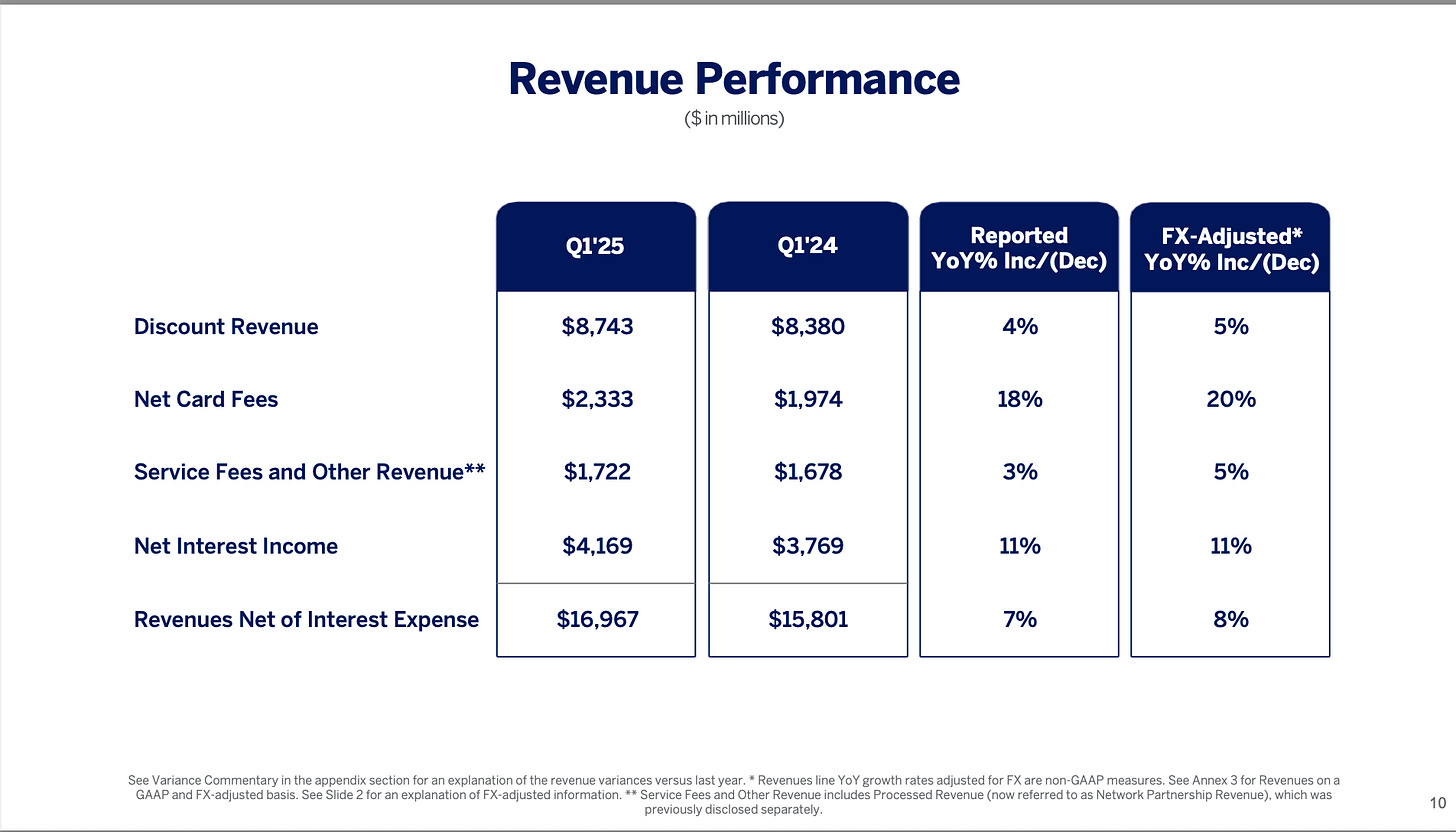

Alright, money talk time. AXP pulled in a whopping $16.97 billion in Total Revenues (after interest costs), a neat 7% jump from Q1 last year. Smooth out the bumps from changing currency values (that's the FX-adjusted bit), and the growth actually hits 8%. The bottom line looked good too – Net Income got a nice lift, climbing 6% year-over-year to $2.58 billion. For the shareholders, that works out to Earnings Per Share (EPS) of $3.64, which is 9% higher than the $3.33 they saw a year ago. Not too shabby!

Where did this growth come from?

Here's how AXP made its money this quarter:

Discount Revenue: The slice Amex gets every time you swipe? That hit $8.74 billion, up 4% (or 5% if you ignore currency wiggles).

Net Card Fees: Thanks to all that fancy plastic, Amex saw an 18% boom in card fees, raking in $2.33 billion (a shiny 20% FX-adjusted!).

Net Interest Income: With more people carrying balances, that super important income source leaped 11% to $4.17 billion.

Service Fees & Other: The 'everything else' bucket nudged up 3% to $1.72 billion (5% FX-adjusted), getting a little help from things like foreign exchange fees and partnership deals.

Overall, the total amount spent on Amex cards (that's "billed business") climbed a respectable 6% (FX-adjusted). Now, even though profits were up, things weren't perfectly rosy because spending also went up. Total Expenses jumped 10% compared to last year, landing at $12.49 billion. What caused the bump? Blame it partly on splurging more on Card Member Rewards (up 16% to $4.38 billion) and covering the costs for Card Member Services (up 13% to $1.33 billion). Hey, keeping premium customers happy costs money!

The US Engine & The Global Horizon

Want to read the rest? Level Up Your Investing!

Tuesdays (Free): Get market insights and tips delivered to your inbox.

Thursdays (Premium): Exclusive access to:

Earnings analysis

Portfolio insights

Bonus articles

Quarterly market reviews

Free copy of my book "Investing With Eagles".

Subscribe to Waver Premium for only 7.49$ per month for in-depth market knowledge and financial growth. that less than 2 Starbucks coffee a month.