2024 Recap: Our Portfolio Delivers and We're Not Just Clowning Around!

Another year, another round of market mayhem successfully navigated!

2024 was a year of steady growth and contrarian conviction for our portfolio. We kicked things off with a solid lineup of familiar faces – Payments provider, Insurance company, credit cards, retail – all companies we handpicked for their exceptional quality, growth prospects, and management teams that seem to know what they're doing (unlike that guy who cut me off in traffic this morning...).

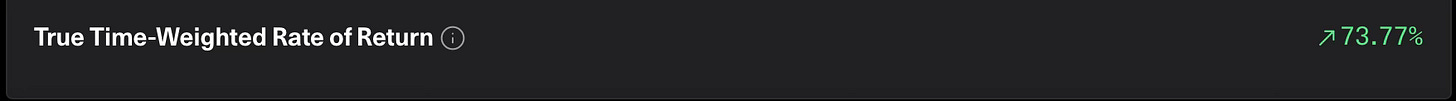

Remember how we crushed it in 2023 with a 31.2% TTWR, leaving the S&P 500 in the dust with a 7% alpha? Well, we kept the momentum going in 2024, proving that slow and steady wins the race (or at least beats the market).

Hold Your Horses, We're Not Miracle Workers

We've been absolutely crushing it since we opened up our portfolio playbook back in 2023, racking up an average annual return of 31.8%. Now, that's the kind of performance that makes you want to do a victory dance (or maybe just grab an extra slice of cake). But before we get carried away, let's have a little chat about expectations.

While we're all for shooting for the moon, we also believe in keeping our feet firmly planted on planet Earth. We're not expecting to pull a rabbit out of our hat and deliver 30%+ returns year after year. Honestly, that's about as likely as finding a unicorn in your backyard.

Our investment philosophy is all about finding companies that can consistently grow their owner earnings – that's the real money they're making, not just some accounting magic trick. We're aiming for a sweet spot of 15-20% annual growth in owner earnings.

Now, it's important to remember that we're talking about owner earnings, not stock performance. While we can estimate roughly that owner earnings will grow at a rates we’re seeking, it's impossible to know for sure if the stock will follow suit (even though, in the long run, it usually does). Think of it like this: a company's owner earnings are the foundation of its success, and the stock price is like the house built on top. A strong foundation usually means a solid house, but there can be other factors at play.

That's why we're building a solid, long-term investment strategy, brick by brick. We're not trying to win the lottery every year by chasing short-term stock gains. Instead, we focus on those underlying owner earnings, confident that our approach will deliver consistent, market-beating results over time.

In other words, we're in it for the marathon, not the sprint. And we're pretty sure that slow and steady wins the race (and maybe even gets a bigger trophy).