A book that taught me a lot : The Warren Buffett Way

Your Guide to Investing Like the Oracle of Omaha Without Losing Your Mind or Your Money

Ever wished investing was as exciting as a theme park ride? Well, buckle up, buttercup, because "The Warren Buffett Way" by Robert G. Hagstrom is here to turn that dream into a reality! This book spills the secrets of Warren Buffett, the investing wizard who's richer than a Scrooge McDuck vault, all thanks to his knack for picking winning stocks. Forget crystal balls and get ready for a deep dive into the business brain of the Oracle of Omaha!

Buffett's Investing Philosophy: It's Not Magic, It's Common Sense!

Buffett's approach to investing is like building a delicious sundae: a scoop of value investing, a dollop of long-term thinking, and a sprinkle of wisdom from his mentors, Benjamin Graham and Philip Fisher. Forget get-rich-quick schemes; Buffett's all about understanding businesses inside and out, like they're his favorite comic book. He treats companies like buddies, not just ticker symbols, and sticks with them longer than a Netflix binge.

Here's the secret sauce to Buffett's investing recipe:

Ignore the Market Mayhem: Think of the stock market as a rollercoaster; it's a wild ride with ups and downs that'll make your stomach churn. Buffett's like that chill dude who just enjoys the view, ignoring the screams and thrills. He knows the real value is in the business, not the crazy price swings.

Ditch the Economic Fortune Tellers: Predicting the economy is like guessing what your pet goldfish is thinking – good luck with that! Buffett says forget the forecasts and focus on businesses so strong they can weather any storm, like a superhero with an economic umbrella.

Fall in Love with the Business, Not the Stock: Don't just swipe right on any stock; get to know the company like it's your potential BFF. Buffett says to treat every stock purchase like you're buying the whole darn business, warts and all. Do your homework and find companies you truly adore.

Be a Business Collector, Not a Stock Market Gambler: Diversification is for scaredy-cats! Buffett's like a kid in a candy store, carefully picking his favorite treats. He invests in a handful of companies he knows like the back of his hand, building a portfolio of businesses he loves.

Evaluating Businesses: It's Like Judging a Pie-Baking Contest!

Buffett's got a four-pronged fork for picking winning businesses, and it's sharper than a Gordon Ramsay insult:

Business Tennets: The Crust

Keep it Simple, Smarty Pants: Buffett's not into fancy-pants businesses with more layers than an onion. He likes companies he can understand, like a good joke. If you can't explain it to your grandma, it's probably not a Buffett-worthy business.

Steady as She Goes, Captain: Buffett loves businesses that are as reliable as his morning coffee. He looks for companies with a history of smooth sailing, proving they can handle rough seas and still deliver the goods.

Franchise Fever: Forget one-hit wonders; Buffett's after businesses with staying power, like the Rolling Stones. He loves franchise businesses with a secret recipe for success, products so good they practically sell themselves.

Management Tennets: The Filling

Rationality Rules: Buffett wants managers who are as cool as cucumbers under pressure, making smart decisions like a chess grandmaster. He's after leaders who treat the company's money like it's their own, investing wisely and sharing the profits like a good friend.

Honesty is the Best Policy: Buffett's not into companies with secrets; he wants managers who are open books, sharing the good and the bad. He likes leaders who tell it like it is, building trust like a superhero with a truth lasso.

Don't Follow the Herd: Buffett's a lone wolf, not a sheep. He admires managers who think for themselves, not blindly following the crowd like a bunch of lemmings. He wants leaders who blaze their own trail, even if it means going against the grain.

Financial Tennets: The Toppings

ROE, the Cherry on Top: Forget earnings per share; Buffett's all about Return on Equity (ROE), the real measure of a company's money-making mojo. He wants businesses that squeeze every penny out of their investments, like a lemonade stand with a line around the block.

Owner Earnings: The Secret Ingredient: Buffett's got a secret recipe for calculating a company's true cash flow, like a master chef with a hidden spice rack. He factors in depreciation and capital expenditures to get a clear picture of how much dough the company's really making.

High-Profit Margins: The Sweetest Part: Buffett's got a sweet tooth for businesses with high-profit margins, like a bakery overflowing with delicious treats. He knows that keeping costs low means more money for shareholders, and who doesn't love a bigger slice of the pie?

Value Creation: The Proof is in the Pudding: Buffett's not just looking for companies that make money; he wants them to create value, like a magical money tree. He checks if the company's adding at least a dollar of market value for every dollar it keeps, proving it's not just hoarding cash but making it grow.

Market Tennets: The Price Tag

Calculate the Value: Don't Overpay for Your Pie: Buffett's got a magic formula for figuring out a business's true worth, like a price-savvy shopper with a calculator. He uses a discounted cash flow (DCF) model to see if the company's a bargain or a rip-off.

Margin of Safety: Get a Discount, or Walk Away: Buffett's a bargain hunter, not a sucker. He only buys businesses when they're on sale, like a Black Friday shopper with a mission. He wants a margin of safety, a discount so big it's like getting a free scoop of ice cream with his sundae.

Example: Calculating Business Value: Baking a Pie with Numbers

Want to see Buffett's magic formula in action? Let's bake a pie with numbers! Imagine a company with a sweet cash flow, growing faster than a beanstalk. We'll project those cash flows into the future, sprinkle in some growth, and then use a discount rate to bring it back to today's value. It's like a time-traveling baking show, and the result is a delicious valuation!

Assumptions:

The company's cash flow is growing like a weed, at a compound rate of 15% per year for the next 10 years.

We'll use a discount rate of 9% to account for inflation, because nobody wants stale bread, right?

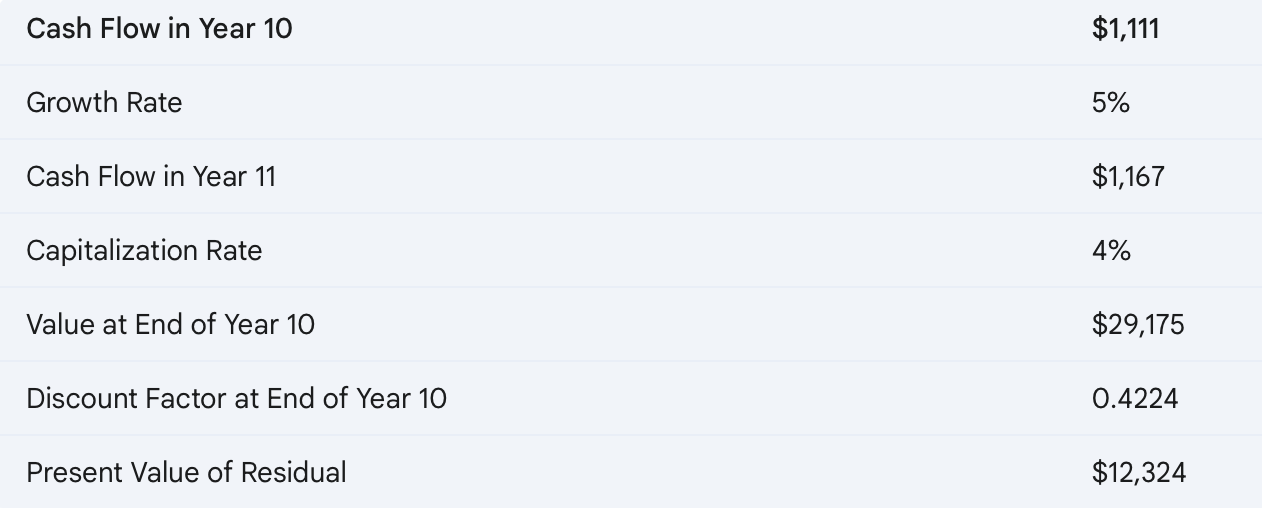

In year 11, we'll assume the growth slows down a bit to 5%, like a runner catching their breath.

All dollar amounts are in millions, because we're playing with big bucks here!

Present Value of Future Cash Flows:

Calculation of Residual Value:

Business Value:

Business Value = Present Value of Future Cash Flows + Present Value of Residual

= $3,731 + $12,324

= $16,055 million

Ta-da! We've baked ourselves a delicious valuation, showing us what the business is truly worth. Now we can compare it to the market price and see if it's a sweet deal or a sour lemon.

Conclusion: Ready to Invest Like a Boss?

"The Warren Buffett Way" is an excellent guide to understand his methodology. It breaks down Buffett's strategies into bite-sized pieces, making it easier to digest than a whole pizza. So, grab your copy, put on your chef's hat, and get ready to whip up a portfolio that's as impressive as a Michelin-star meal!

Hungry for More Market-Crushing Insights?

Join our tribe of savvy investors! We're serving up fresh, insightful articles every Tuesday and Thursday to help you navigate the market like a pro.

Tuesdays are for treating yourself! Get a free dose of market wisdom delivered straight to your inbox. We're talking market trends, personal finance tips, and investment strategies to help you level up your game.

Thursdays are for the truly dedicated! Our premium subscribers get the VIP treatment for only :

Exclusive access to my view on earnings releases: Stay ahead of the curve with in-depth analysis and expert commentary.

Quarterly letters : Because who doesn’t love a recap of what happened last quarter?

A peek inside my portfolio: See what moves I'm making and why.

Bonus articles: Dive deeper into the most interesting market happenings.

A free copy of my book: Unlock even more financial knowledge and become a true market master.

Don't let your family eat you! Click here to subscribe and start your journey to financial freedom! Okay, maybe we can't guarantee complete freedom from your family, but we can definitely help you bring home the bacon... or at least the investment returns!

Disclaimer: The information provided in our analyses and reports is for informational and educational purposes only and should not be considered investment advice. We are not financial advisors, and nothing we say or write should be construed as a recommendation to buy or sell any security.

While we strive to provide accurate and insightful information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information presented.

It is important to note that we may or may not hold positions in the companies we discuss. Any opinions expressed are our own and are subject to change without notice.

Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. Never invest more than you can afford to lose.